-

Retirement planning isn’t only about saving – it’s about building a framework for your clients’ lives. Here are 3 questions advisors should ask clients to help get them started.

April 21 -

Because women can expect to live longer and on average have less retirement savings than men, they may need to adjust their retirement plans. Here are some ways advisors can help.

April 21 -

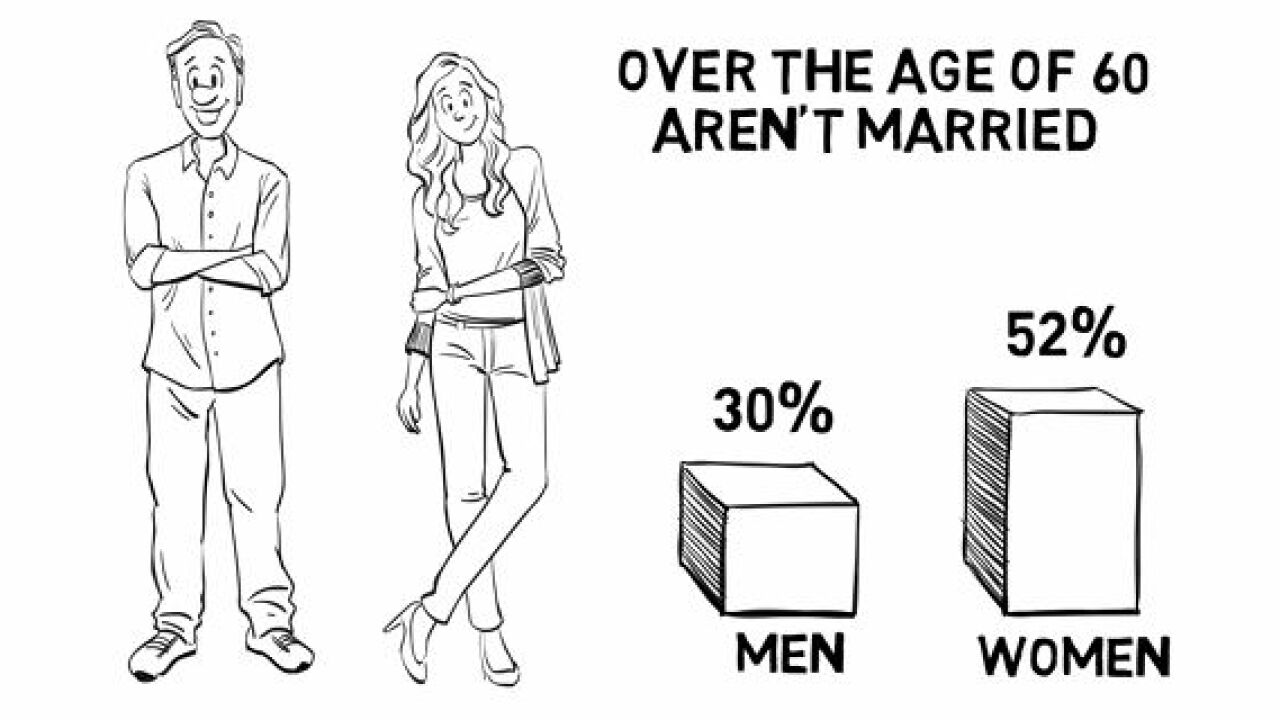

Most advice about claiming strategies is for married couples, but what about your single clients? How can they maximize their benefits?

April 21 -

Here's what your divorced clients need to know about their Social Security benefits.

April 21 -

Advisors managing assets within retirement plan vehicles, including IRAs, will need to take a hard look at their own pricing and practices, because simply disclosing conflicts of interest is no longer good enough under the new rule.

April 21 -

Many people don't need life insurance once they retire, but here are five types of clients who may want to keep their policies.

April 21 -

Your clients want to know if they'll have enough money in retirement. The answer, of course, depends on how long they can expect to live.

April 20 -

Retirement savers are advised to consolidate their old 401(k) plans to manage the money more easily and avoid administrative expenses; plus, why Social Security is a women's issue.

April 20 -

Voices: Even independent advisors have some adjustments to make. Here are some of the most important, according to managing director of TD Ameritrade Institutional.

April 20 Financial Planning Association

Financial Planning Association -

Despite the many benefits that IRAs offer, many people do not use them as a retirement saving tool; plus, what parents should know about Social Security.

April 19