-

The Internal Revenue Service has released its annual list of the 12 most dangerous tax scams, including a new long-term capital gains credit scam, bad advice on social media, and more.

March 10 -

The pilot program for the new Trump accounts will deposit $1,000 into the accounts of children born between 2025 and 2028.

March 6 -

The Pinpoint Policy Institute's public campaign against the Institute for the Fiduciary Standard reflects a mysterious phase of the ongoing debate on private investments in 401(k) plans.

March 2 -

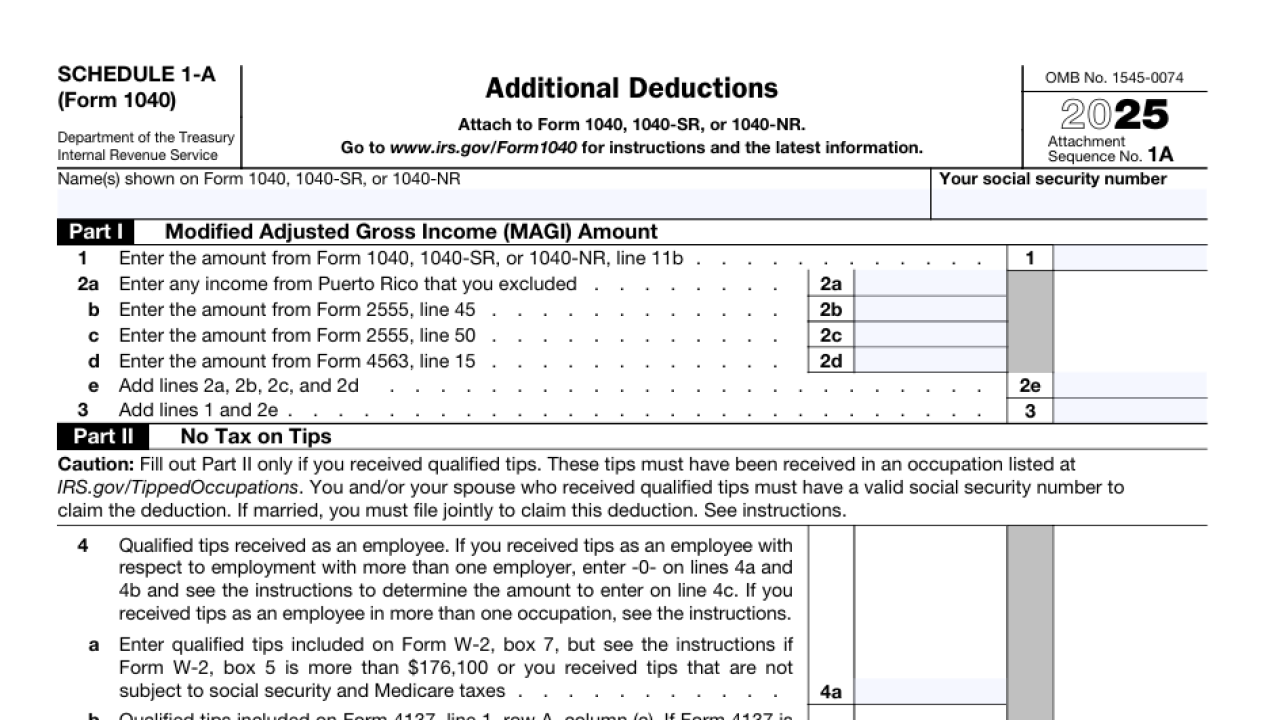

The new Schedule 1-A and updated instructions enable taxpayers to claim the new tax breaks for tips, overtime, car loans and senior citizens for tax year 2025.

March 2 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

The release coincides with a $6.25 billion donation from Michael Dell and his wife to kickstart the savings program.

December 4 -

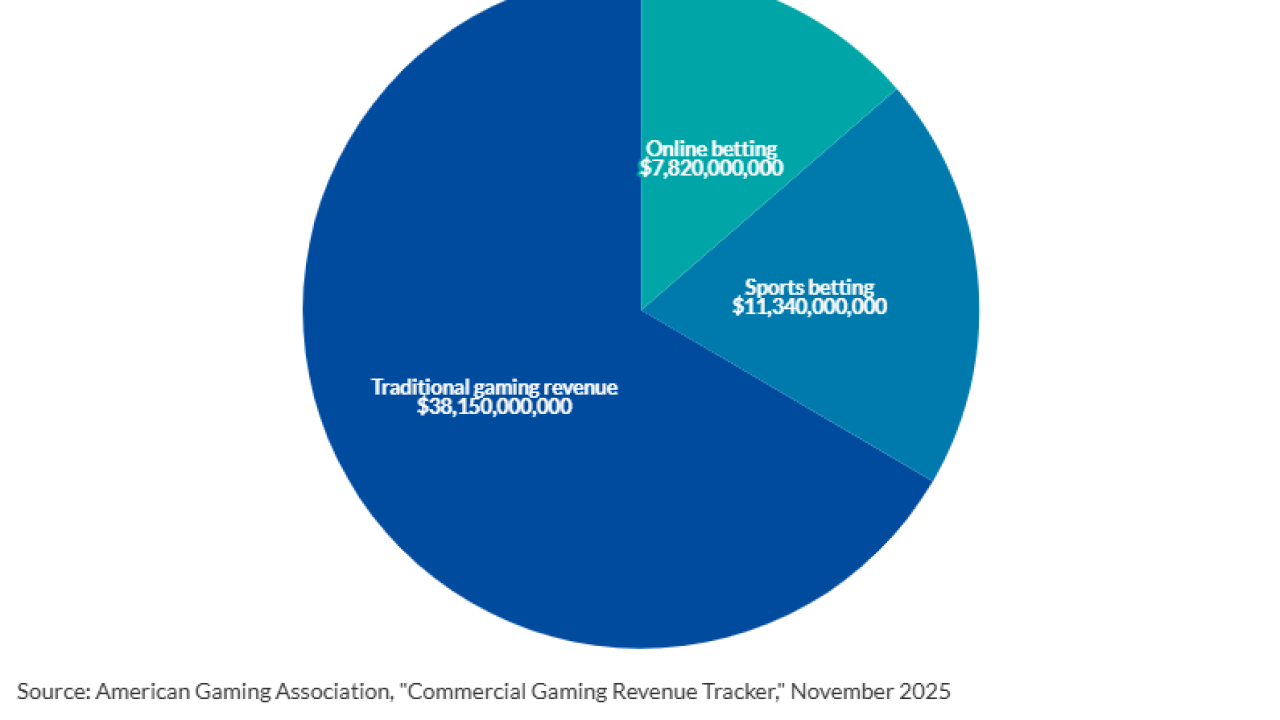

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

The Internal Revenue Service has shut down its Direct File free tax-filing program, sending an email to the 25 states that offered it this year.

November 6 -

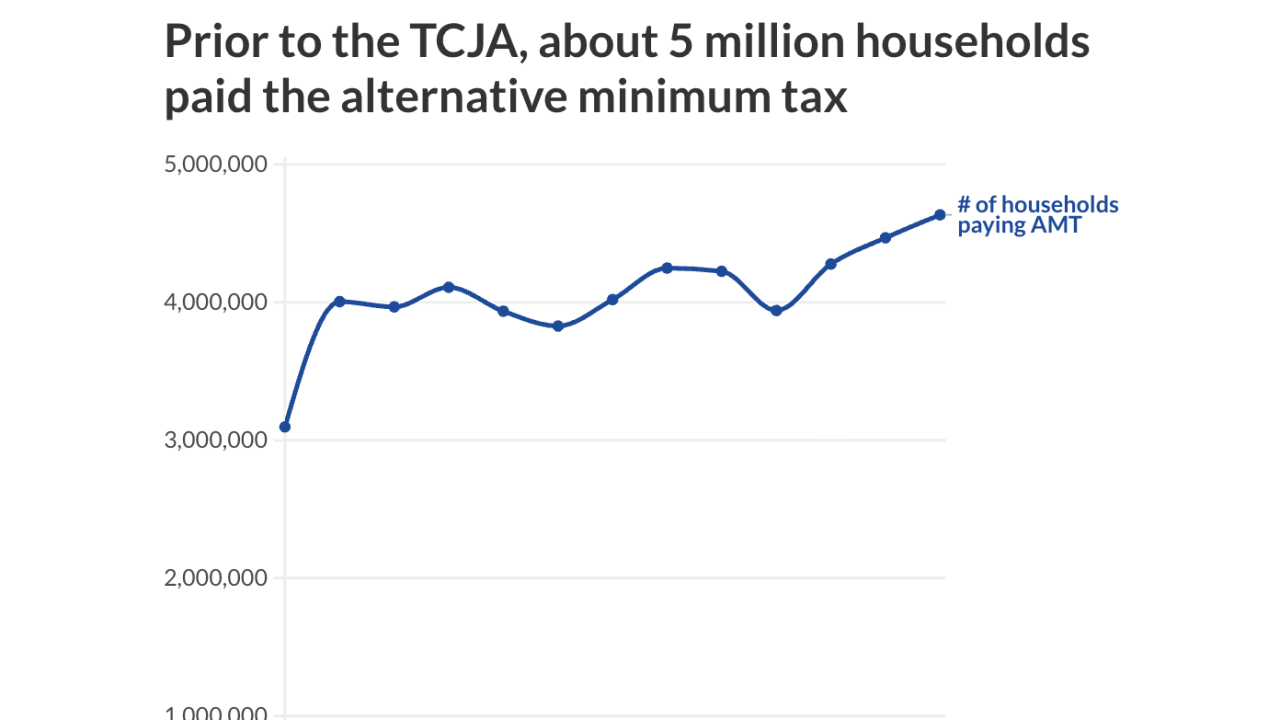

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

Rev. Proc. 2025-32 from the Internal Revenue Service detailed a number of changes, including a rise in the standard deduction to $32,200 for married couples filing jointly.

October 9 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

The Treasury and the IRS issued guidance on qualified OZ investments in rural areas under the One Big Beautiful Bill Act.

September 30 -

Senate and House Democrats proposed a bill to ensure billionaires pay a "fair share" of taxes, without actually raising their tax rate under current law, while Republicans advanced legislation pertaining to the IRS and the U.S. Tax Court.

September 18