-

The Internal Revenue Service granted additional relief to victims of Hurricane Harvey on Wednesday by making it easier for 401(k)s and other employer-sponsored retirement plans to give loans and hardship distributions to aid victims.

August 30 -

The amount that can be transferred is equivalent to the HSA's annual contribution limit, which is $3,400 for singles and $6,750 for couples.

August 21 -

Making excess withdrawals could result in taxes on the earnings and a hefty 10% penalty.

August 18 -

The withdrawals can be taken early in the year, late in the year or in installments throughout the year. Each approach has advantages to consider.

August 11 -

Congress may have a difficult time closing tax code loopholes that benefit households more than corporations, an expert suggests.

August 11 -

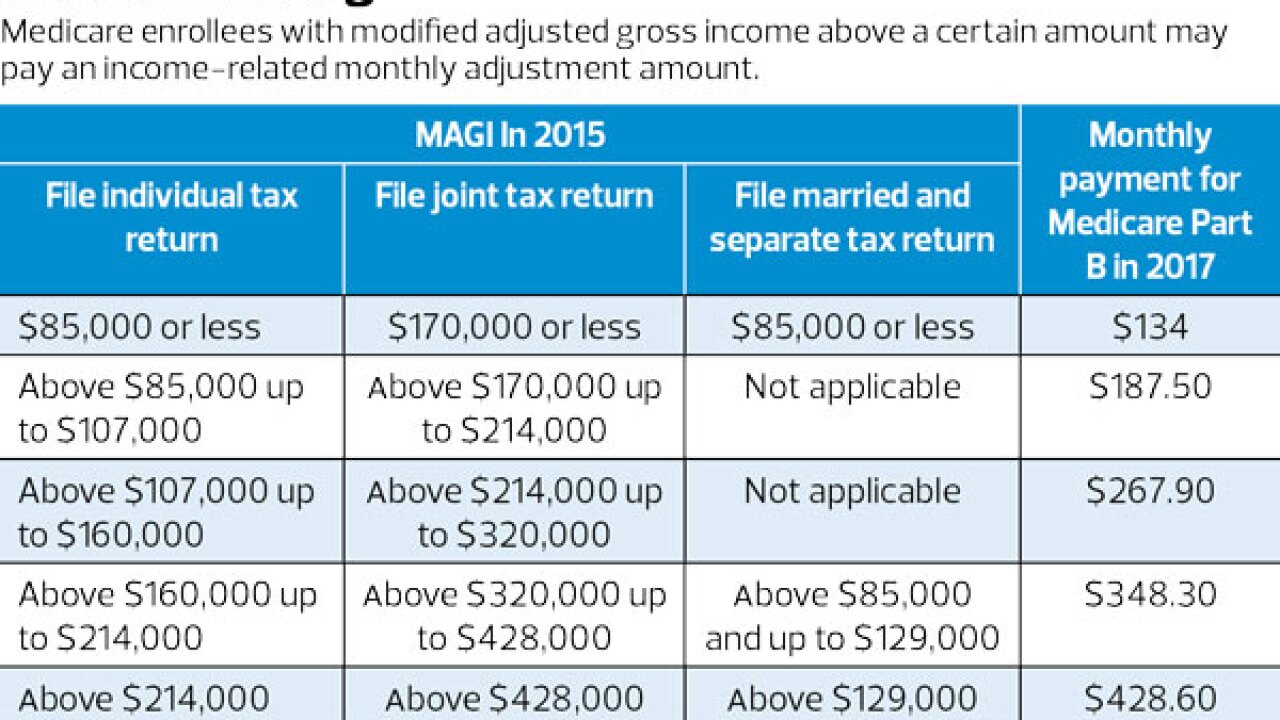

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

If clients tap their Roth accounts at the wrong time, even after retirement, they could lose out on some potential tax benefits.

August 4 -

Clients should plan to replace roughly 80% of their pre-retirement income after they leave the workforce for good.

July 26 -

Only 3% of households earning under $50,000 a year benefitted from the mortgage interest tax deduction.

July 21 -

Here’s how receiving investments on a stepped-up cost basis can save a client’s inheritance.

July 10 -

The average score of correct answers was 47%, and only 5% of respondents earned a grade higher than C.

July 3 -

A new report indicates that projected medical expenses of a 45-year old couple, after they retire, will be 122% of their total Social Security benefits.

June 16 -

Here’s what advisers should know about this increasingly available option, so they can help clients make the most educated choice.

May 31 -

Harvesting losses to write off taxable gains is one strategy to address the Trump administration's plan to scrap the 3.8% net investment income surtax.

May 26 -

A retiree living off her portfolio suffers hundreds of dollars a year in lost income for every added basis point of fund expense ratio and advisory fees.

May 18 -

Some questions were as relatively complex as the time-value of money; others were a simple as life expectancy. Answers were poor on all of them.

March 24 -

It's possible to use these distributions to preserve clients' savings well past their anticipated lifespan.

March 23 -

There are ways around having to pay as much as a 50% penalty. Plus, inheriting Roth IRAs and designing more efficient retirement portfolios.

January 31 -

IRA investors who turn 70 before June 30 have a little more than a year to make their first withdrawal.

January 19 -

It's not too late to help clients improve their tax situation for 2016 and beyond.

December 28Thomson Reuters Checkpoint