-

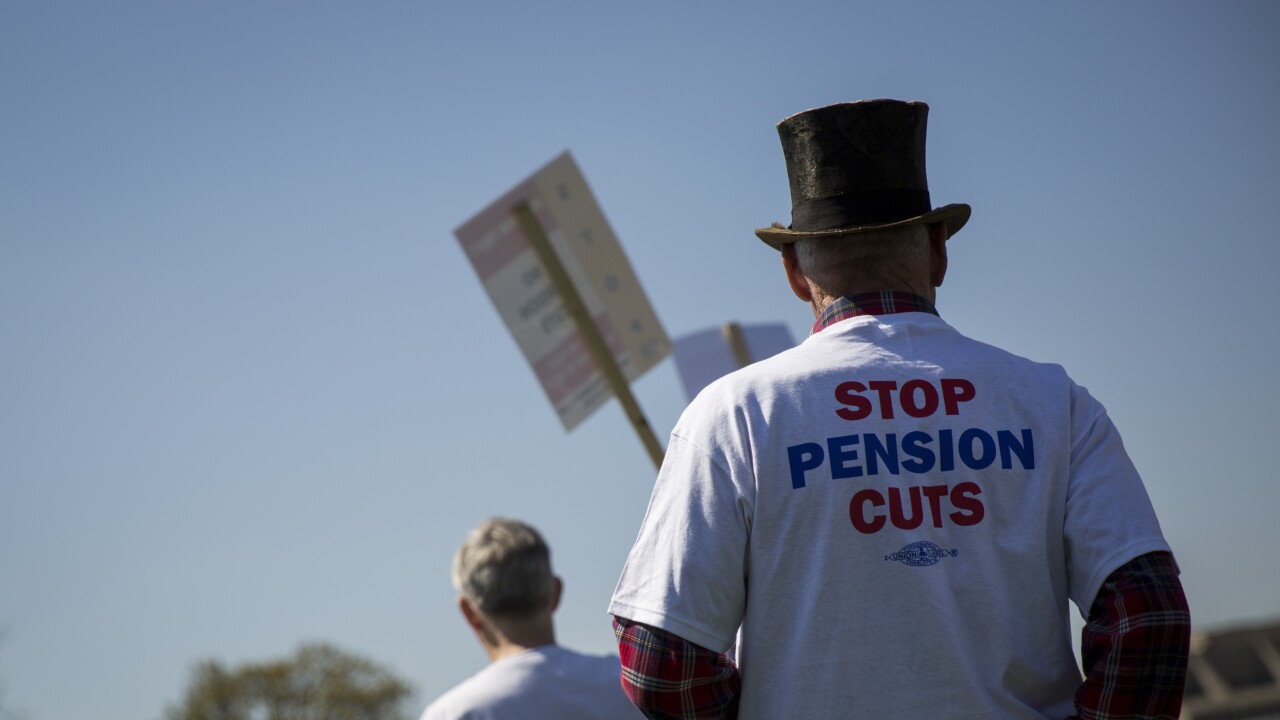

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

The proposed budget includes a provision that would give Medicare recipients the option to contribute to a health savings account, which would offer various tax benefits.

February 15 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13 -

Younger investors may see the market's swing as just another fluctuation in the market, while assuming that time is on their side. Older investors, on the other hand, may be far more stressed.

February 12 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9 -

Retirees are advised to step back to get a better perspective and then review their asset allocation in their portfolio.

February 8 -

Investors are advised to liquidate some assets or transfer them to certificates of deposit and money market funds.

February 7 -

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 6