-

The biggest QCD question is whether it will be effective for a check not cashed by year’s end?

December 18 -

The average woman will work 12 fewer years than a man, according to one expert. There’s a “slew of issues” around this topic.

December 18 -

Even as equities have taken a beating, I haven't received a single frantic call or text.

December 18 Mercer Advisors

Mercer Advisors -

The Trump tax cut may have changed the calculus for some couples filing joint returns.

December 18 -

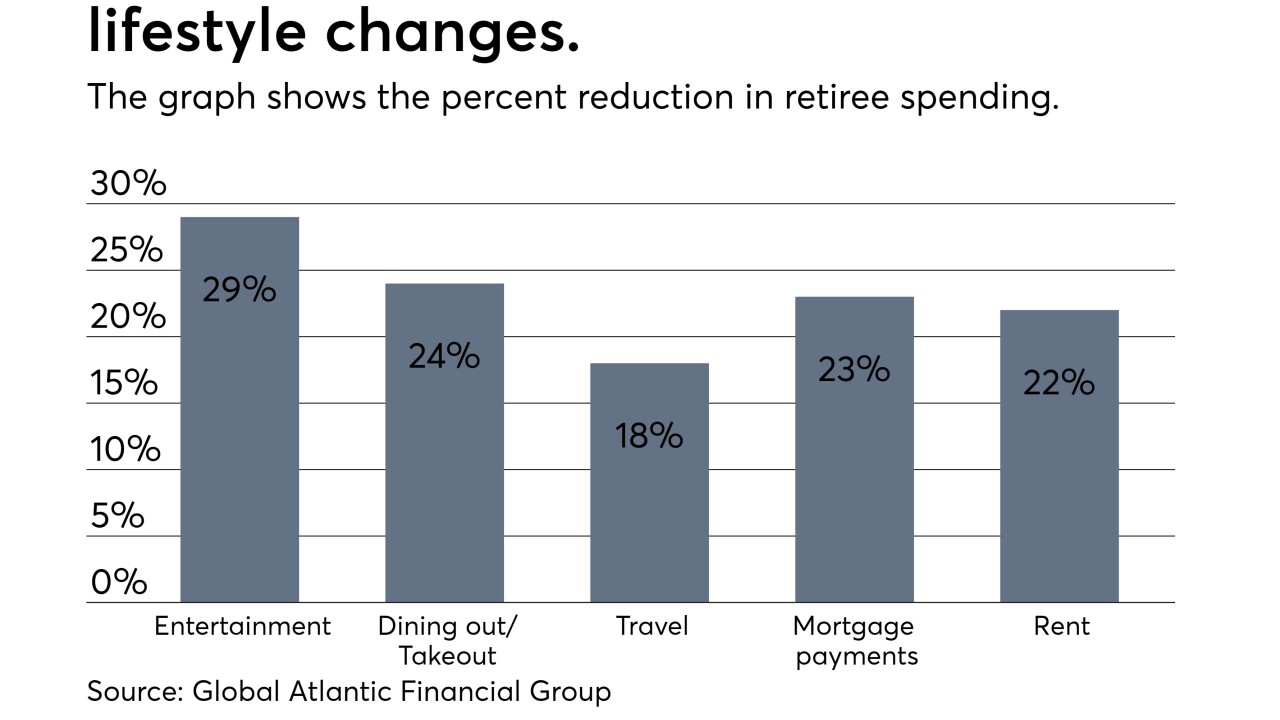

Building income streams that mimic the predictability of a working lifestyle is a delicate skill.

December 17 -

Failing to take the mandatory distribution on time may push retirees to a higher tax bracket.

December 14 -

There has been a robust increase in employers' registration since the program started last year, data shows.

December 12 -

Lower-earning spouses who took time off to raise children or care for an aging parent may not be eligible based on the taxes they paid into the system.

December 11 -

Millions of workers have multiple jobs. That means they might have multiple retirement plans. Here are the rules for situations in which a client can set up and/or contribute to more than one plan at a time.

December 7 -

When his sons were diagnosed, this financial advisor had to learn to focus on what he could control. Now he uses those lessons in his business.

December 3 CJM Wealth Management

CJM Wealth Management