-

The CEO of the firm’s parent says it expects to trim hundreds more advisors from its ranks over coming months.

February 20 -

The president reportedly feels strongly that state and local taxes should be applied to online purchases.

February 20 -

The right strategy can put them “in the 0% tax bracket,” an expert writes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Battles will ensue over the Trump tax plan’s treatment of payments to former spouses.

February 16 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

Advisors and their clients may not yet realize how much the new regulations dramatically change their strategies.

February 14 -

Homebuyers are most likely to slow their purchases or stay on course if mortgage rates rise above a certain benchmark, but some could act more quickly or drop out.

February 13 -

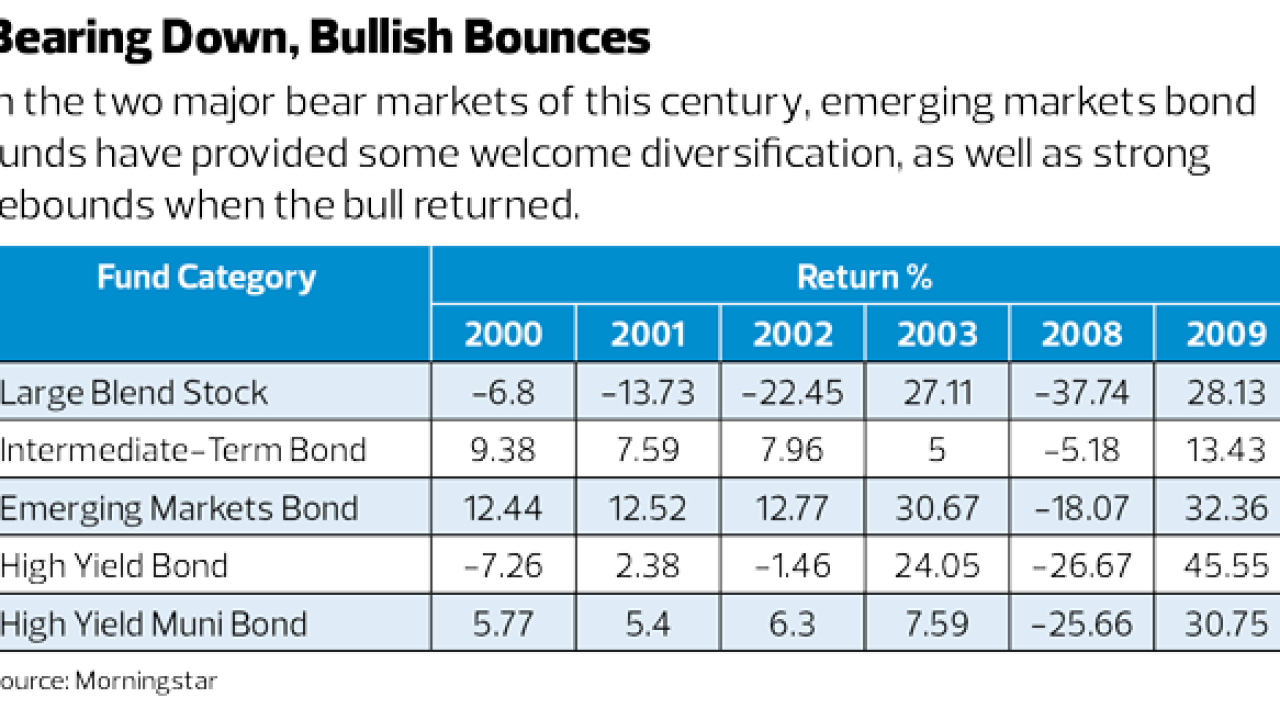

After stellar performance in a hectic decade, advisors home in on these funds.

February 13 -

The law has numerous income tax consequences for individuals and businesses.

February 9 Snell & Wilmer

Snell & Wilmer -

-

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 6 -

Claiming above-the-line tax write-offs doubles the standard deduction.

February 6 -

What some clients tried to claim on their tax returns shows they often don't know much about accounting.

February 5 -

The products exceeded their previous monthly flows record by nearly 30%.

February 2 -

Securities Service Network is entering a space usually regarded in the industry as the specialty of HD Vest and 1st Global.

January 31 -

A more comprehensive approach to low-cost investing could save thousands for retirement age clients.

January 31 -

What do they bring to the table? Lobbying clout, alternative fee structures and technical expertise are just part of the equation.

January 31 Financial Planning

Financial Planning -

Personal income is not subject to state taxes in Alaska, Florida and five other states, while 31 states do not impose taxes on Social Security benefits.

January 30 -

Bonus depreciation, Section 179, interest and loss limitations — what does it all mean?

January 30 Engineered Tax Services

Engineered Tax Services