Charitable giving jumped to $400 billion last year and donor advised funds are becoming an increasingly important part of that scenario, according to Giving USA’s annual report on philanthropy. Anecdotal evidence suggests that 2018 has been even stronger, despite earlier worries of a decline.

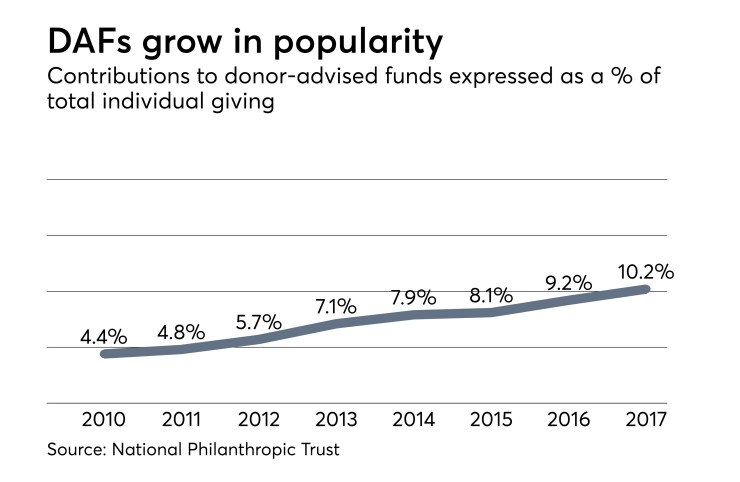

The number of individual DAFs grew by 60.2% in 2017, according to the National Philanthropic Trust. Cash flows surged as well, with both grants and contributions reaching record highs. Meanwhile, assets notched $110 billion, surpassing the $100 billion mark for the first time.

“While these record-breaking totals are significant, the rates of change are even more interesting,” according to the NPT’s 2018 DAF Report.

Still, some clients find the notion of donor advised funds a mystery.

“When we start the conversation and mention donor-advised funds as an option, very few clients know what they are,” says Malcolm Macpherson, managing director of New York-based RIA Williams Jones Investment Management. “Most clients have heard of a foundation, most clients know they can make direct gifts to a charity, but very few know anything about the donor-advised fund. We’re bringing it to them for the first time, there’s an education process, there are a lot of questions, but we feel very confident in [DAFs] just through our years of experience using them.”

Donor advised funds create a “simple, straightforward, seamless way” for clients to concentrate their charitable giving, Macpherson says. Once clients learn about DAFs and understand how they work “we’ve found it’s been tremendously beneficial because before our clients were using low costs stock to make direct charitable gifts or they were writing checks.”

“If they’re writing checks that’s coming directly out of their cash flow, so through an education process we’ve made them aware that the best charitable giving source from their end is fully appreciated stock,” Macpherson says, “because they don’t have to pay tax on the gains.”

-

It may seem counterintuitive, but advisors who offer robust philanthropic guidance see major boons to their bottom line.

November 5 -

Schwab’s nonprofit arm and many firms allow advisors to serve clients while helping charities.

October 25 -

Almost half of wealthy donors don’t have a strategy in place to guide their charitable giving.

November 27

When the Tax Cuts and Jobs Act went into effect at the beginning of 2018 it was largely assumed that charitable giving would suffer as a result. But strong economic conditions have seen clients remain committed to their philanthropic endeavors, says Kim Laughton, president of Schwab Charitable.

Indeed, a survey of Schwab clients showed that charitable giving can continue under the new tax law.

“There was a sense at the beginning of this year, after two very strong years of giving — both after the election and then in conjunction with the tax reform act being passed in December — that people had really given a lot in 2016 and 2017, there was some concern that they may not have as much to give this year,” she says.

However the 2018 numbers show — at least from Schwab’s perspective — that giving is still robust this year. “Both our contributions and grants are up around 40% this year over last year,” Laughton notes.

Offering charitable advice to clients “is a great way is a great way to grow your practice,” Laughton says. “Some of the assets that clients can contribute to charity effectively are assets that perhaps the advisor isn’t currently managing. Let’s say it [entails] shares of privately held investment or real estate, something that’s not under management by the advisor so it’s a great way to identify those. If [clients] end up deciding to donate to a charitable vehicle like a donor-advised fund, it’s a way for the advisor to potentially manage the assets of that vehicle.”