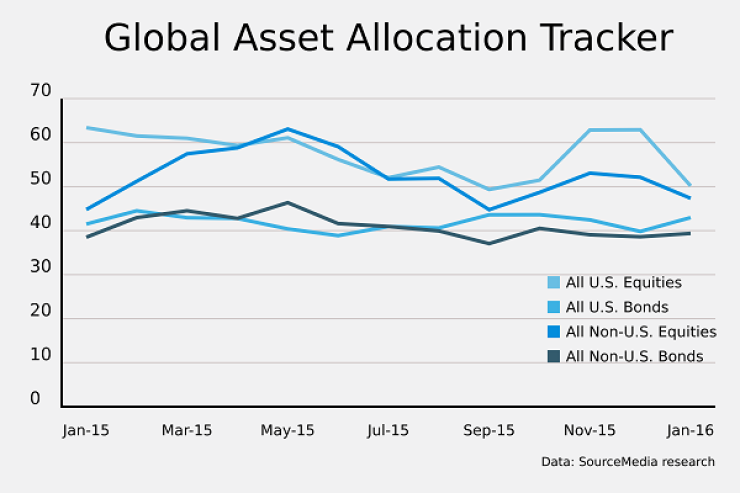

Advisors have been cutting back on their allocations of assets to equities in the face of a long list of factors that have clients feeling uneasy. High among these concerns are worries about China and other global events, and the possibility of inflation in the wake of the Fed's interest rate increase, according to the 320 respondents in this month's Global Asset Allocation Tracker survey.

"Due to a weak global economy and uncertainty surrounding issues in China, clients have been reluctant to invest in any foreign mutual funds," even those that are not tied to China, one advisor said. Many advisors noticed that their clients are holding on to cash.

Despite wariness about investing in global securities, recent market volatility has led to a significant drop in U.S. equity allocation as well.

"Clients have been holding on to cash, waiting for a sell-off to put it back into U.S. equities," said one planner.

Another advisor agreed: "The markets are in a state of turmoil, and it is prudent to wait for their direction before committing resources."

Despite the interest-rate hike, many advisors said they continued to increase their allocations in U.S. bonds.

Some of the advisors surveyed expressed optimism about global assets moving forward. "With the continued volatility in global equity markets, we see opportunity. With the volatility in the global credit markets, we see more risk and potentially big portfolio swings," according to one advisor.