-

The agency is asking taxpayers to account for multiple jobs within a household and to factor in the $2,000 child tax credit for each kid under 17.

June 4 -

The limit on deductible contributions to health savings accounts will jump by $50 for individuals and $100 for families next year.

May 31 -

As much as 46% believe Medicare will cover the costs of long-term care.

May 23 -

Clients who consider contributing to their health savings accounts past their full retirement age are advised to rethink their plan.

May 17 -

Some seniors are missing out on a potential 20% tax deduction, and “no one is talking about what a wonderful retirement planning technique" it is, says an expert.

May 14 -

Fixing the results of job-related stress could mean working less or doing more work you enjoy.

May 10 -

Recessions, bubbles and bear markets can teach advisors about the general investing public they look to serve.

May 9 -

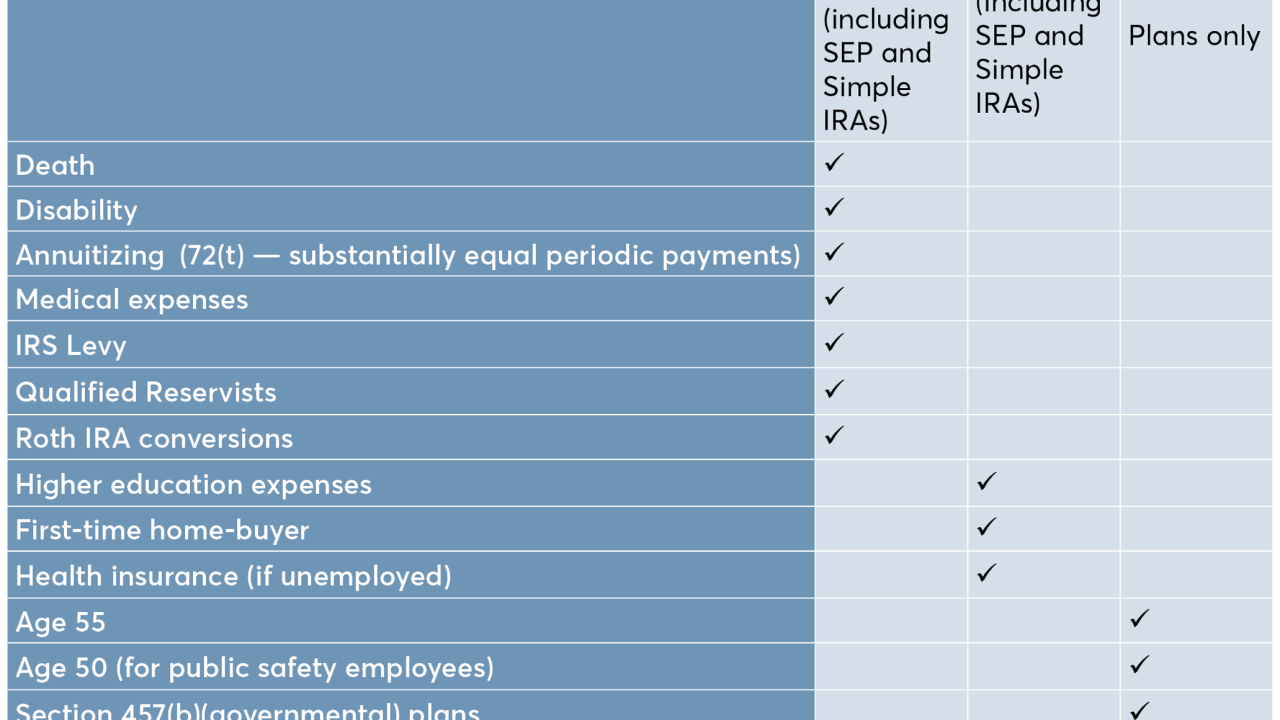

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

The earlier they begin planning, the easier it'll be to avoid a big tax hit.

April 23 -

The number of health savings accounts has topped 25 million, and employer contributions also have increased after several years of decline.

April 11