-

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Battles will ensue over the Trump tax plan’s treatment of payments to former spouses.

February 16 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

Advisors and their clients may not yet realize how much the new regulations dramatically change their strategies.

February 14 -

Homebuyers are most likely to slow their purchases or stay on course if mortgage rates rise above a certain benchmark, but some could act more quickly or drop out.

February 13 -

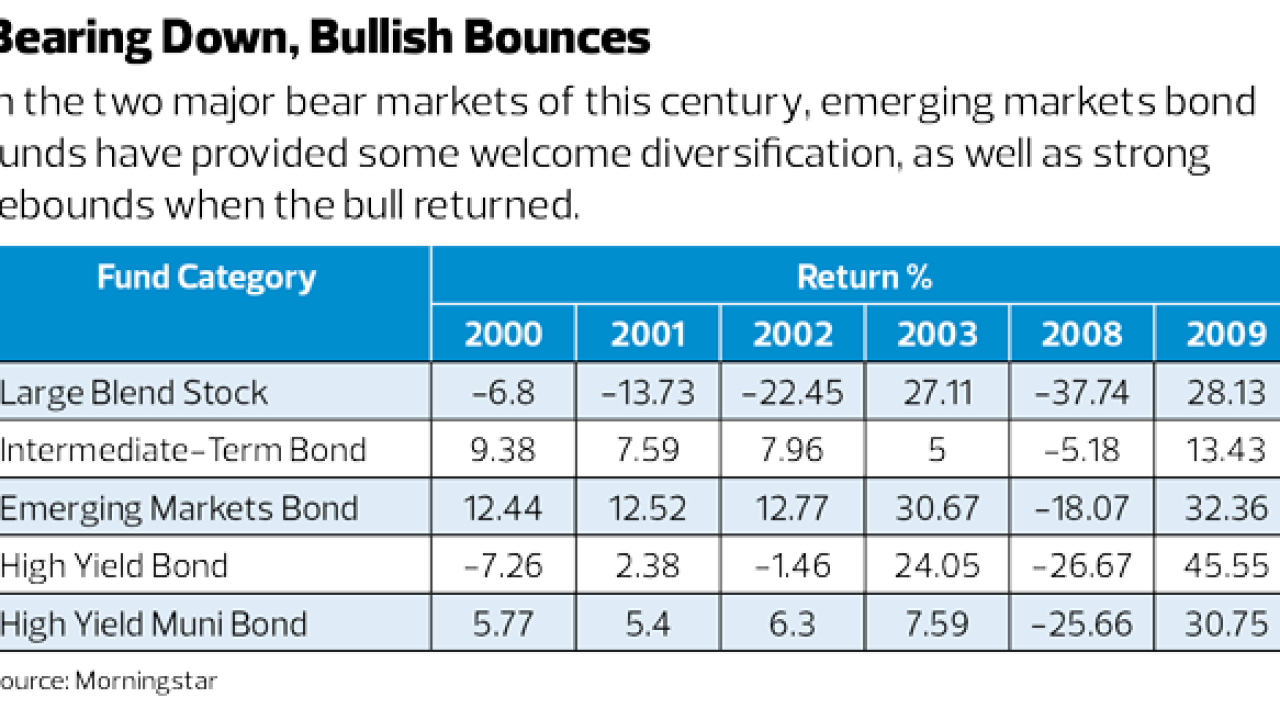

After stellar performance in a hectic decade, advisors home in on these funds.

February 13 -

The law has numerous income tax consequences for individuals and businesses.

February 9 Snell & Wilmer

Snell & Wilmer -

-

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 6 -

Claiming above-the-line tax write-offs doubles the standard deduction.

February 6