-

The legislation includes a provision that would raise the age limit for making contributions and taking required minimum distributions.

June 6 -

Living a luxurious lifestyle for less is a possibility — provided retirees are willing to move overseas.

June 4 -

With income taxes attached to hardship withdrawals, they are often advised to carefully weigh other options.

May 28 -

The approved legislation relaxes rules for retirement savers.

May 23 -

They are not required to pay taxes on income accrued from properties leased for no more than 14 days.

May 20 -

With accounts now often reaching seven figures, estate planning expert Natalie Choate delved into the complexity of the increasingly important tool.

May 15 -

In one case, a 6-year-old owed $7,000 in federal taxes two years after his father, a U.S. Navy senior chief petty officer, died of a heart attack.

May 14 -

With longer life expectancies leading to increased health care spending later in life, experts are second-guessing the 10% savings rule.

May 9 -

“People didn’t want to use up their estate tax exemption,” but that has changed as a result of the new law, an expert says.

May 6 -

A market correction only becomes a real risk if investors act and make buy or sell decisions to alleviate mental anguish today at the expense of tomorrow, says an expert.

May 3 -

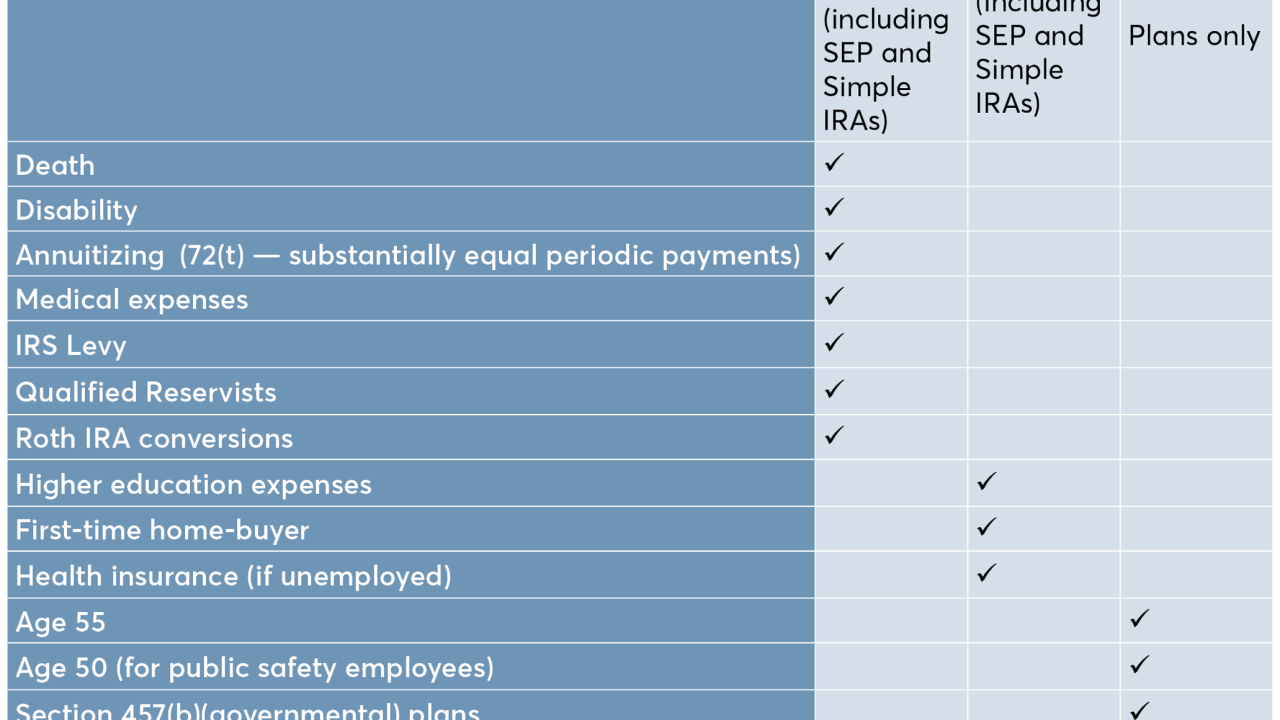

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

“Health care prices are increasing at levels that significantly exceed overall inflation,” an expert warns.

April 23 -

The earlier they begin planning, the easier it'll be to avoid a big tax hit.

April 23 -

Unfortunately, physical and cognitive decline are among potential side-effects.

April 22 -

The strategy only applies to investments held in taxable, not tax-favored, retirement accounts.

April 16 -

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

If spending $5 a day on fancy coffee puts your retirement at risk, you’ve got bigger problems.

April 4 -

The bill has bipartisan support in the House and Senate.

April 3 -

There are still several moves that clients can make to reduce their 2018 tax bill.

April 1 -

Errors are regrettably common. They are also easily avoidable.

April 1