-

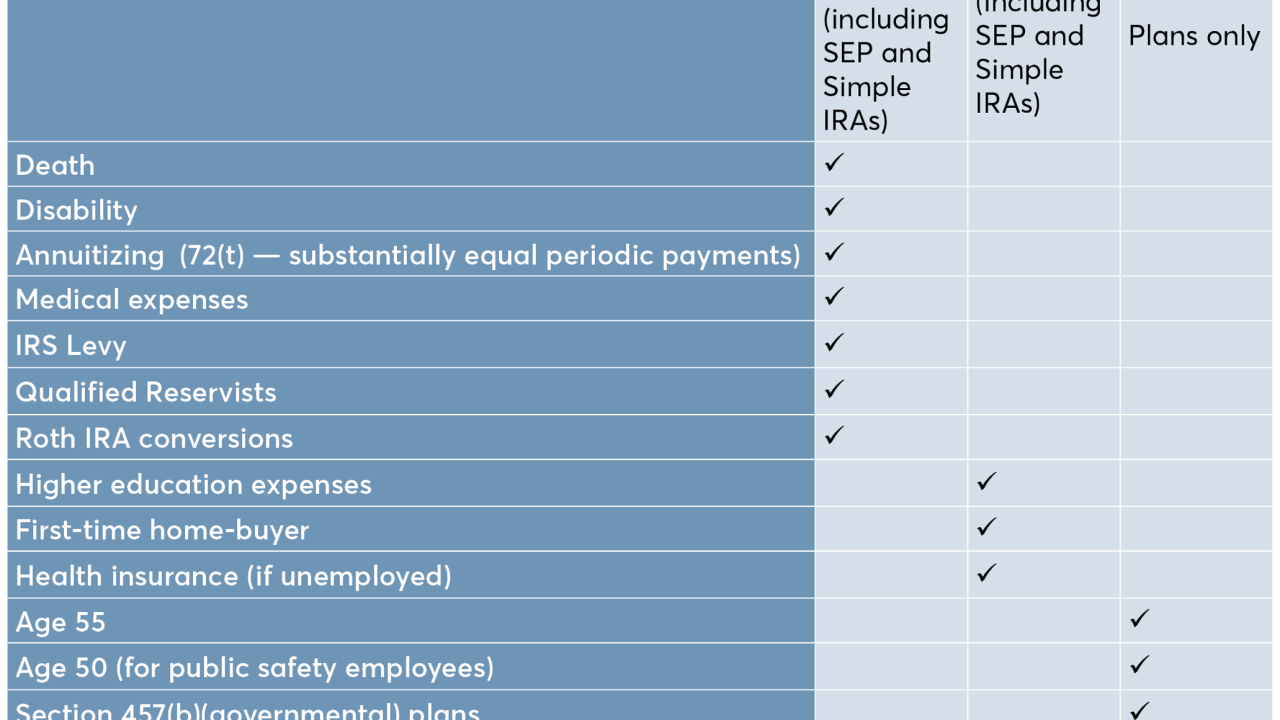

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

“Health care prices are increasing at levels that significantly exceed overall inflation,” an expert warns.

April 23 -

The earlier they begin planning, the easier it'll be to avoid a big tax hit.

April 23 -

Unfortunately, physical and cognitive decline are among potential side-effects.

April 22 -

The strategy only applies to investments held in taxable, not tax-favored, retirement accounts.

April 16 -

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

If spending $5 a day on fancy coffee puts your retirement at risk, you’ve got bigger problems.

April 4 -

The bill has bipartisan support in the House and Senate.

April 3 -

There are still several moves that clients can make to reduce their 2018 tax bill.

April 1 -

Errors are regrettably common. They are also easily avoidable.

April 1 -

Those who fail to meet the cutoff face a penalty equivalent to 50% of their required minimum distribution.

March 29 -

Dental expenses can eat away a considerable amount of retirees’ savings, but these costs are important to prevent health complications and other medical expenses.

March 21 -

There are a lot of options — and potential missteps.

March 19 -

The tax law has made deducting philanthropic contributions more difficult, but there are ways to help clients reap benefits from their generosity.

March 19 -

The Trump administration unveiled its proposed budget that includes provisions that would enable Medicare beneficiaries to contribute to a health savings account.

March 13 -

For many workers, moving assets from old 401(k)s into a traditional IRA may not be a smart move. One reason: IRAs often don’t offer stable value or guaranteed fund investment options as do most 401(k)s.

March 4 -

Some clients may experience a taxable event that pushes them into a higher tax bracket.

February 26 -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 22 -

Clients can avoid tax liability on their capital gains by donating securities that have appreciated in value, an expert says.

February 19 -

No client wants to pay up. But, some could benefit from more tax exposure in retirement than actual spending.

February 12