Want unlimited access to top ideas and insights?

Clients’ exuberance about their retirement prospects following private and public sector reopenings amid a widespread vaccine rollout may have cooled slightly over the past month, according to the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

Specifically, some advisors cite concerns about overheated markets and the specter

"With the threat of COVID-19 continuing its decline, investors' confidence is improving with reopening of businesses, however, they remain concern[ed] with the prospect of inflation," one advisor says.

Overall, the composite RACI score in May checked in at 55, off 1.7 points from April, but up nearly 10 points from the same period a year earlier.

RACI scores higher than 50 denote an increase in confidence, with scores below that mark indicating a decline.

Several key RACI indexes posted scores well above 50, but were down just slightly from the previous month, a downtick some advisors attribute to investors taking the surge in market values as a potential warning sign that a correction could be coming.

"Clients were a bit more conservative in May than in April of '21 because of recent stock market returns," one advisor says. "We are seeing many more clients wishing to become more conservative and increase their fixed-income holdings versus increasing their equity holdings."

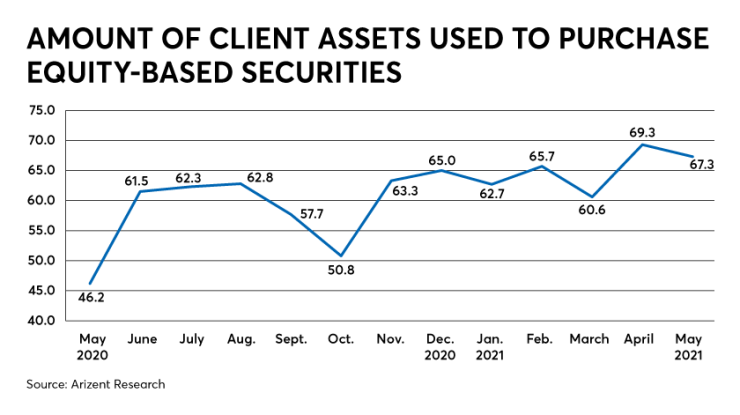

The RACI component that tracks clients' assets allocated to equities posted a score of 67.3, off two points from April but still a staggering 21.1 points ahead of May 2020.

For context, last month's equities score notched the highest mark in the history of RACI polling — and this month's score was the highest since January 2017.

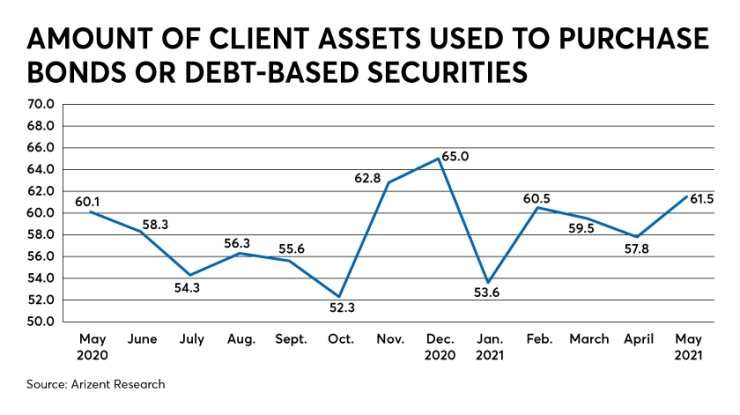

Some advisors have been moving to rebalance clients' retirement portfolios away from equities in favor of bonds. One advisor described bonds as "underweight" in clients' portfolios and others report that the strong equity values of recent months are making clients nervous.

"The view is the market is fully valued and due for a correction," one advisor says. "Defensive posture — adding short-term bond funds — is typical from April to May."

The RACI component that tracks client assets allocated to bonds or debt-based securities posted a score of 61.5 in May, up 3.8 points from April, marking the highest score in that category since December 2020.

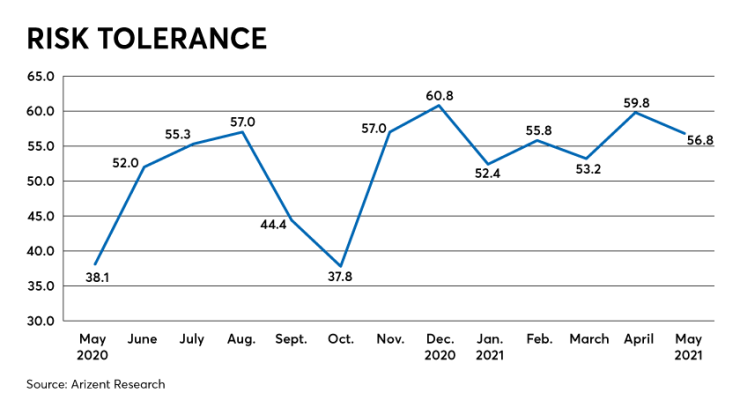

Those modest fluctuations in equities and bonds match investors' attitude toward risk. While some advisors report that their clients are still bullish and willing to take on more risk, in aggregate, the RACI score measuring clients' risk tolerance dipped three points from April to May to a score of 56.8.

But that score was 18.7 points above last year's mark, and with confidence scores in key metrics across the board hovering in the mid-50s or higher, clients seem to be feeling good about their retirement picture, even if some of the initial euphoria of the reopenings has worn off.

"People are generally still feeling confident in the market," one advisor says. "With employment numbers looking up, overall vaccination number high (though slowing) and things feeling a little more back to normal.'"