Alexandra Armstrong, one of the first individuals to obtain a CFP certification, still remembers walking into Ameriprise more than 25 years ago and asking for a $10 million donation.

Armstrong, now 81, and the late financial planning pioneer Don Pitti didn’t have a formal business plan for the seedling non-profit foundation they were launching, and they didn’t yet have any corporate donations as a track record.

They did have the support of the Financial Planning Association — then known as the International Association for Financial Planning — as well as a well-articulated vision: To help the people financial advisors typically don’t and to meet the “crying need” for good, objective and free advice for the people who need it most.

“They were kind enough not to laugh in our faces,” Armstrong says, noting that Ameriprise, then a division of American Express, gave the foundation a five-year gift totalling $1 million.

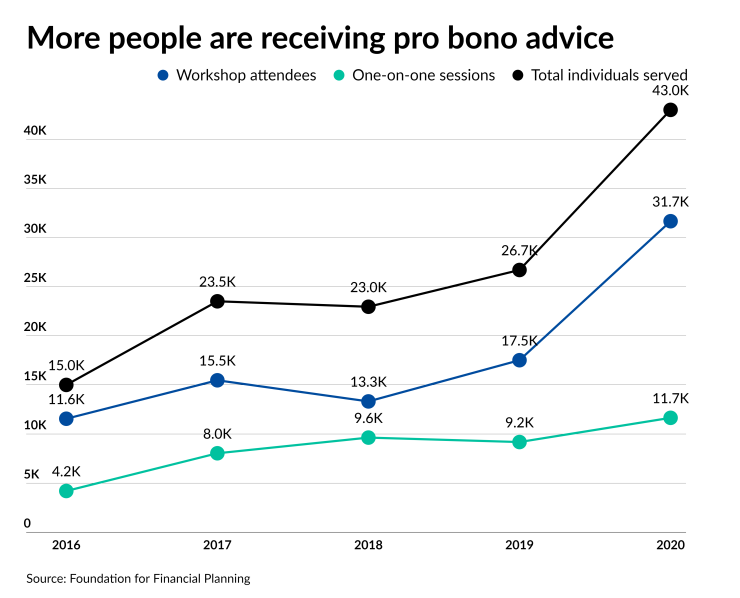

It was the first corporate donation for the Foundation for Financial Planning, a non-profit organization that has burgeoned into a full-fledged foundation with a $23.7 million endowment fund. The non-profit organization has awarded more than $8 million in grants to pro bono programs and has contributed to the delivery of free financial advice to more than 500,000 people, according to its records.

It’s also an organization that has brought together rivals from across the independent channel under a common cause: to give back.

Getting on the map

The Foundation for Financial Planning started as a joint venture between its initial board members and the FPA.

The non-profit entity, which the FPA originally formed to do an advertising campaign about financial planning, had been dormant for several years before the FPA board sent a survey to 70 prominent financial planners across the country, questioning whether it should be revitalized and what its purpose would be, according to Armstrong, who is the Foundation for Financial Planning’s historian.

The FPA put together a board for the seedling non-profit and lent then-FPA employee Dale Brown, who is now CEO of FSI, as a part-time worker. Armstrong was recruited by Pitti, the foundation’s first chair, to fundraise from financial planners in 1995.

The initial donation from Ameriprise “put us on the map,” Armstrong says.

The foundation hired Jim Peniston, who had worked in non-profits previously and was willing to work for a low salary — he was close to retirement and believed in the cause, Armstrong says.

“He and all of us were always very aware of keeping expenses down, because we knew financial planners cared about that. We emphasized that the board was not being paid a cent — that they paid all their own expenses,” Armstrong says.

While the foundation is no longer affiliated with the FPA, the Foundation for Financial Planning supports the FPA’s pro bono initiatives and many of its branches through grants, including a $75,000 grant that contributes to the salary of the FPA’s pro bono director.

The foundation officially started the transition from grant-making organization to volunteer-focused group after 9/11, recalls Kate Healy, the current chair of the foundation’s board. A former TD Ameritrade executive, Healy has been involved with the foundation since around 2010.

In the wake of the New York City terrorist attack that shook the world, there was increasing momentum not only to give money to support pro bono work, but also to play a larger role in helping those families and individuals who had been impacted.

“That was like a catalyst that really got the organization moving,” Healy says.

People moves and deals at RBC, LPL, Baird, Dynasty, Beacon Pointe, Rockefeller Capital Management and other quick takes from this week in the financial advice industry.

A big move

Six years ago, the Foundation for Financial Planning began re-evaluating where it sat in the industry and its end goals.

“It was just smaller and hadn't grown yet, and it didn't have the awareness. We spent a lot of time thinking through who we were and what we could be,” Healy says.

Its 13-year executive director, Peniston, was retiring, and the board did a five-year analysis of what it would cost to hire someone who would make the foundation more effective and give it a higher profile, as well as move it to Washington, D.C. (It was located in Atlanta at the time, where the FPA’s headquarters had been before moving to Denver).

“We were no longer operating out of our garage,” says Armstrong, who was on the executive search committee to find a new leader and nail down a competitive salary.

The board’s choice for a

It was time for the group to pay up to attract quality talent, according to Bernie Clark, head of Schwab Advisor Services, who was chair of the foundation's board at the time. Schwab is the foundation’s largest donor since inception, followed by Fidelity, according to Dauphiné

“If you're going to get a foundation of $20-plus million dollars off the ground, and you launch it to have campaigns and get the contributors that you want to be getting and have the impact that you want … You’re going to have to go to market,” Clark says.

A new leaf

In 2016, with Dauphiné at the helm, the organization moved to Washington, where it rented space from the CFP Board and hired three new staff members.

“We really set about creating much stronger ties to the leaders in the profession,” Dauphiné says, noting that he started a CEO Summit with the FPA, NAPFA and the CFP Board, to initiate a regular discussion about pro bono work.

“At the time, there had been no data sharing. There was really no cross-pollination,” Dauphiné says.

The foundation conducted research in partnership with the CFP Board to evaluate who was engaging in pro bono advice and how advisors preferred to give it. More than two-thirds of CFPs are giving an average of

While Dauphiné has been focused on improving pro bono metrics and data, it’s still hard to measure how many advisors are giving free advice, and how many hours are being offered, he says. Only the foundation’s grantees are required to provide these metrics, and even that doesn’t always encapsulate all hours or volunteers, he says.

In terms of corporate support, Dauphiné launched a Corporate 100 club and a Corporate Advisory Council in early 2018. Companies that donate more than $100,000 get advertising recognition and the ability to allocate their donations to certain programs or campaigns.

Independent companies, from portfolio management fintech Orion Advisor Services to asset manager Dimensional Fund Advisors, are donors and participants, although RIA custodians are the foundation’s largest supporters.

Apart from its grants and endowment fund, Dauphiné has been focused on rallying its grantees, as well as financial advisors across the industry, to put in the hours to help those who need it. Finding volunteers, but also improving support and training materials to help them, has been a key focus, he says.

To find more meaningful ways to help specific communities, the foundation has launched several campaigns, such as its Pro Bono for Cancer program, which provides financial advice to families facing a serious cancer diagnosis, and the retirement resilience program, which is a partnership between Dauphiné’s former employer, AARP, to connect pro bono planners with financially at-risk seniors. Pershing has given $200,000 to fund a Communities of Color initiative from 2021 to 2023, according to the foundation.

During the coronavirus pandemic, the foundation launched a

Approximately 60% of the individuals the foundation is helping planners serve are from communities of color, according to the foundation.

It’s also made efforts to recognize charitable work being done across the industry, launching an award with the CFP Board for a university program doing the most innovative work to connect its student advisors with underserved communities. It also gives an annual award to recognize a FPA chapter doing outstanding pro bono work.

Uniting the industry

The momentum behind pro bono advice has intensified, and it has brought rivals in the independent channel, and particularly the custodians, behind a common cause.

“I think it's helped to bring the industry together,” Schwab’s Clark says. “We’re all competitors, right? 90% of the time we're talking about [business and growth], and then we come together and we make really big decisions, we share our ideas, we share our talent.”

Dauphiné wants pro bono work to become ubiquitous in wealth management and is urging the CFP Board to recommend CFPs give at least

A small gesture can do a lot to rally support for the cause as well, Armstrong has found. She says she writes a hand-written letter every time someone gives $1,000 to the foundation.

“I think they should know it's important, and I think they should know that I think it's important,” she says.

Armstrong

“Maybe we need to do an even better job of what we're doing for the under-served. But I just think we've all been pretty lucky in this business ... And I don't understand why everybody doesn't give,” Armstrong says.