-

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

The release coincides with a $6.25 billion donation from Michael Dell and his wife to kickstart the savings program.

December 4 -

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

The Internal Revenue Service has shut down its Direct File free tax-filing program, sending an email to the 25 states that offered it this year.

November 6 -

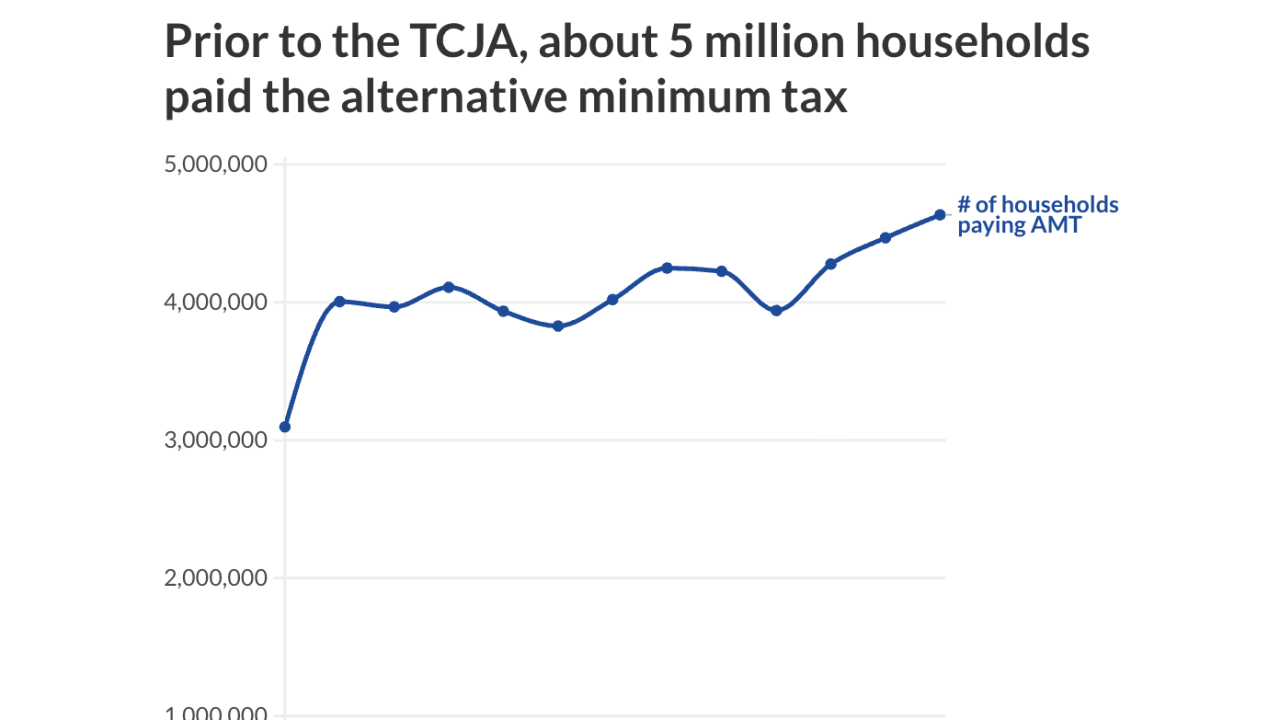

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

Rev. Proc. 2025-32 from the Internal Revenue Service detailed a number of changes, including a rise in the standard deduction to $32,200 for married couples filing jointly.

October 9 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

The Treasury and the IRS issued guidance on qualified OZ investments in rural areas under the One Big Beautiful Bill Act.

September 30 -

Senate and House Democrats proposed a bill to ensure billionaires pay a "fair share" of taxes, without actually raising their tax rate under current law, while Republicans advanced legislation pertaining to the IRS and the U.S. Tax Court.

September 18 -

The Internal Revenue Service and the Treasury issued final regulations on the new Roth catch-up contribution rule from the SECURE 2.0 Act.

September 16 -

The IRS posted guidance just in the nick of time for some taxpayers on the treatment of research and experimentation expenses under the new tax law.

August 29 -

The Internal Revenue Service has provided guidance on how to deal with the restoration of full expensing of research and development costs under the One Big Beautiful Bill Act.

August 28 -

The total effective tax rate for the 400 wealthiest Americans was lower than the general population, according to a new study.

August 25