Retirement investors' confidence in the economy was plummeting at record speeds in June. In July, the plunge showed some encouraging signs of slowing, but widespread anxiety remains.

According to new data from Arizent's Retirement Advisor Confidence Index (RACI), the investors' composite score — an aggregate of different figures measuring economic confidence — rose to 46.8. That's 3.1 points up from June's score of 43.7, which was nearly an all-time low.

Scores above 50 indicate rising confidence, while scores below that reflect a decline. That means confidence last month was still dropping, but not as fast as the month before.

"My clients are starting to move some assets back into the market," one advisor said. "Many believe we are nearing a bottom."

The modest improvement was fueled by a steep jump in risk tolerance, which rose to 38.6. That's up 13 points from June's score of 25.6, the

But that doesn't mean clients are optimistic — which is understandable, given all that happened in July. On July 27, the Fed substantially

"Clients are very nervous," one advisor told RACI's survey. "I've had far more conversations and contact with clients over the last two months than previously."

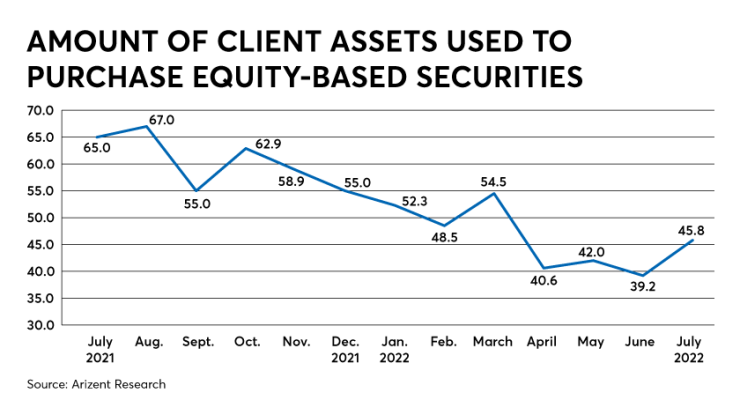

And yet a number of data points showed glimmers of hope. For example, the amount of client assets invested in equities crept up 6.6 points, to 45.8. That's up from June's score of 39.2 — the lowest point since March 2020, when the country was first plunged into the COVID-19 pandemic.

Similarly, total contributions to retirement plans inched up 2.7 points, to 53.2 in July. That's not an enormous increase, but it brings the score up from its June doldrums at 50.5, the lowest point since April 2020.

Some advisors — though not many — said their clients were weathering the storm without too much concern.

"Clients aren't terribly upset about inflation at the moment," one said. "Some think it is transitory, and others are expecting to spend time later this year harvesting losses in their bond portfolios by swapping to other securities."

Two survey questions, however, showed that most investors are worried. When asked whether their clients believe the economy is in a recession, 52% of advisors said yes. Of those, 23% said the "vast majority" of their clients believe so. Only 7% said most of their clients do not believe a recession has started.

The second question was about inflation. When asked how their clients felt after the Fed raised interest rates again, 52% of investors said their clients felt more concerned about inflation than before. Only 6% said clients were now less concerned, and none said the "vast majority" were less concerned.

"Inflation remains the primary concern along with the volatility of the stock market," one advisor said. "There is little confidence that the Fed will be able to better control inflation over the short term."

Many said their clients blame leaders in Washington for the rocky economy, citing a "lack of trust in the Fed, the administration and Congress."

"Fed's incremental tightening isn't doing enough to stop inflation," one advisor opined. "Printing more money and calling it an Inflation Reduction Bill really isn't fooling anyone and will do more harm than good toward long-term inflationary numbers."

Other advisors said their own steady counsel was keeping clients calm.

"Short-term trends do not affect our operations or outlook," one advisor said. "Isn't that why we exist?"