Federal Reserve

Federal Reserve

-

Janet Yellen will frame a decision this week to forgo an interest rate increase as necessary to achieve the Fed’s economic goals. Donald Trump and his supporters are likely to frame it as political.

September 20 -

Central bankers began mulling a hike sooner, than later, causing the S&P 500 to fall 2.4%, its biggest weekly drop since February.

September 9 -

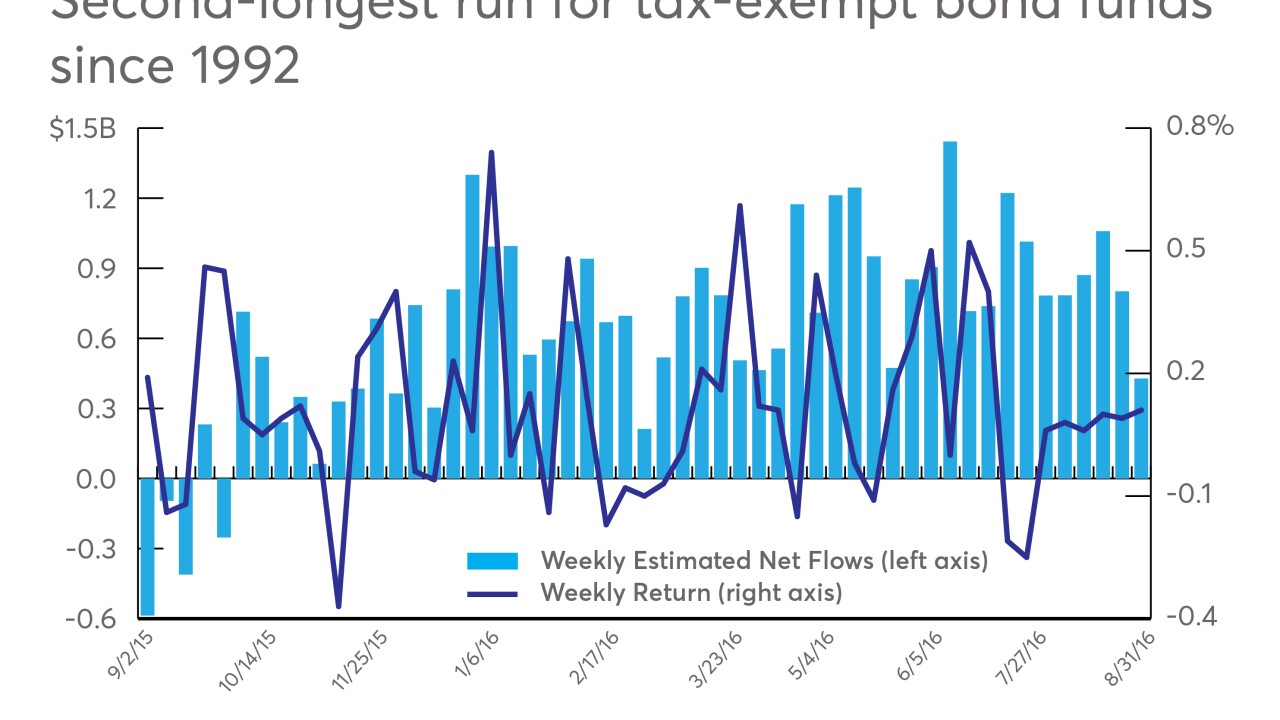

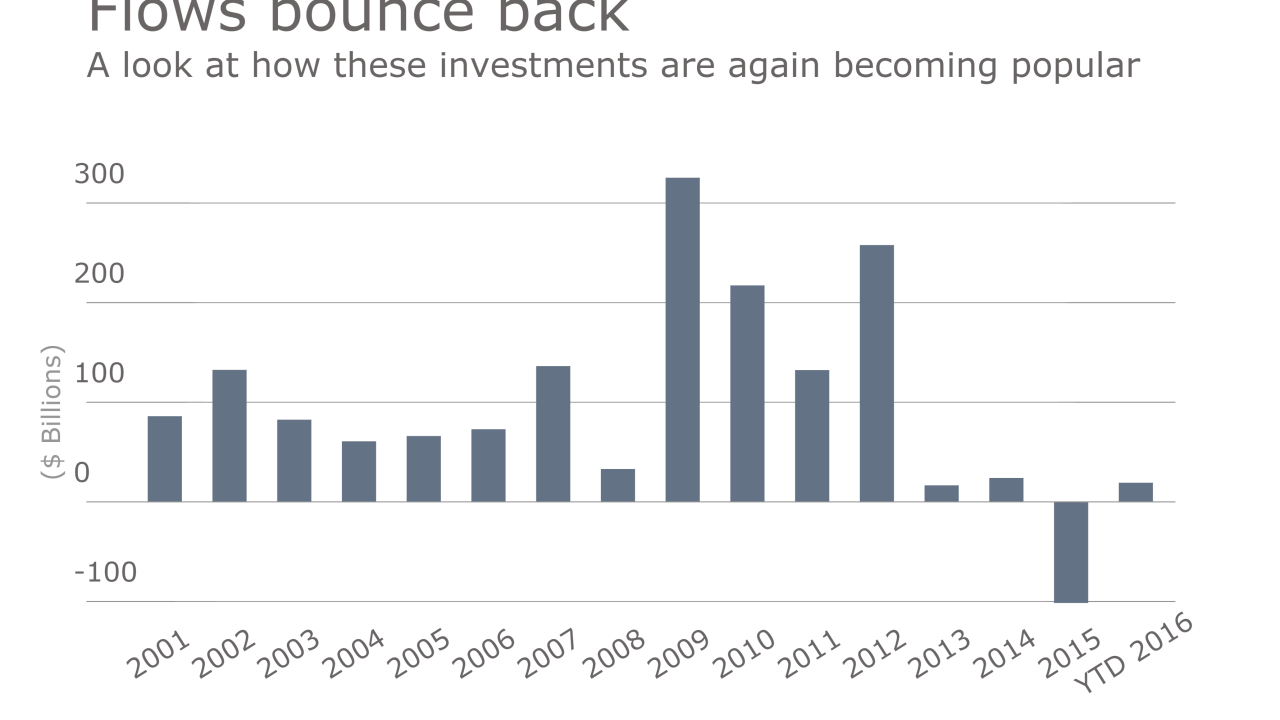

Will the rally continue, or are the winning ways of this asset class nearing an end?

September 9 -

Recent economic data has been weaker than expected, but that does not mean it's weak, says the chief economic adviser at Allianz.

September 7 -

The firm is recommending investors continue to buy five-year U.S. sovereign debt, even as the securities head for their worst month since February of last year.

August 30 -

The fundamental nature of the social network is interaction and conversation — not the simple spouting of PR.

August 25 -

Because of looming long-term risks, officials need to consider "trying to slowly normalize rates, because otherwise you contribute to excessive risk taking," says Allianz's chief economic adviser.

August 23 -

Investors will listen closely for additional clues on timing for a rate hike when Fed leaders meet at an upcoming symposium.

August 17 -

Investors have once again taken a liking to taxable bond funds — a marked difference from last year. Advisers may find that clients are taking notice, too.

August 4 -

While Chairwoman Janet Yellen has repeatedly stated that the Fed is likely to raise interest rates gradually, market volatility and the unexpected dip in job gains have delayed such plans.

July 27 -

Inflation and unemployment haven't reached levels that would justify an increase in interest rates, even without risks from Britain's vote to leave the European Union, Federal Reserve Governor Daniel Tarullo said.

July 6 -

"Gold and silver have already come a long way, so perhaps it's not surprising to see them pull back a little," one analyst says.

July 5 -

Investors see a nearly 80% chance that rates will be unchanged at the next two meetings of the Federal Open Market Committee, according to prices of options on eurodollar futures contracts.

July 1 -

As volatility remains a real concern, advisers will need to continue to transition into holistic and goals-based advice.

July 1 -

Brexit isn't seen having fallout as severe as the 2008 financial crisis, but you wouldn't know it from the rush to safety in the global market for sovereign debt.

June 30 -

There are risks of contagion to other countries, but "it will take a significant amount of time to see how all that unfolds," says Federal Reserve Bank of Dallas President Robert Kaplan.

June 30 -

Even as markets regain footing after vote turmoil, there is still a “dark cloud” that advisers must be ready to discuss, says Greg Valliere, chief strategist for Horizon Investments.

June 28 -

Britain's vote to leave the European Union will almost certainly have repercussions for the Federal Reserve -- and those could play out over days or months.

June 24 -

Clients holding municipal bonds are in a good position to wait it out, after policy makers left the target interest rate unchanged and signaled increases will be gradual, strategists said.

June 16 -

Fewer Federal Reserve officials expect the central bank to raise interest rates more than once this year, as policy makers gave a mixed picture of a U.S. economy where growth is picking up and job gains are slowing.

June 15