-

The contributor was recently called to be an expert witness and realized that defending a retirement plan in court can provide a good opportunity to better understand a portfolio.

February 27 -

The products can offset potential losses from lowered state and local deduction limits.

February 27 -

Working seniors who intend to start collecting Social Security benefits in the middle of the year should know about the monthly earnings test.

February 26 -

82% of beneficiaries who qualified for survivor benefits and their own benefits were not informed that they could opt for a restricted application and boost their benefit.

February 23 -

New FINRA rules will help the wealth management industry do its part to identify and prevent elder abuse.

February 21

-

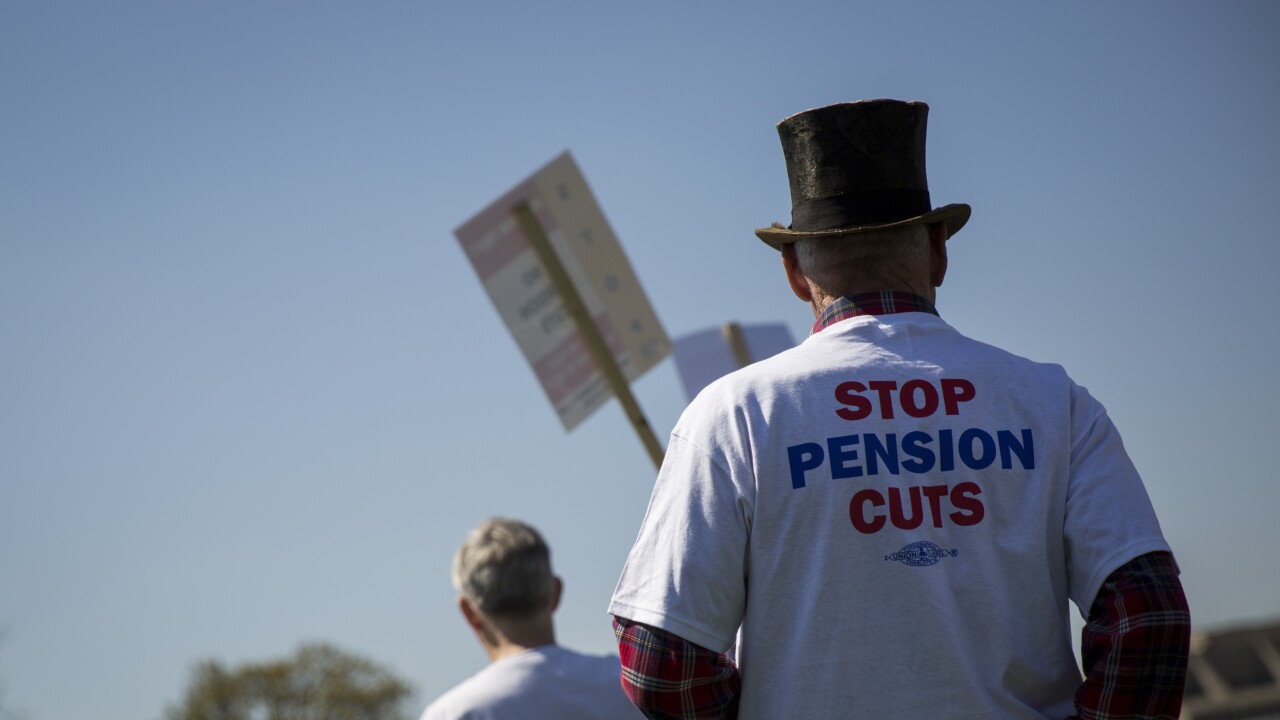

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

The right strategy can put them “in the 0% tax bracket,” an expert writes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9