-

Holiday parties and team-building outings may still be deductible. What about entertaining prospects over dinner?

April 24 -

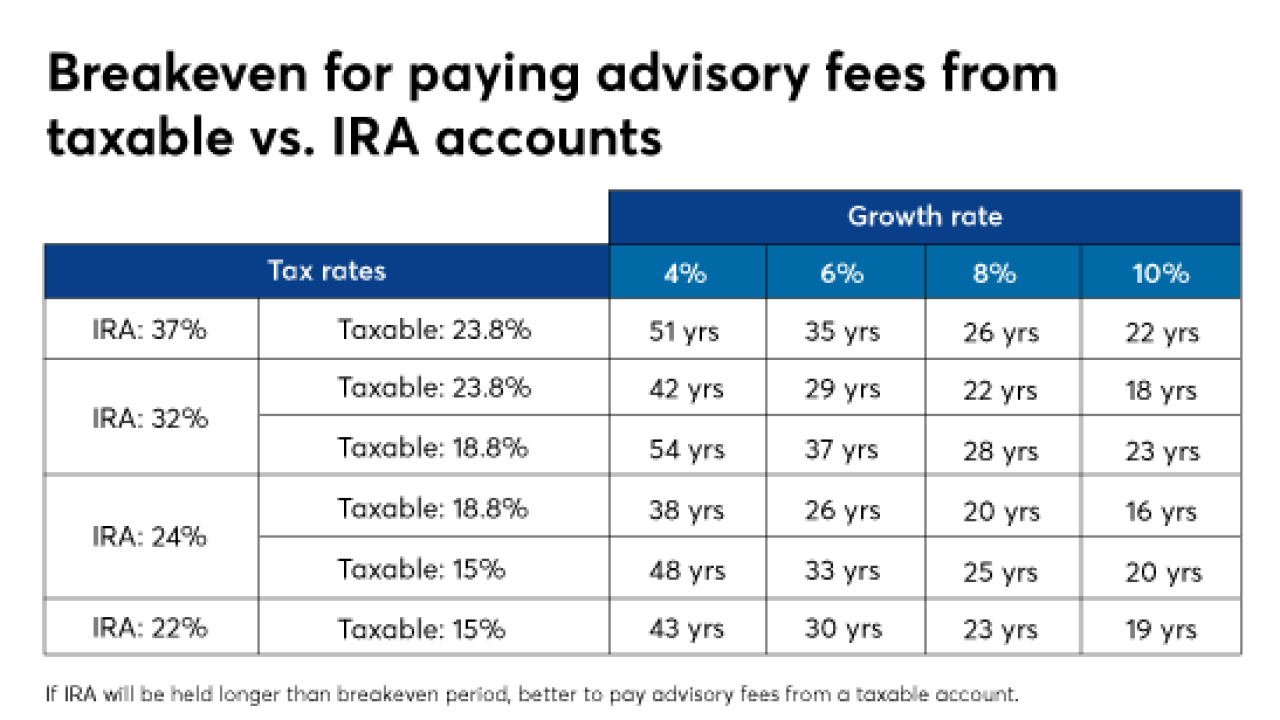

Financial advice sometimes is — and isn’t — deductible.

April 23 -

A majority of affluent Americans are likely to adjust their financial plans under the new law, according to the AICPA. Here's how advisors can help.

April 19 -

Higher deduction ceilings have made itemizing a moot point for most individuals, but a novel strategy can yield real additional savings.

April 13 -

Audit rates are dropping, but there are still triggers that taxpayers can avoid to further reduce their risk.

April 9 -

Sweeping tax changes have made it more important than ever to understand what is, and isn’t, deductible.

April 8 -

The tax treatment of bitcoin and its ilk raises major questions.

April 3 -

Homeowners have fewer options as state and local deductions have been capped under the new law.

April 3 -

Clients may be in the dark about the regulators new rules for taxing digital currencies.

March 23 -

Borrowers can still use the allowance as long as it’s for home improvements.

March 20