-

Rethink bonds and hedged funds while prepping clients for a market correction — or worse — in the coming year, counsels the CEO of Toews Asset Management.

December 10 Toews Asset Management

Toews Asset Management -

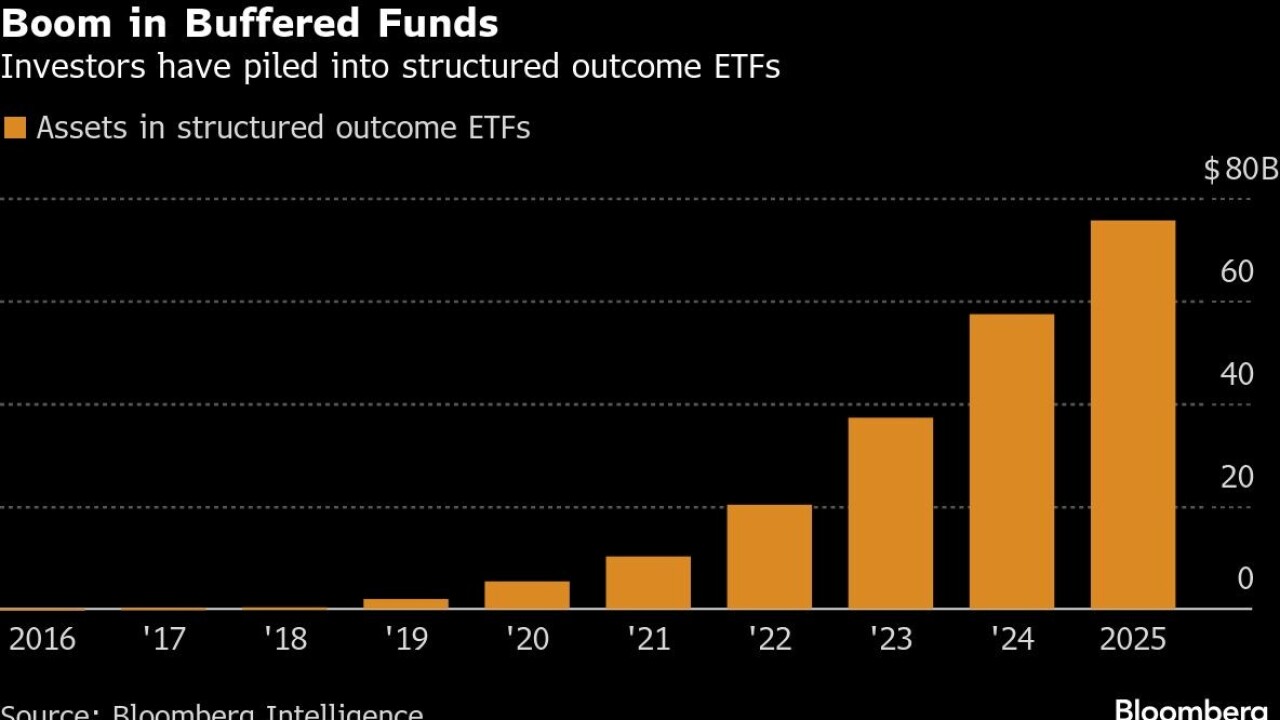

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

After years of strong market returns, concern over stretched equity valuations is rising. Could a long-overlooked options strategy be the right tool for the moment?

November 18 -

In a record-setting bull market, the products offer investors a straightforward way to protect against downside risk. But not all financial advisors are convinced of their utility.

August 1 -

A 90-day pause on most reciprocal tariffs sent stocks briefly soaring. Financial advisors say recession and inflation risks still loom large.

April 10 -

Large exchanges argue some of the changes could make it more costly for them to offer rebates to brokers in return for order flow.

September 18 -

Massachusetts regulators accused the wirehouse of not conducting proper oversight of stock sales made a First Republic executive shortly before the bank collapsed last year.

September 6 -

Citigroup finds 31% of the changes needed for the move to faster settlement cycles still have to be completed.

September 4 -

Financial planners have had to field plenty of questions about why they weren't more aggressively chasing returns. With the market correction, they now have a chance to show the benefits of a diversified strategy.

August 5 -

The firms acknowledge on social media that they are responding to technical difficulties.

August 5 -

Industry groups say RIAs are receiving SEC letters inquiring about compliance with the new T+1 settlement rule for stock and bond trades.

July 18 -

Difficulties loom over syncing U.S. stock exchanges with global transaction cycles.

May 28 -

Some wealth managers see themselves as playing a distinct role in helping investors navigate the treacherous waters of private equity, credit and real estate.

March 21 -

The Fed reports that net worth increased by $11.6 trillion from 2022, or 8%, to $156.2 trillion.

March 8 -

The wealth management giant is the latest firm seeking to give investors access to private vehicles that have generally outperformed their public counterparts in recent years.

March 7 -

Passive funds reached a long-anticipated milestone that no one would suggest will reverse anytime soon. But these managers argue expertise has enduring appeal.

February 13 -

The market-making firm warns of costs and intrusions into investors' privacy.

February 12 -

The asset and wealth division helped drive the gains, posting its highest quarterly revenue in two years on a gain tied to the sale of a financial-management business. That helped counter fixed-income trading results and investment-banking fees that fell short of expectations.

January 16 -

Finance gurus see the coming 12 months as a time to dilute concentrations in cash and large firms' stock and consider emerging markets and small caps.

December 27 -

Brian McDonald, head of Morgan Stanley at Work, spoke with Financial Planning about how the firm aims to extend its roots in Silicon Valley and build on equity compensation offerings.

November 27