While investors have some concerns about the economic policy of the new administration, clients planning for retirement generally are feeling bullish about the business climate and the progress of the vaccination rollout, according to the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

April's survey saw confidence markers that were considerably higher than the same period a year ago, continuing a sharp uptick in confidence that has accompanied the widespread distribution and administration of COVID-19 vaccines.

"Reopening of the economy leads to more optimism and risk tolerance," one retirement advisor says.

"Investors are more confident as we exit the pandemic," another advisor says.

Clients' views on investing in the stock market reveal signs of that confidence. The RACI component that tracks investments in equities posted a score of 69.3, an all-time high in 10 years of polling.

RACI scores higher than 50 indicate a rise in confidence, with scores lower than that mark signifying a decline in confidence.

The April equities score was the sixth consecutive month that that category checked in above 60, but marked a jump of 8.7 points over March, and 27.1 ahead of the same period in 2020.

"Improving economic conditions led to higher earnings, greater optimism, higher risk tolerance and increased contributions to retirement plans," one advisor says.

Overall, the composite RACI checked in at 56.7, the highest score since January 2018. April's mark was a modest uptick of 1.7 points from the previous month, but 13.2 points ahead of the same period a year ago.

Advisors don't always share their clients' enthusiasm, with some expressing concerns that markets might be overvalued and due for a correction. One noted the psychological trap that some clients can fall into following a long run of market increases.

"Clients are always more enthused about investing for retirement after good stock markets returns like we had this past year," that advisor says. "Unfortunately, they are not as excited after a couple of bad years in the stock market."

But it was hard to read April's report as anything other than a good-news story.

Another key measure of advisor sentiment — risk tolerance — also had a strong showing. That component of RACI posted a score of 59.8, up 6.5 points from March, and up 25.1 points from last year.

"Clients were willing and wanting to take on more risk this month as the economy continues to improve," one advisor says.

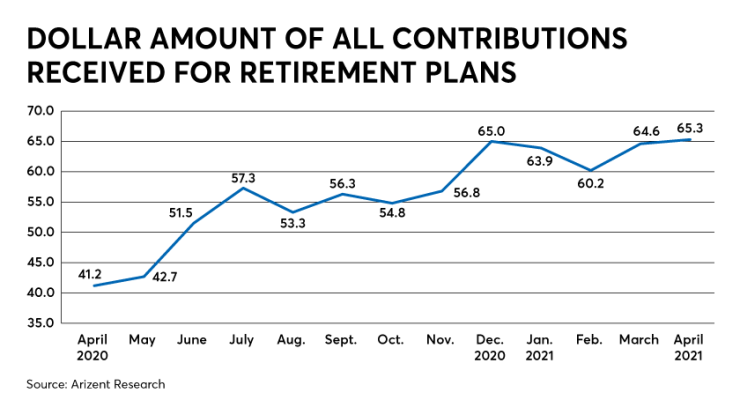

An improved economy meant that more businesses were hiring again, which translated into more funds moving into retirement plans.

The RACI component that tracks dollar amounts of contributions to retirement plans posted a score of 65.3, the highest mark since December 2019, and a 24.1-point increase over April 2020.

Some advisors say that they are fielding more calls from clients with concerns over inflation and potential tax increases, one of the few trouble spots in April's report.

However, some advisors report that some of the federal stimulus dollars are finding their way into retirement savings as clients are feeling more secure about their financial situation.

"Some government payments to citizens have been used to fund retirement plan contributions," one advisor says. "Investors are more confident as we exit the pandemic."