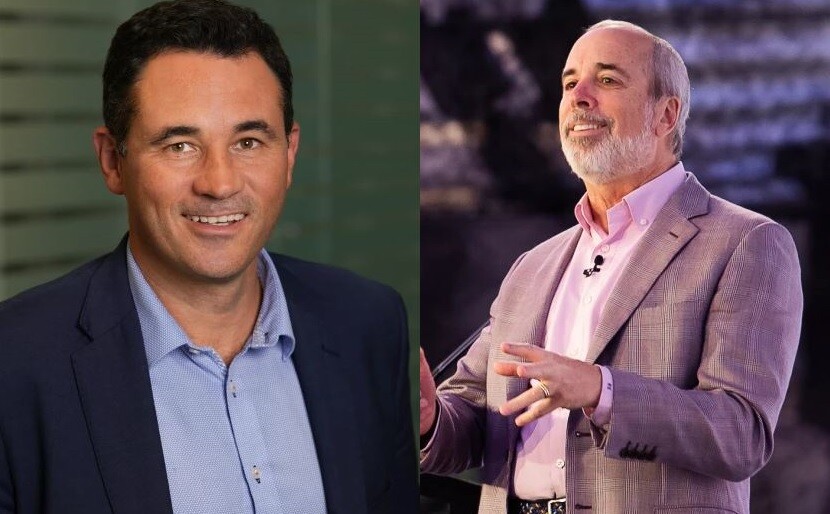

Ric Edelman is the latest supporter of an Australian-based fintech that is rapidly expanding its U.S. presence throughout 2022.

Founded in 2020 by veteran financial advisor Santiago Burridge, Lumiant made its

Burridge, Lumiant's global CEO, and Wood want to help advisors more easily merge a client's personal and financial goals by placing a greater emphasis on families and life outcomes.

Lumiant extends the planning conversation beyond whomever may be considered head of the household by removing "key person dependency" and focusing more on family members, especially the "non-financial spouse."

That means bringing family members beyond the financial head of household into the planning discussion, allowing advisors to create strong bonds with the families they serve.

To accomplish this, the company's software tracks and measures goals that have more to do with a family's values, ideals and aspirations than with dollars and cents.

Edelman's investment in Lumiant, which serves more than 4,000 families globally, follows a $3 million investment by

"Lumiant's advice process lets advisors uncover what's truly important to their clients," Edelman said in a statement. "The platform helps the advisor focus on offering solutions for where their client is headed, not where they've been. It does so in such an engaging and visual way that I'm convinced that any advisor who uses this service will be among the most successful in the business."

Burridge, who spoke to Financial Planning about his new backer during the 2022 Future Proof Festival, said that having Edelman's support is "a testament to what we've built."

"We've reimagined the financial advice experience to help advisors center on life planning, giving them the tools they need so they can connect with their clients on an emotional level,"Burridge said. "This allows them to have incredibly meaningful conversations with clients, making their advice quantifiable, meaningful and measurable."

Scroll down to get caught up on other recent fintech news you might have missed in our Wealthtech Weekly recap. And check out