-

Most retirees said they adapted to their situation of having limited retirement income and they have had few regrets, according to a survey.

October 5 -

Owning a home can bring tax benefits, as well as equity that can be used to create an income stream, but in some cases a rental can be a better deal for retirees.

October 2 -

Can your clients use the increasingly popular "still working" rule? Yes, but get a handle on the rules first.

October 2 -

Some consumer advocates worry that this will negatively affect small businesses and middle- and low-income Americans.

September 29 -

Are you taking full advantage of the tools at your disposal? Advisors share insights about approaches.

September 25 -

The answer is in the investment details. If your employer offers a match, contribute at least enough money to get it since matches amount to "free money."

September 12 -

Clients under 35 are the only age group with a negative savings rate. These tools can help them prepare.

September 11 -

Each pre-retiree couple is in a unique circumstance, and needs to account for their health and longevity, as well as their willingness and ability to work.

September 5 -

Not tapping tax-deferred retirement accounts until the age of 70 1/2 can be a wrong move, as required minimum distributions can be big enough to push retirees to a higher tax bracket.

August 28 -

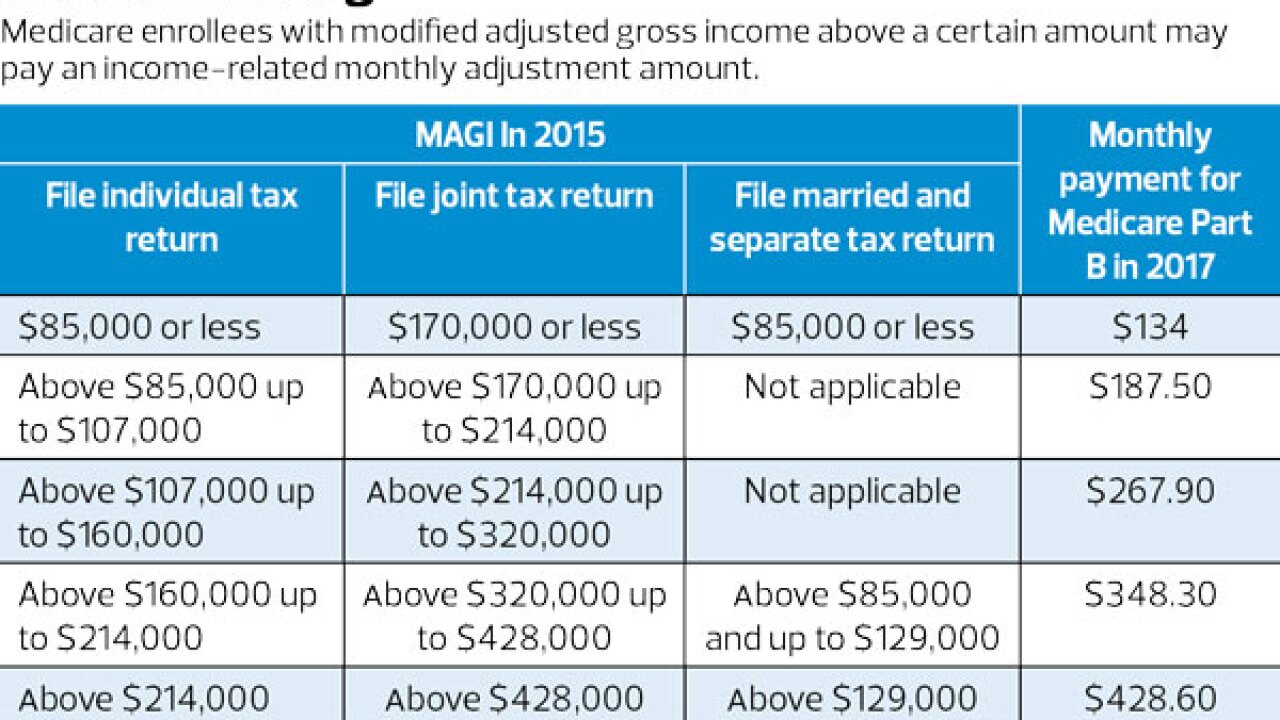

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

If clients tap their Roth accounts at the wrong time, even after retirement, they could lose out on some potential tax benefits.

August 4 -

The agency says its adoption of WebEx will allow for improved outreach with clients in the more rural regions of the country.

July 28 -

The most important consideration is that clients are able to complete the 35-year work period because benefits are based on the 35 highest-paid years from their careers.

July 27 -

With smaller paychecks and longer life expectancies than men, one strategy includes moving their IRA assets into a Roth to reap the tax advantages.

July 14 -

Here’s how receiving investments on a stepped-up cost basis can save a client’s inheritance.

July 10 -

Although traditional IRAs offer upfront tax deductions, clients will have to pay taxes later in life when they likely will be in a higher tax bracket.

July 7 -

A new line of mutual funds can help retirees manage their RMDs – which many fail to take – and avoid the hefty penalty.

June 13 -

Continuously increasing the FRA is particularly hard on lower-income workers because they tend to retire early.

May 18 -

If implemented, wealthy clients may consider making charitable donations and waiting until next year to realize income.

May 8 -

Retirees are advised to find gigs that suit them and have realistic expectations about the work they do.

May 8