Million-Dollar Club: Top Managers With Lots of Skin in the Game

According to recent research from Morningstar, portfolio managers investing more than $1 million of their own money in their funds had a significantly higher success rate than those who invested less, or even nothing at all.

"It turns out that manager investment does have predictive power," said Russel Kinnel, editor of Morningstar FundInvestor and author of the study. "The [success] rate generally progressed higher with manager investment levels."

Overall, the group of managers who oversee Morningstar 5-star rated funds and have more than $1 million of their own money invested in their portfolio numbered less than 100.

Following are the top 10 managers, ranked by their respective funds' five-year performance. Though some of the funds have additional leaders, only managers meeting the $1 million minimum are listed. --Suleman Din

Click through or view as a single page here.

All data is from Morningstar as of March 30, 2015.

10. Charles T. Akre, Jr., Akre Focus Fund Institutional (AKRIX).

9. Jonathan D. Coleman, Janus Triton D (JANIX).

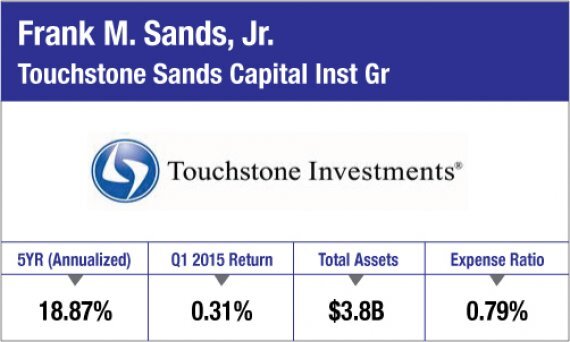

8. Frank M. Sands, Jr., Touchstone Sands Capital Institutional Growth (CISGX).

7. F. Thomas OHalloran, III, Lord Abbett Developing Growth A (LAGWX).

6. Kyle Weaver, Fidelity Select IT Services Portfolio (FBSOX).

5. Joshua K. Spencer, T. Rowe Price Global Technology (PRGTX).

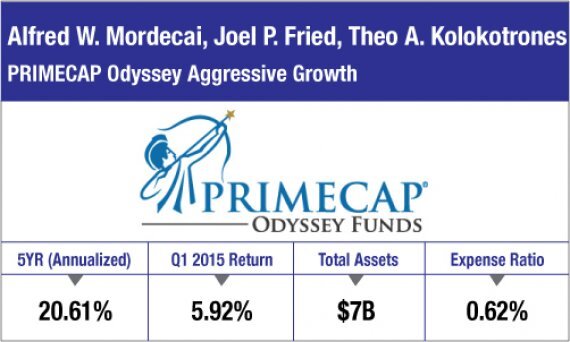

4. Alfred W. Mordecai, Joel P. Fried, Theo A. Kolokotrones, PRIMECAP Odyssey Aggressive Growth (POAGX).

3. John C. McCraw, AllianzGI Ultra Micro Cap Institutional (AUMIX).

2. Jeffrey A. Kolitch, Baron Real Estate Institutional (BREIX).