-

The tax-filing season for individuals just opened recently, but businesses already got a head start on various tax incentives in the One Big Beautiful Bill Act.

February 6 -

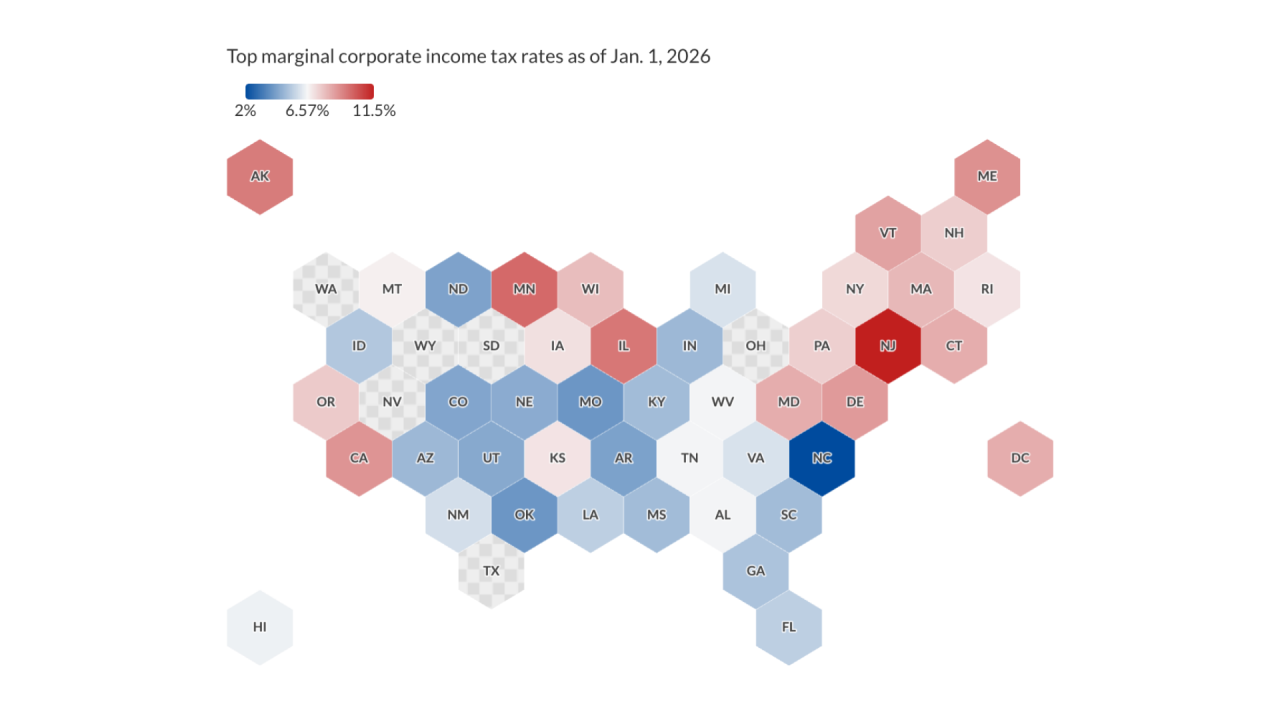

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

One of the most lucrative tax breaks corporate America won in Trump's economic legislation is hitting a roadblock in a minimum tax Congress set three years ago.

September 25 -

While many companies have not stated what they might do, last month's tax legislation is helping ease some concerns while they grapple with tariff uncertainty.

August 5 -

When a company considers adding new jobs or making new investments, many state and local authorities offer tax incentives to support that growth.

May 28 McGuire Sponsel

McGuire Sponsel -

Warren Buffett said the company has paid the U.S. government more than $101 billion in taxes since he took the helm 60 years ago, more than any other company in history.

February 24 -

The optional standard mileage rate for automobiles driven for business will increase 3 cents next year.

December 19 -

From those with no corporate tax at all, to those that tax everything they can — a guide to most and least competitive states when it comes to taxing businesses.

December 12 -

Beverage giant Coca-Cola said that it will pay the very old debt, but it is still appealing.

August 5 -

This year's Greenbook proposals contain some greatest hits, including a higher corporate minimum tax.

June 19 -

There's a growing sense of unease among asset managers that companies with conspicuously small tax bills pose a financial liability too big to ignore.

March 4 -

The lowest-ranked states have property and unemployment insurance taxes like every state, but significantly they also have complex, non-neutral taxes with comparatively high rates.

February 26 -

Corporations will be the beneficiaries of a reduction in the top marginal rate in all six states.

February 12 -

Donald Trump plans to make permanent the 2017 individual tax cuts that he enacted as president while keeping corporate tax levels unchanged in an appeal to working and middle class voters should he retake the White House.

January 8 -

Key justices suggested the tax, which aimed to collect hundreds of billions of dollars on a one-time basis, wasn't fundamentally different from other levies imposed by Congress over the years.

December 5 -

Financial and accounting teams are inundated by new data streams that accompany hybrid work on a global scale.

May 16 Blue dot

Blue dot -

Two-thirds of small-business owners would rather get a mullet or remove a nest of angry bees than do their taxes.

February 23 -

Senator Joe Manchin and Majority Leader Chuck Schumer have struck a deal on a tax, energy and climate bill, breaking a deadlock on the Democrats’ long-sought legislation to enact major parts of President Joe Biden’s agenda.

July 28 -

Under the 2017 Tax Cuts and Jobs Act, R&E expenses paid or incurred after 2021 must be capitalized and amortized over five years (15 years if research is performed overseas).

October 20 Tax & Accounting Professionals business of Thomson Reuters

Tax & Accounting Professionals business of Thomson Reuters