-

New data from J.P. Morgan reveals how retirement expectations diverge from reality, and what that means for advisors helping clients navigate life after work.

March 2 -

The Pinpoint Policy Institute's public campaign against the Institute for the Fiduciary Standard reflects a mysterious phase of the ongoing debate on private investments in 401(k) plans.

March 2 -

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

February 27 -

President Donald Trump unveiled a federal plan offering government-backed retirement accounts with a $1,000 annual match for workers without employer-sponsored plans.

February 25 -

New research shows visuals and gamified tools can dramatically boost client understanding and engagement around complex retirement rules.

February 24 -

Small oversights when drafting a trust can snowball into major headaches for clients and their heirs. Here's how advisors can help.

February 23 -

A new bipartisan bill would exempt retroactive Social Security payments from federal taxes, easing a surprise financial burden for millions of retirees.

February 20 -

Financial advisors have critical roles for modifying financial plans to cover costs and long-term plans when clients find themselves faced with caring for a family member.

February 19 -

More retirees are going back to work amid financial pressures and economic uncertainty, an AARP survey finds. Advisors weigh in on when "unretiring" makes sense.

February 17 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

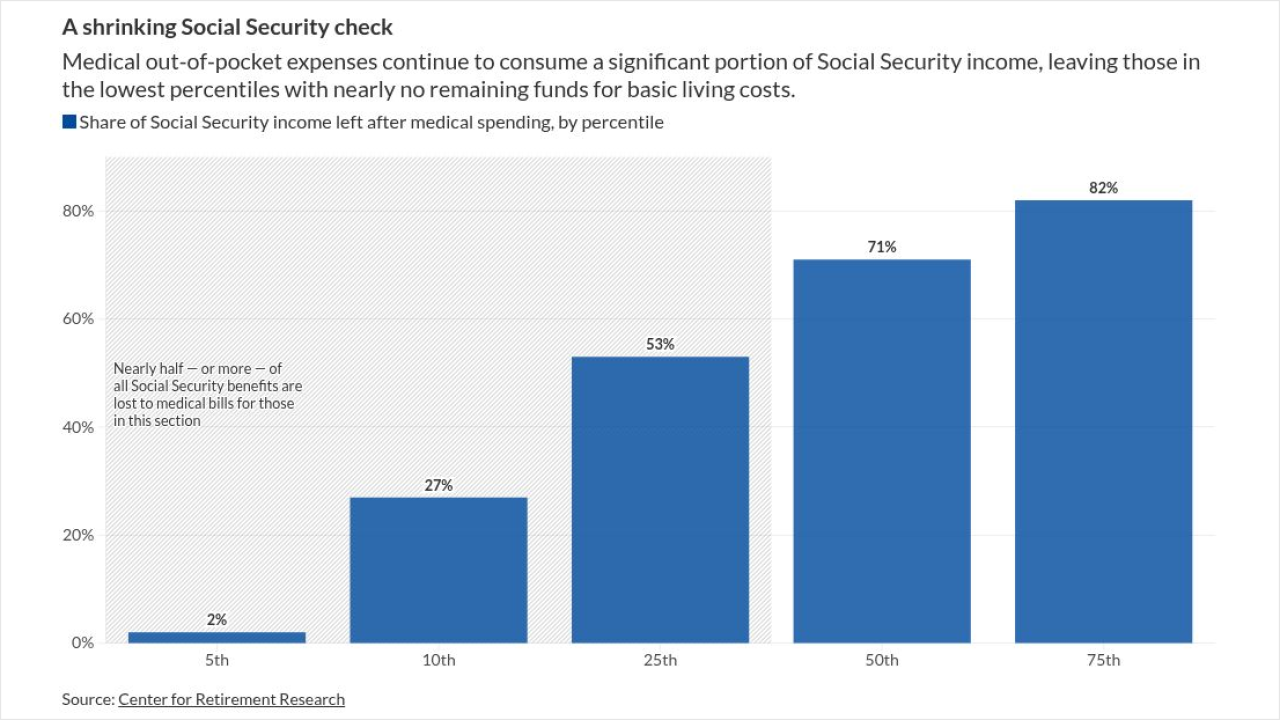

Medical inflation is projected to climb at double the rate of Social Security cost-of-living adjustments, leaving a growing number of retirees with a shrinking share of their benefits.

February 9 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

Fixed-income ETFs are rapidly gaining popularity among advisors, driven by growing familiarity, diverse offerings and strong asset flows, new Cerulli research shows.

January 22 -

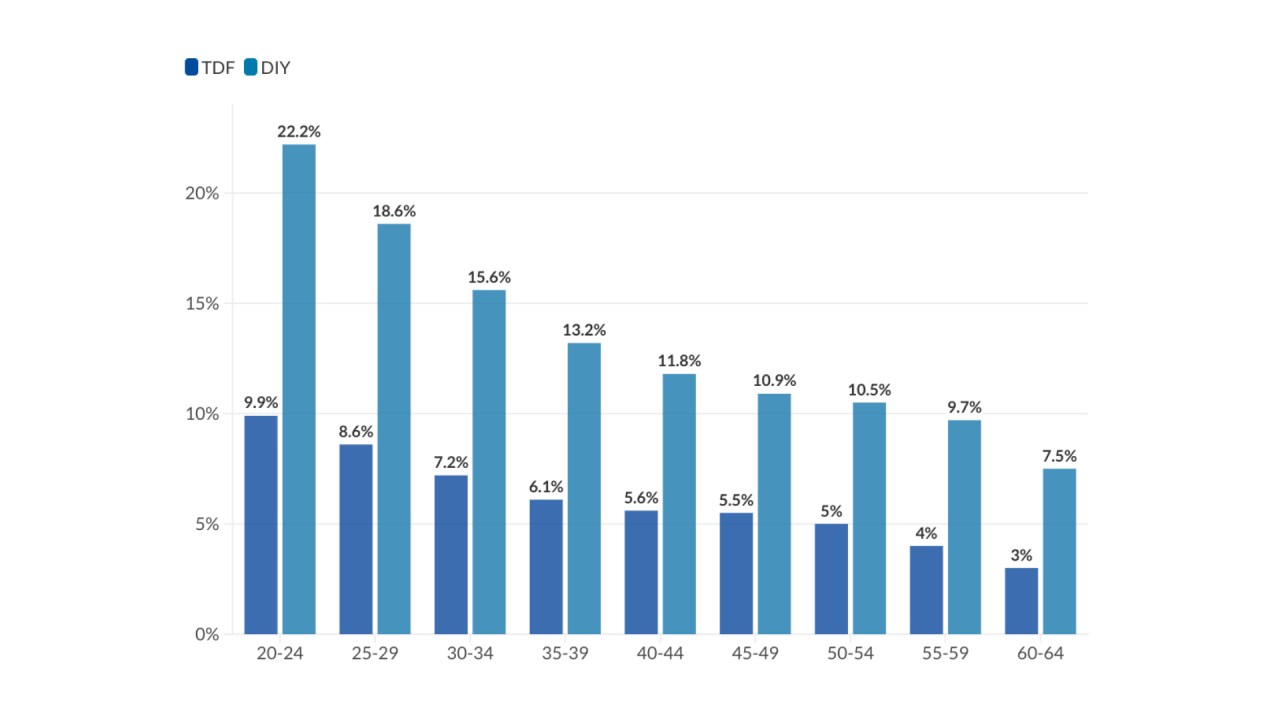

A new Morningstar study suggests managed accounts can significantly boost retirement wealth, particularly for younger workers and those currently managing their own portfolios.

January 20 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

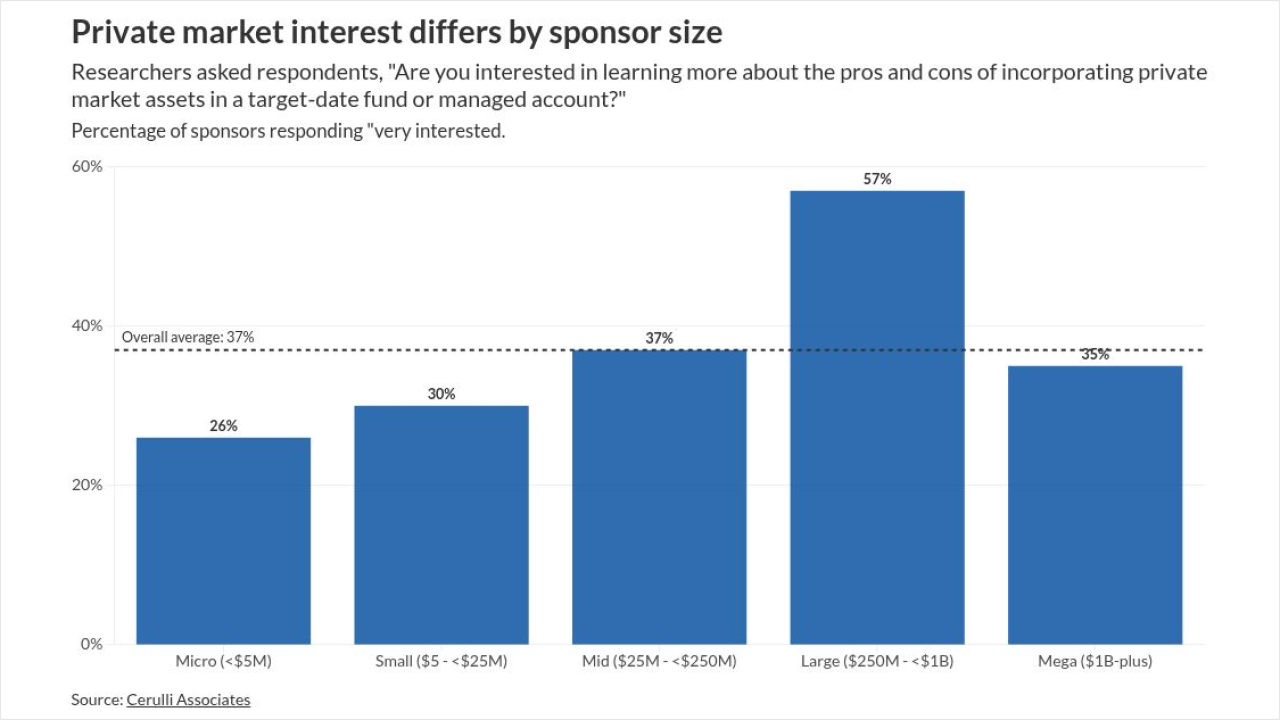

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

Financial advisors often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice for most households.

December 31 -

From AI advancements to greater access to private markets to the forces shaping retirement, six experts share their hot takes on what's just over the horizon in wealth management.

December 30 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29