Mothers Day Reality Check: 10 Obstacles to Womens Retirement Goals<br><br>

And while women today are more financially independent than they were in previous generations, far too may are still financial unprepared (in general and in comparison to men) for retirement.

Not only do women live longer than men, they often are the sole caregiver – or assume that role following a divorce – for their children, a responsibility that, according to a recent MetLife survey, comes with an average price tag of $324,000 in lost wages, lost Social Security benefits and other lost opportunity costs over their lifetimes.

Here’s a closer look at 10 of the biggest challenges women of all ages face saving and investing for retirement.

Sources: ING Retirement Research Institute and the Society of Actuaries.

1. Savings Disparity<br><br>

Over time, given lower absolute average incomes for women, these percentage/contribution gaps can lead to significantly lower lifetime retirement savings for women, who will likely need more in savings to fund longer lives in retirement (with a corresponding increase in the likelihood of high medical costs).

Forty-two percent of women demonstrate retirement savings contributions at the lowest levels (between 1% and 5% of annual income) compared to 34% of men.

2. Barriers to Savings<br><br>

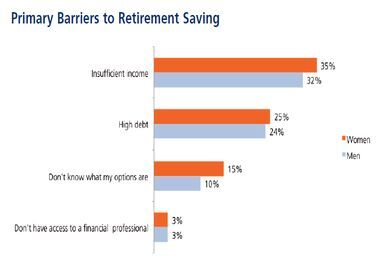

For both genders insufficient income is the most cited reason, followed by high level of debt in roughly similar measures. Women, however, are more likely to report that not knowing what my options are is a significant impediment to retirement saving.

3. Being Divorced or Widowed Doesnt Help<br><br>

4. Women Struggle With How and How Much<br><br>

While 45% of women younger than 50 dont understand how to reach retirement goals, that drops to 36% of women age 50-64 and just 23% (but still nearly one quarter!) of working women age 65-69.

And, two thirds of women (64%) have never tried to calculate how much they may need to (hopefully) reach their retirement goals; fully three quarters do not have a formal financial plan in place.

5. Women Want and Expect More Retirement Information From Employers<br><br>

6. Women Say They Have More Immediate Concerns<br><br>

That jumps to nearly half of women (48%) with one months salary or less in reserve (but just 36% of men). Only 28% of women (but 35% of men) have the recommended six months salary or more in emergency reserve.

7. But Most Women Have The Right Financial Priorities<br><br>

For 25% of women, improving their emergency savings is a #1 short-term financial goal... and that emergency fund is more important to divorced and widowed women (30%) than to those who are married or single.

8. Women Have Less Discretionary Income Than Men<br><br>

9. Regardless of Gender or Marital Status, Retirement is Important to Everyone<br><br>

Still working full time, with a mean retirement savings of $189,000, women age 65-69 may be especially pessimistic about ultimately being able to leave the workforce. Debt, for these older women, may also get in the way of retirement. 31% of women age 65-69 more than women in any other age group say that paying off debt is their most important long-term financial goal; just 22% of men in this age group report the same.

Paying off debt, for women, increases in importance as a long-term goal with age. For men, that focus on debt remains more stable, and is lower at every age.

10. Good News/ Bad News Scenario for Women<br><br>

On average, that’s five more years women will need additional retirement savings and investments to ensure they live out their golden years in style.