-

High-net-worth clients can bump into income limits when it comes to making Roth IRA contributions, but they can find other tax-saving strategies to save for retirement.

September 21 -

Many older Americans are now facing hefty life insurance premiums due to dwindling interest rates. Many seniors are sitting on a "ticking time bomb."

September 20 -

Advisors to the ultra-rich are upgrading strategies for wealth transfer and philanthropic planning.

August 31 Boulevard Insurance Strategies

Boulevard Insurance Strategies -

While proceeds from life insurance are not subject to income tax, there are other taxes that will apply. But there are steps to take to avoid those liabilities too.

August 29 -

Rents have increased an average of 3% annually over the 14-year time period of the study, while incomes have declined .1% annually.

May 9 -

Medicare premiums will increase for high-income retirees because of the change in the income brackets that will serve as basis for determining these premiums for their Part B and Part D coverage.

May 3 -

Compliance expert Alan J. Foxman explains why a 1035 exchange might trigger increased scrutiny.

February 23 -

Advisors and their clients may not yet realize how much the new regulations dramatically change their strategies.

February 14 -

Seniors are less likely to itemize tax deductions this year as a result, an expert says.

January 16 -

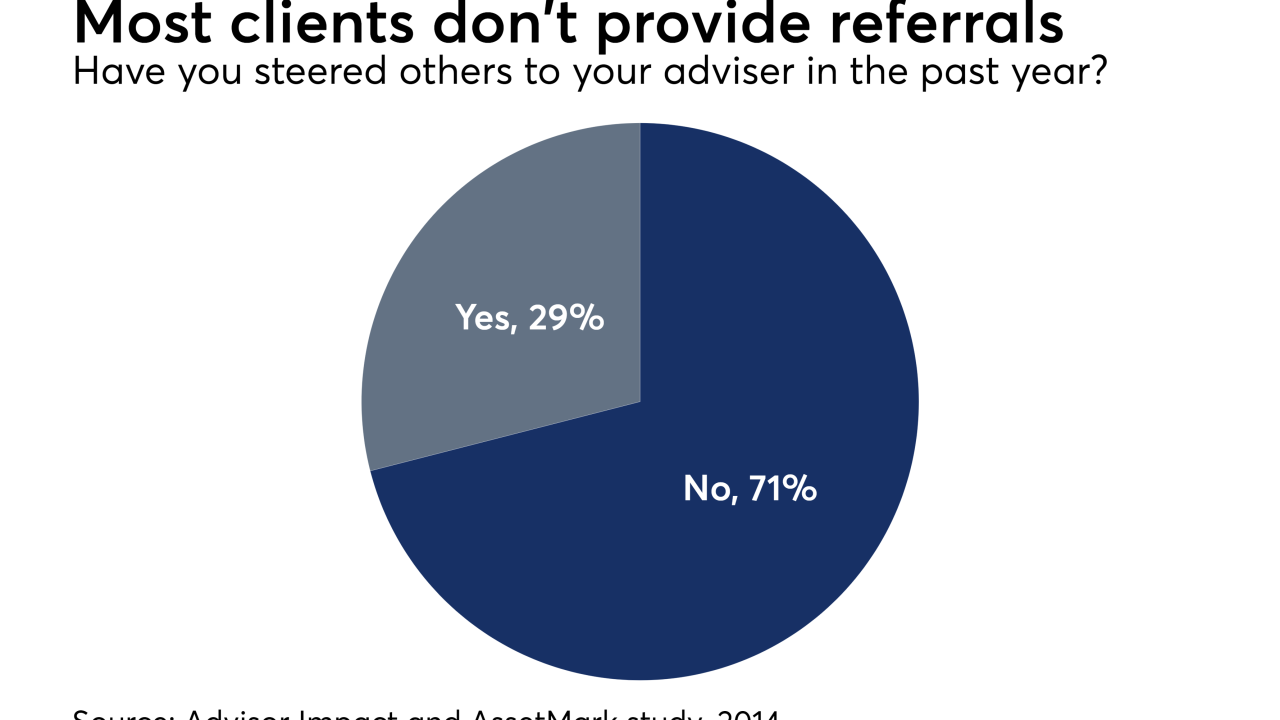

Existing clients and contacts can activate a fire hose of new revenue, so why do advisors shy away from the practice?

December 18