As the $144.5 billion playing field for target-date, or lifecycle, funds continues to get more and more crowded-last year fund companies introduced 302 target-date funds and assets soared 61%-the funds are diversifying their holdings to distinguish themselves. Others are extending their equity exposure with the goal of equipping longer-living retirees with enough money to last throughout their lifetimes.

But is this diversification and high equity exposure making these funds far too risky and could they end up failing investors miserably? Although target-date funds have been available since 1993, they didn't start to flood the market until the past few years. Thus, the industry has yet to see how these funds will fare in a prolonged bear market or how well they will actually serve retirees.

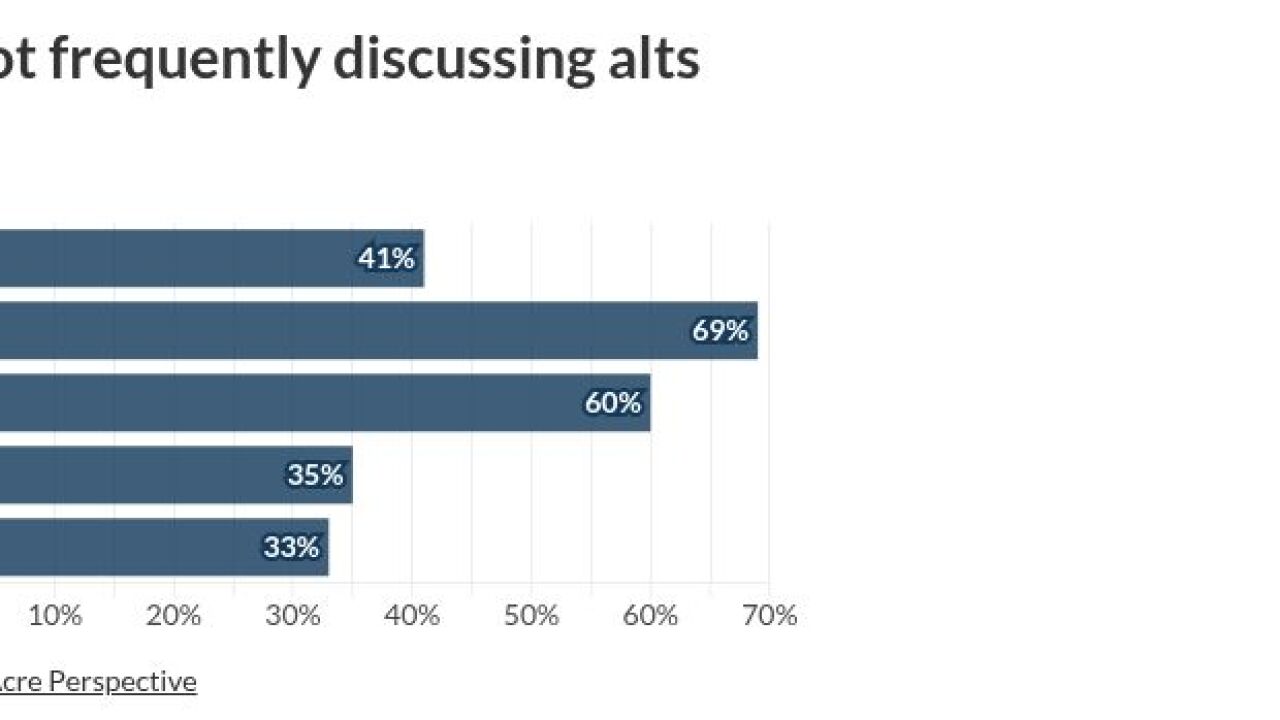

In the meanwhile, more target-date funds are looking to alternative investments-such as private equity, real estate investment trusts, directly held real estate, commodities, emerging-market debt, natural resources, exchange-traded funds, high-yield bonds and even such hedging strategies as absolute return and leveraged loans.

"The thinking is to provide more of the types of diversification [in a defined contribution retirement savings plan] that you might typically see in a defined benefit plan," Lori Lucas, senior vice president at Callan Associates, recently told The Wall Street Journal.

Other companies, including Fidelity Investments, State Street Global Advisors, TIAA-CREF and Vanguard, recently increased the equity exposure in their target-date funds. AllianceBernstein, John Hancock Financial Services and T. Rowe Price Group have traditionally had a high level of equities in their target-date portfolios.

The seven TIAA-CREF lifecycle funds, for example, increased their equity allocation from 80% to 90% at the outset of the glide path and from 35% to 50% at retirement, where it will remain for 10 years, at which time it will be ratcheted down to 40%.

JPMorgan Chase recently issued a white paper on target-date funds-"Insights: Ready! Fire! Aim?"-that warns against these very strategies and says firms aren't taking contribution levels into consideration when determining allocations.

Peter Brady, a senior economist with the Investment Company Institute, said the industry must be careful not to market target-date funds as an end-all for retirement income (see MME April 30, 2007). Unless a target-date fund has best-of-breed managers, actual defined benefits, an infinite lifespan, use of alternatives and investment consultants, these funds shouldn't be marketed as mini-defined benefit plans, concurred Benjamin Poor, an associate director with Cerulli Associates.

(c) 2007 Money Management Executive and SourceMedia, Inc. All Rights Reserved.

http://www.mmexecutive.com http://www.sourcemedia.com