Concerns about inflation and potential changes to the tax code, compounded by a rising wave of COVID-19 infections amid the omicron variant, have clients worried about their retirement pictures.

Advisors polled in the most recent Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers, described clients feeling nervous about headline issues beyond their control, but said they have been struggling to find investment options to meet the moment.

"Feels like inflation and omicron scares have gotten some investors a little spooked," one retirement advisor said. "Unfortunately, there are few places to run to mitigate risk and still find a decent yield."

Many advisors reported that risk was an operative factor in their work with retirement clients in December. In that month, the component of RACI that tracks risk tolerance posted a score of 46.1, the second-lowest mark in that category since October 2020.

RACI scores above 50 indicate an increase in confidence, and scores below that mark signify a dip in confidence.

December's risk tolerance score was down nearly a point from November, but off 14.7 points from the same period in 2020. It was a choppy end to the year — risk tolerance scores had been hovering in the mid-50s for most of 2021 before tumbling to 43 in September.

Overall, RACI saw a composite score of 51.2 in December. That figure was still above water and represented only a slip of 0.4 points from November, but it followed the same pattern as risk tolerance. Excepting the September slump this year, December's RACI score was the lowest mark since October 2020 and continued a year-end slide from scores that were consistently in the mid-50s throughout the earlier months of the year.

Some advisors report that news from Washington has clients on edge, particularly on the tax front, as the Biden administration seeks to advance a social-spending bill.

"People [are] very nervous about changes to [the] tax code and if and when they will occur," one advisor said. "People are starting to look to protect some of their gains from the past couple of years, but with such low interest rates, not many choices."

The general anxiety among clients that advisors described didn't translate neatly into their attitudes toward market exposure, however. The RACI component that tracks investments in equities checked in at 55, still well above water but off 3.9 points from November and down 10 points from the same period last year.

December's equities score tied with September for the lowest mark since October 2020, but at 55 represented the persistent draw that rising stock prices have for clients.

"There is confusion about how COVID-19 will impact the economy, but few clients are content to be on the sidelines while market prices rise," one advisor said. "They can accept volatility in a bull market while being nervous about any declines."

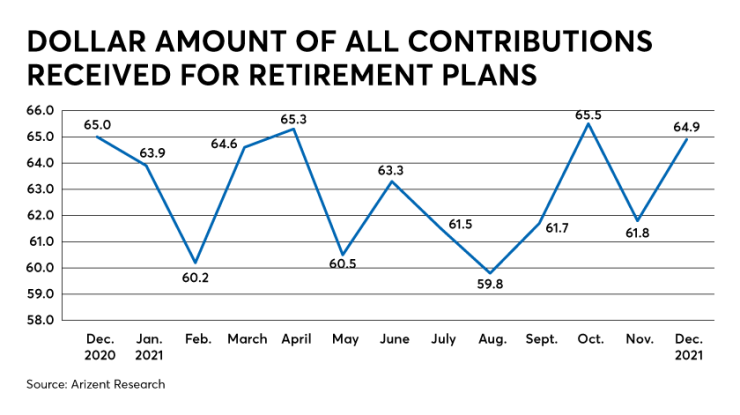

On the other hand, many advisors reported a strong close to the year as measured by retirement products sold and overall contributions. The RACI component that tracks dollar contributions to retirement plans posted a score of 64.9, up 3.1 points from November, and very likely a product of the typical surge at the end of the calendar year.

"Year-end has a significant increase in retirement assets in general," one advisor said. "More new accounts, and last-minute funding is very busy in December."