-

These funds can be expensive and may not be accurate in determining investors' risk tolerance, among other potentail downfalls.

March 23 -

Clients still have a few weeks to make deductible contributions to various retirement accounts, as well as health savings accounts, to reduce their 2017 tax liabilities.

March 23 -

Seniors should consider designating joint agents, reviewing the security features on their financial accounts, and having their names removed from credit card solicitations.

March 16 -

Parents should ensure that their child has earned an income to be able to open the account.

March 14 -

Lottery winnings of retirees will not result in a lower retirement benefit, as the windfall will not be subject to the earnings test.

March 9 -

Retirement investors may want to adopt the billionaire's investing strategy if their risk tolerance allows them.

February 22 -

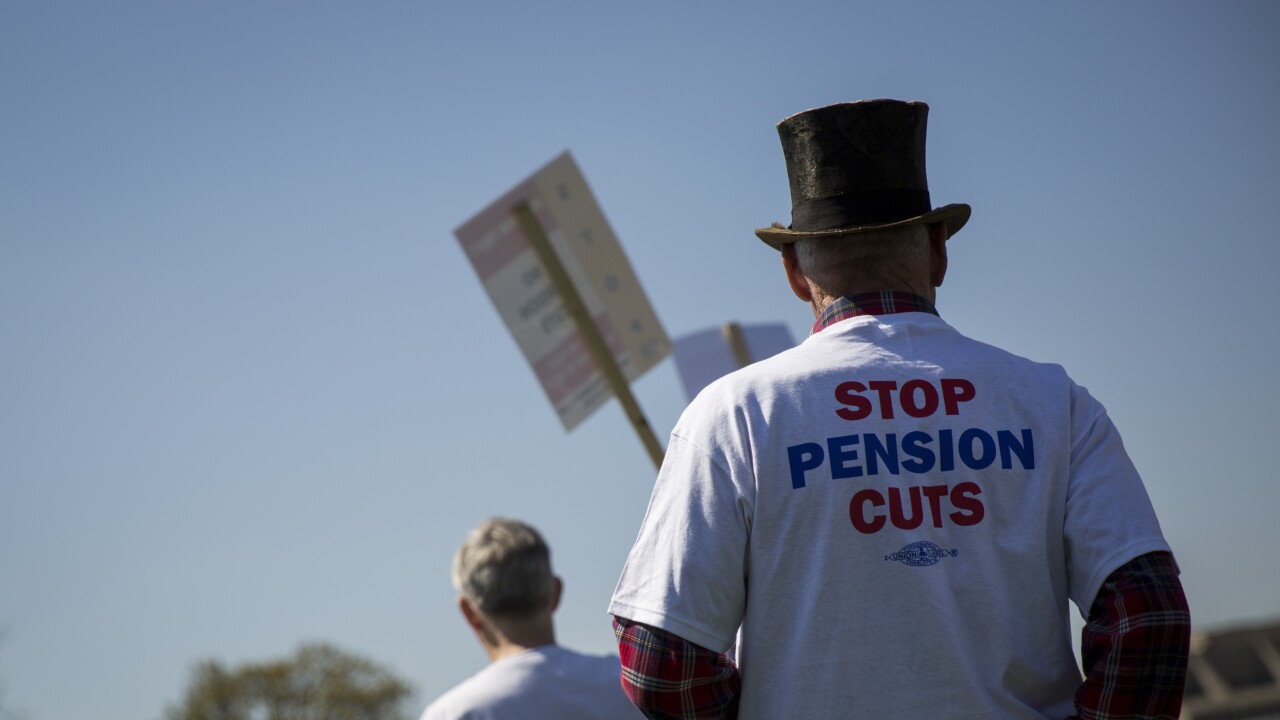

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

The proposed budget includes a provision that would give Medicare recipients the option to contribute to a health savings account, which would offer various tax benefits.

February 15 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13