Supporters and those in opposition to the Department of Labor's new fiduciary duty rules could probably agree Christmas came early for industry attorneys. Law firms racked up billable hours reviewing the 1,000 pages of rules and advising their clients about compliance strategies, and maybe even helping some consider legal challenges to the rules themselves.

But the new rules aren't the bonanza for legal counsel that was possibly imagined when the industry first learned of DOL's strategy to require an enforceable contractual obligation for advisors to serve their clients' best interests in the face of conflicts of interest.

Tucked away in the details of the BIC exemption is confirmation that firms are still free to require mandatory arbitration as part of their client agreements, avoiding the expense and potential public exposure of settling disputes in the legal system.

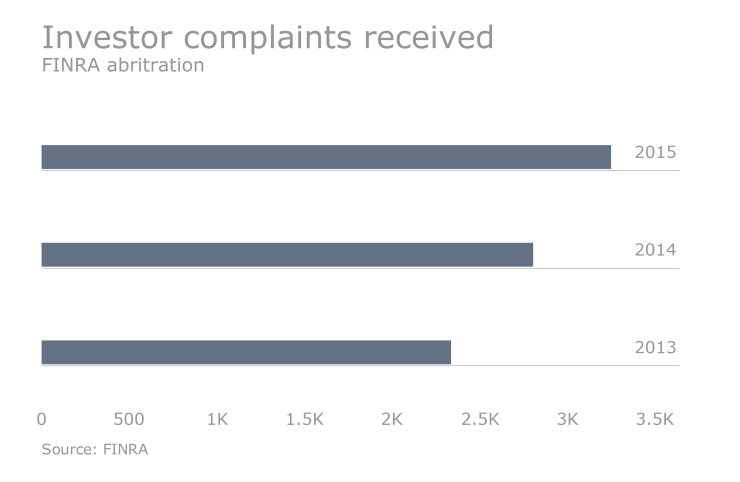

Alleged systemic abuses by firms may now be subject to class actions so legal peril isn't completely avoided, but for problems between individual clients and their brokers, mandatory FINRA arbitration will still be the required remedial path. This might even be seen as an advantage relative to advisors who are subject to regulation by the SEC under the Investment Advisers Act, who can still get sued the old fashioned way when clients perceive breaches of duty.

AN IMPERFECT SYSTEM

What's not to like about arbitration? As an alternative path to fighting things out in court, it is potentially quicker and less expensive for all parties.

But as we pointed out in our 2014 review of global investor redress mechanisms, FINRA's arbitration system isn't perfect and may put investors at some disadvantage. In particular:

- Investors can't negotiate their abdication of their legal rights; it is a standard feature of brokerage account documentation.

- Arbitration records may be expunged, so that investors may know of amounts awarded but not the other details of broker conduct that would be of interest.

- Arbitration is still a complex process and investors may still require legal help to navigate it successfully; costs are also potentially significant which may discourage pursuit of redress of more modest claims.

- There isn't much transparency around how arbitrators are selected to be eligible or dismissed; although investors can choose to have only public (i.e. non-industry related) arbitrators for their case, suspicions remain over whether an industry-funded organization like FINRA is truly neutral in selecting who may serve as an arbitrator in the absence of a fully transparent system.

The new DOL rules also allow for waivers of punitive damage claims, with the thinking being that "make-whole" restorations should be sufficient motivation for advisors and firms to take compliance with the BICE seriously.

ACCESSIBLE FOR ALL

The noisy debate around a best interest standard has been useful in confirming the general intuition that investors are best served by advisors who manage conflicts of interest appropriately to affirm investor interests. And the DOL's approach is an interesting innovation away from a prescriptive, rules-based regulatory system.

But for the new rules to really work in protecting investor interests, the dispute resolution system must be accessible and effective for all parties.

FINRA should take the next step to address some of the weaknesses of its arbitration system, with particular attention to reinforcing the integrity and transparency of arbitration to serve as a fair forum for resolution of investor claims.

The DOL obviously took to heart critics' comments about unbounded liabilities for advice providers in the proposed rules. It is essential that the bodies responsible for resolving related investor claims also take the steps to ensure a balanced and transparent system that honors the principle of putting investors first.