After two months of rising confidence, retirement investors' moods soured in September as stocks tumbled and the Fed raised interest rates for a third time.

New data from

"With the market pullback and world events, clients are getting a bit skittish," one retirement advisor said. "It is getting harder for them to keep the faith between three interest rate increases, no clarity about when the end is in sight and geopolitical events such as [the war in] Ukraine."

"Most are terrified," another advisor said of their clients. "Unjustifiably so, but terrified nonetheless."

Composite scores above 50 indicate rising confidence, while scores below that show a decline. That means that in September, retirement confidence switched directions — from rising to sinking.

Fueling the turnaround was a significant drop in risk tolerance among future retirees, from a score of 51.8 in August to 38.2 in September.

"Inflation, volatility and the political situation around the world have made some clients much more cautious," one advisor wrote.

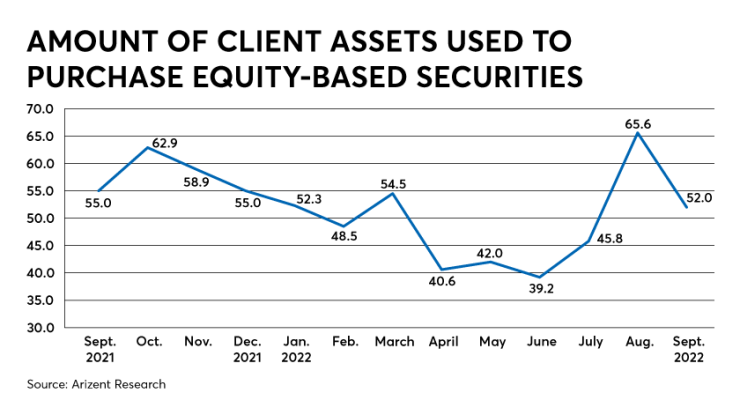

Investment in stocks, another indicator of confidence, was also down. From August to September, the amount of client assets used to buy equities plunged from a score of 65.6 to 52.0.

"Clients are becoming pessimistic about the equities improving in the next several months," one advisor said.

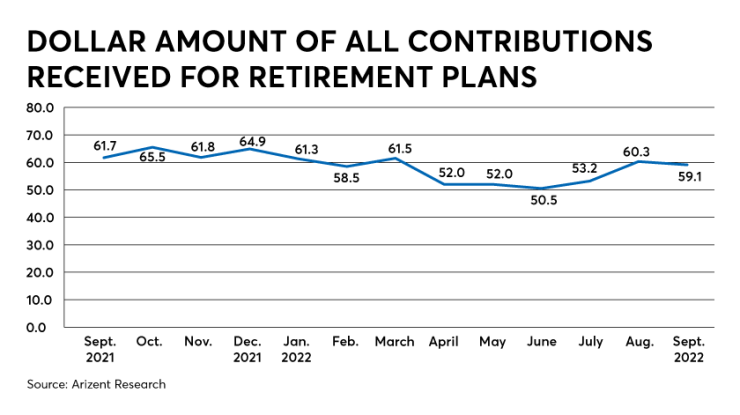

Total contributions to retirement plans, meanwhile, declined less steeply. The RACI score for the dollar amount of all contributions dipped only slightly, from 60.3 in August to 59.1 in September.

Taken together, the numbers paint a darkening picture of how retirement savers feel about the economy. And they bring an abrupt end to what had been a steady improvement in July and August, when the composite RACI score rose twice in a row — first from 43.7 to 46.8 and then to 53.1. In those summer months, advisors attributed the uptick to encouraging news about the economy, including lower gas prices and a modest stock market recovery.

Since then, the news has grown more concerning. From mid-August to the end of September, stocks slid back downward, with the S&P 500 erasing all its gains from earlier that summer. Even more alarming to many clients was the Fed's decision on September 21 to raise interest rates by three-quarters of a point — the third time it has done so in three months — in order to tame inflation.

Many advisors pointed to this decision, and its context of skyrocketing prices, as a major source of anxiety.

"Clients are feeling that the interest rate hikes are not succeeding in bringing down inflation, but it is hurting the housing market by slowing new home purchase activity," one advisor wrote.

"Most feel that a recession is already here and that the Fed could make it much worse if they take rates up too far," another said.

Even those who agreed with the central bank's approach said it made investors nervous.

"The steep drop in the markets due to the persistently high inflation rate and commensurate (and appropriate) Fed actions really impacted our clients' tolerance of risk," one advisor said.

Nevertheless, many advisors said they were managing to keep their clients calm. Some spoke of "staying the course," while others counseled investors to "ride it out."

"Most are focused on the long term," one advisor wrote. "There is a light at the end of the tunnel."