-

Retirees are likely to have fewer choices when they start shopping around for Medicare Advantage plans during the open-enrollment period that begins October 15.

August 29 -

The amount that can be transferred is equivalent to the HSA's annual contribution limit, which is $3,400 for singles and $6,750 for couples.

August 21 -

Making excess withdrawals could result in taxes on the earnings and a hefty 10% penalty.

August 18 -

Retirees who under-reported their income to avoid taxes will also get smaller retirement benefits than they deserve.

August 16 -

Retirees should weigh a number of factors, including the fact that the closing costs for reverse mortgages are higher than those for regular mortgages.

August 15 -

IRA investors should consider implementing a charitable lead annuity trust when converting some of their funds into Roth to mitigate the tax bite.

August 14 -

The withdrawals can be taken early in the year, late in the year or in installments throughout the year. Each approach has advantages to consider.

August 11 -

Congress may have a difficult time closing tax code loopholes that benefit households more than corporations, an expert suggests.

August 11 -

Recent graduates tend to be in a low tax bracket early in their careers when it pays for them to save as much as they can in a Roth IRA or Roth 401(k), writes an industry expert.

August 10 -

The total out-of-pocket health care expenses of a 65-year-old couple in retirement could exceed $320,000, plus 5% annual increases.

August 8 -

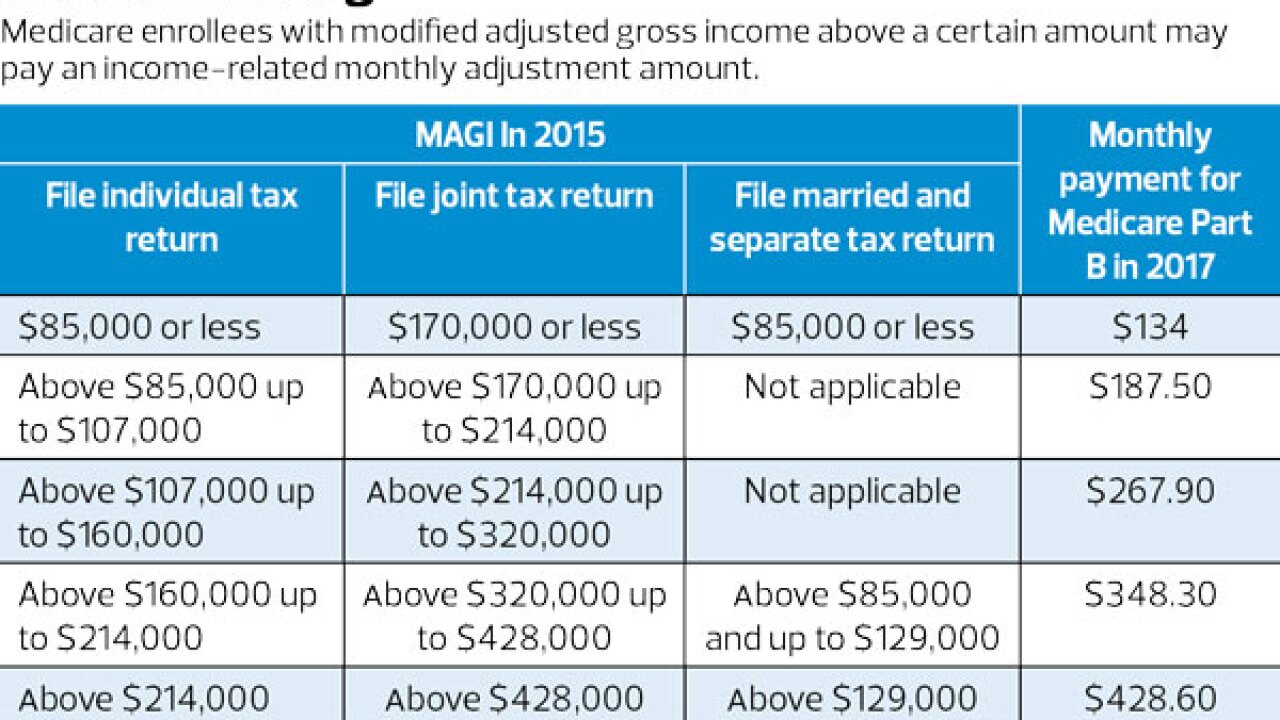

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

If clients tap their Roth accounts at the wrong time, even after retirement, they could lose out on some potential tax benefits.

August 4 -

Naming a young grandchild as beneficiary of a traditional IRA could be a wrong move, as the distributions will be subject to the "kiddie tax."

August 2 -

Investors are about to enter the worst two-month period of the year for stocks, according to an expert with Bespoke Investment Group.

August 1 -

Yes, advisers can invest these funds in nontraditional assets, but you must understand the risks before giving clients the OK.

July 28 -

The agency says its adoption of WebEx will allow for improved outreach with clients in the more rural regions of the country.

July 28 -

Clients should plan to replace roughly 80% of their pre-retirement income after they leave the workforce for good.

July 26 -

Although the market continues to rally, a possible setback remains likely and retirement investors should be ready for this scenario.

July 14 -

With smaller paychecks and longer life expectancies than men, one strategy includes moving their IRA assets into a Roth to reap the tax advantages.

July 14 -

Here’s how receiving investments on a stepped-up cost basis can save a client’s inheritance.

July 10