Clients are investing more in their retirement plans even as stock market volatility has frayed nerves and pushed some into safer holdings, advisors say.

Both the dollar amount of contributions for all retirement plans and the number of retirement products sold increased, according to the latest Retirement Advisor Confidence Index — Financial Planning’s monthly barometer of business conditions for wealth managers. The component tracking contributions came in at 55 and the component tracking products sold came in at 50.9. (Readings above 50 indicate an increase and readings below 50 indicate a decline.)

“Everything has been stable” despite worries about risk, one advisor says, noting, “Most clients have contributions automated.”

Another advisor says seasonal factors are helping to support retirement investment flows, as “funding of retirement plans usually picks up as we get closer to the end of the calendar year.”

Advisors also say that the healthy economy and robust hiring is supporting retirement savings. “We saw retirement-plan participants move more into cash and less into stocks,” an advisor says. “They did not stop contributing, though.”

Advisors do report that the retreat in stock prices has dinged revenue, however. The index component tracking fees for retirement services dropped 4 points to 48.3, the lowest level in more than two years.

“Fees were lower as assets under management went down,” an advisor says.

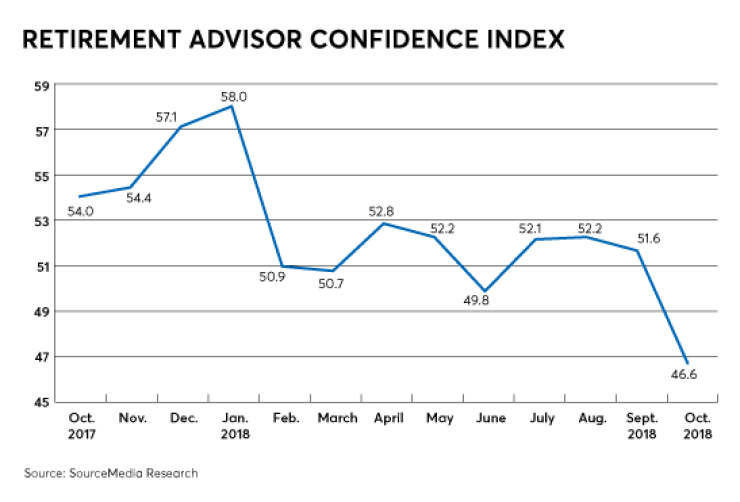

Overall, the composite RACI slid 5 points to 46.6, matching a low reached in the summer of 2015. In addition to retirement plan contributions, product sales and fees, the composite tracks risk tolerance, asset allocation, investment product selection, new retirement plan enrollees, and client tax liability.

The biggest drag on the composite was the component tracking client risk tolerance, which plummeted 16.2 points to 30.9, the lowest level since the beginning of 2016.

“Market volatility is scaring people,” an advisor says.

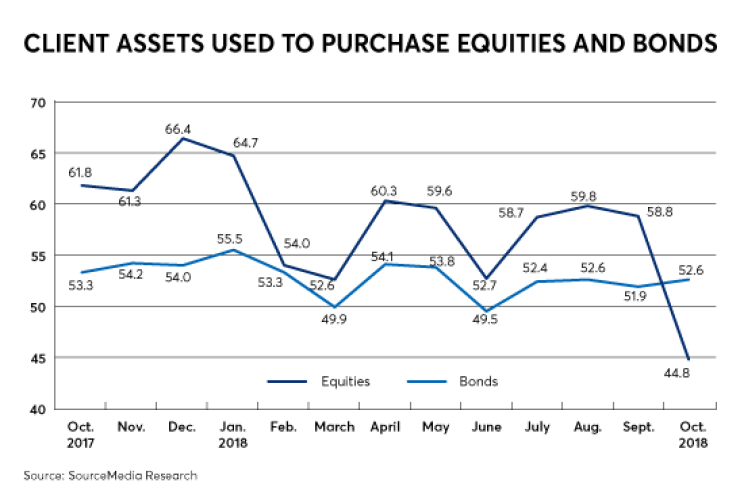

The risk pullback was evident in changes in asset allocations reported by advisors. The component tracking flows into stocks plunged 14 points to 44.8, the lowest level since the index was launched in mid-2012. Meanwhile, the component tracking flows into bonds edged up 0.7 points to 52.6.

“Clients moved to the sidelines due to market volatility and an increase in perceived risk,” an advisor says.

Some advisors say that moves to reduce risk have been particularly sharp among older clients. One advisor observes “higher allocations to cash for retired clients who are spending down portfolios.”

Broadly, however, advisors say they are encouraging clients to focus on the long term, and that rebalancing formulas are acting as stabilizers to shift portfolios back into equities at more attractive valuations. Advisors also say that some clients are actively searching for bargains.

“Volatility is normal,” on advisor says. “Some clients were hesitant to invest, others saw a buying opportunity.