Michael Cohn, editor-in-chief of AccountingToday.com, has been covering business and technology for a variety of publications since 1985. Prior to joining Accounting Today and WebCPA, he worked for Red Herring, Internet World, Beyond Computing, Accounting Technology and PC Magazine, and freelanced for a variety of other business publications. A graduate of the University of Pennsylvania with a BA in English, he studied accounting at the Wharton School of Business, and currently lives in New York City.

-

Federal investigators are uncovering billions of dollars in fraud tied to pandemic relief programs.

By Michael CohnSeptember 21 -

Taxpayers are concerned the extra $80 billion will lead to more tax audits.

By Michael CohnSeptember 14 -

The Empire State is expanding a tax break that allows smaller companies to circumvent the $10,000 limit on state and local tax deductions.

By Michael CohnAugust 19 -

There were signs of improvement in terms of audit engagements and quality control systems.

By Michael CohnAugust 19 -

Commissioner Rettig is promising not to use the nearly $80 billion his agency will be receiving to increase audits of small businesses or taxpayers who earn less than $400,000.

By Michael CohnAugust 17 -

The wording has changed from "virtual currencies" to "digital assets" in general, and there are other changes too.

By Michael CohnAugust 9 -

DAFs have been receiving more than half their contributions from complex assets such as shares of public and private companies, real estate and cryptocurrency in the past five years.

By Michael CohnAugust 8 -

The service’s recent policies expedited the hiring of new employees, but prolonged delays in eligibility verification could increase the risk of exposure of taxpayer data, according to a new report.

By Michael CohnJuly 11 -

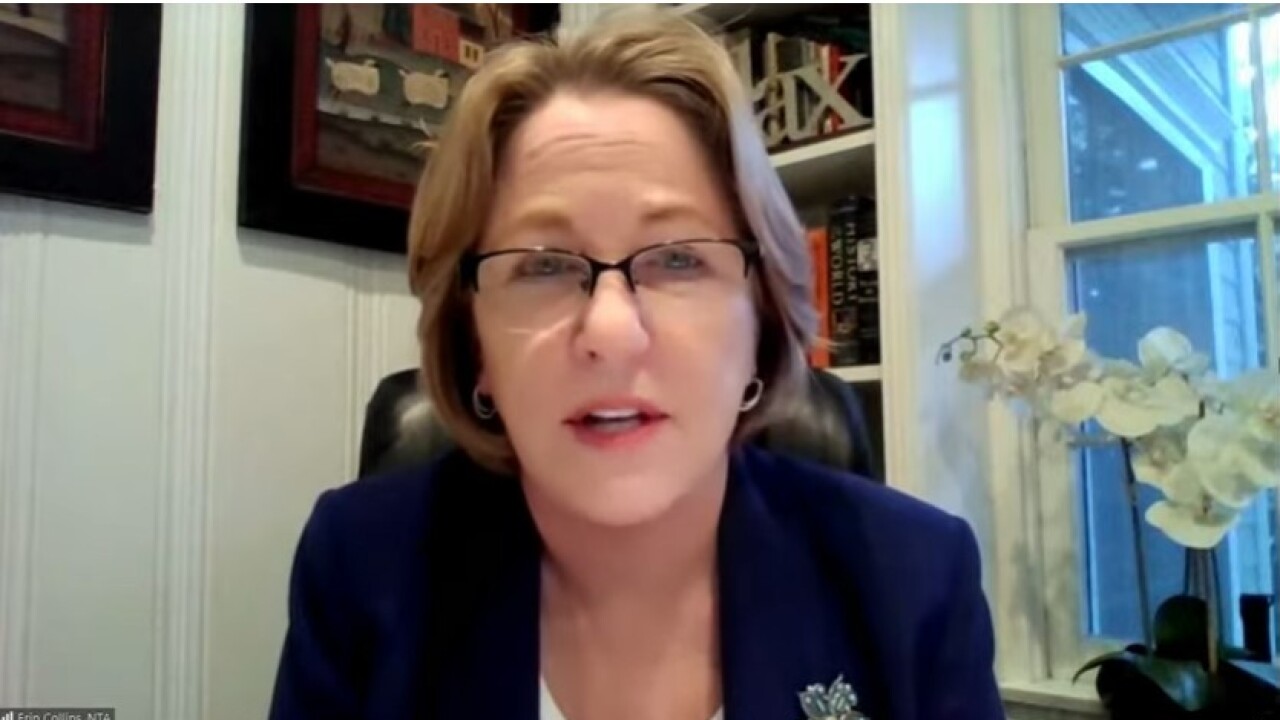

NTA Erin Collins expressed concern Wednesday about continuing delays by the service in processing tax returns filed on paper last year.

By Michael CohnJune 22 -

A congressional appropriations committee wants to give the Internal Revenue Service $1 billion more in funding to improve taxpayer service and technology and make the overall tax system fairer.

By Michael CohnJune 16 -

The plunging value of many cryptocurrencies and nonfungible tokens has led to worries about the tax implications faced by crypto investors and companies.

By Michael CohnJune 1 -

The service is taking steps to increase its audit rates of higher-income taxpayers after coming under sharp criticism in Congress over its lagging audit numbers.

By Michael CohnJune 1 -

The service decided to destroy the documents in March 2021 because of its inability to process its backlog of paper tax returns, according to a new report.

By Michael CohnMay 9 -

The CFA Institute has created a voluntary Diversity, Equity and Inclusion Code for the Investment Profession in the United States and Canada as financial firms wrestle with expanding a more diverse workforce.

By Michael CohnFebruary 25 -

A group of lawmakers teamed up Thursday to introduce bipartisan legislation that aims to create a workable structure for taxing purchases made with cryptocurrency.

By Michael CohnFebruary 3 -

Donor-advised funds increased their donations to charities last year in response to the COVID-19 pandemic, hitting the biggest levels in over a decade.

By Michael CohnNovember 12 -

The service’s recent move to set new requirements for claiming refunds on research tax credits is provoking an uproar among tax professionals.

By Michael CohnNovember 12 -

The service released its annual inflation adjustments Wednesday, including the standard deduction amount for individual and married taxpayers.

By Michael CohnNovember 10 -

The service lifted the limit from $19,500 as part of its annual inflation adjustments.

By Michael CohnNovember 4 -

The Internal Revenue Service’s Office of Chief Counsel is spelling out new requirements for information from companies submitting claims for research credit tax refunds to prove they’re valid.

By Michael CohnOctober 15