Most taxpayers are eager to claim any and all tax deductions, yet the recent expansion of the standard deduction has made that impulse largely moot.

Nonetheless, for those close to the deduction ceilings, there are opportunities to save — sometimes substantially. Indeed, the opportunity to lump and clump deductions together, especially for those who have appreciated assets available to front-load charitable contributions into a donor-advised fund, saving on capital gains taxes in the process, can produce a material tax savings in the future.

Congress allows taxpayers to claim various deductions that can reduce their taxable income. In some cases, the deductions are intended as incentives to encourage certain behaviors — charitable giving chief among them — while in others, they function as subsidies to mitigate a net after-tax cost, such as the deduction for mortgage interest.

To simplify the filing process, all taxpayers have the option to simply deduct a standardized dollar amount. In 2017, these thresholds were $6,350 for individuals and $12,700 for married couples, plus an additional standard deduction for those who are blind, or age 65 or older.

To the extent that a household has more individually itemized deductions than the standard deduction, it’s permitted to claim the total of those itemized deductions on

However, under the

The tax law also curtailed a number of

Meanwhile, the entire category of “miscellaneous itemized deductions subject to the 2%-of-AGI floor” under

From the individual tax planning perspective, these developments are important because taxpayers who claim the standard deduction will find that their previously itemized deductions are literally worthless.

Example 1. Jim is a salesman for a local paper manufacturer, and earns $70,000/year. His deductible expenditures include about 6% in state income taxes, or approximately $4,200, plus $2,500/year in property taxes on a small $175,000 house he inherited from his grandmother, and $1,000/year that he donates to his church and other local charities. Under prior law, Jim’s total deductions for income and property taxes alone were $6,700/year, which was enough to surpass the $6,350 threshold for the standard deduction, which meant he received the full value of his $1,000 charitable contributions deduction.

In 2018 though, Jim’s standard deduction will be $12,000, which means he will claim the same amount regardless of whether he makes any charitable contributions or not.

Consequently, while Jim’s total deductions will increase — reducing his 2018 tax liability at the margin — he will no longer receive any tax benefit for his charitable giving. This reality is anticipated to affect

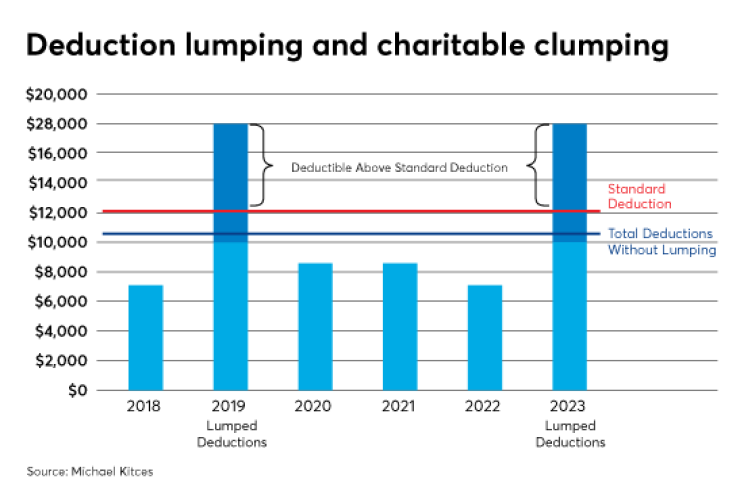

Given these challenges, so-called deduction lumping is coming into vogue. This strategy shifts the timing of deductions, such that they are lumped together within the same year, in an effort to clear the standard deduction ceiling.

Example 2. Steve is single and makes $80,000 year as a freelance programmer, and owns a $220,000 townhouse with a $180,000 mortgage.

At a 5% rate, Steve’s state income taxes are $4,000/year, his property taxes are another $2,500 (at a 1.2% rate), and his mortgage interest is approximately $6,750/year (at a 3.75% rate). Given his total itemized deductions are $13,250/year, Steve will be able to itemize, and get an extra $1,250 of deductions over what the standard deduction alone would have provided.

However, if instead Steve deliberately underpays his estimated state taxes this year and pays them all next year — on top of the state income taxes he’ll already have to pay for next year — he’ll still get a $12,000 standard deduction this year, but a total of $4,000 (2018 state income taxes) + $4,000 (2019 state income taxes) + $2,500 (2019 property taxes) + $6,750 (2019 mortgage interest) next year, for a total of $16,750 in deductions, as the SALT cap would limit the income and property taxes to $10,000 instead of their actual total of $10,500. This means that across two years, Steve’s total deductions are $12,000 + $16,750 = $28,750 instead of just $13,250 + $13,250 = $26,500. That gives him an extra $2,250 in deductions, or about $495 in tax savings at his 22% tax rate.

The improvement comes from the fact that Steve didn’t have to worry about the first $1,250 of his state taxes falling below the standard deduction line in 2018, when he lumped all of them into the 2019 tax year. Meanwhile, he still got the full benefit of the standard deduction in 2018 itself.

Notably in this case, Steve may have an underpayment interest penalty to the state for failing to pay his state estimated taxes in 2018 in a timely manner. However, the Federal government only assesses this penalty

The biggest caveat of deduction lumping is that not many deductions can be shifted from one tax year to the next. For instance, mortgage payments — and their associated interest payments — are generally due when they’re due, without much flexibility to pay the interest any faster or slower (although it is at least possible to control the timing of interest payments, and their deductibility,

Similarly, it’s not feasible to shift the timing of state income tax payments for those who are employees and automatically have state income taxes withheld as a part of the payroll process. That’s because it’s only self-employed individuals and business owners who have the responsibility, and therefore the flexibility, of making their own state estimated tax payments.

And under IRS guidance, the timing of property taxes

Of course, to the extent that the total of state income and property taxes exceed the $10,000 cap on all SALT deductions, this lumping strategy is a moot point, because additional payments above that $10,000 SALT cap aren’t considered anyway.

Moreover, with the elimination of most other miscellaneous itemized deductions — i.e., those previously subject to the 2%-of-AGI floor — many deductions with timing flexibility are gone altogether. Some that remain, such as medical expenses, might have at least some flexibility to impact timing — e.g., paying late-year medical expenses after the new year to lump them into the next tax year.

All of this means that while deduction lumping may be appealing, for many households there simply aren’t many — or any — deductions that are flexible enough to shift and lump together. The exception, however, is one of the most flexible, and often sizable, deductions of all: charitable contributions.

The good news around charitable giving strategies is that, from a tax perspective, individuals have a lot of control over the timing of the deduction.

This is not just because charitable contributions are voluntary, but also because there’s no cap on the dollar amount of the donation as there is with SALT deductions, beyond the overall charitable contribution limits as a percentage of AGI — though those caps are now as high as a generous 60%-of-AGI

In addition, it’s possible to control the timing of the charitable contribution deduction further by front-loading it with vehicles like Charitable Remainder Trusts or a

Example 3. William and Melissa are married, earn $150,000/year in the state of Texas, own a $350,000 single family home with a $275,000 mortgage balance and donate about $3,000/year to local charities. As a result, their deductions include $7,000 of property taxes (at a 2% rate), about $10,000 in mortgage interest (amortizing at a 3.75% rate) and $3,000 in charitable contributions. Notably, this total of just $20,000 in itemized deductions would not be enough to itemize in 2018. Consequently, they receive no tax benefit for their charitable contributions or any of their other expenditures.

To improve the situation, William and Melissa decide to establish an account with a Donor-Advised Fund, and contribute $15,000 of their S&P 500 index fund that was bought years ago with a cost basis of only $8,000. This boosts their itemized deductions up to $32,000, allowing them to get $8,000 of additional charitable contribution deductions that are above the standard deduction for married couples, for a tax savings of $1,920 at their 24% marginal tax rate. In addition, they eliminate a $7,000 capital gain, on which they would have paid another $1,050 in taxes at a 15% capital gains rate.

Over the next five years, they will continue to contribute $3,000/year to their charities of choice, but simply make the distributions from their Donor-Advised Fund instead. In the meantime, the cash for the $3,000/year that they would have donated will instead be used to repurchase the investment in their S&P 500 index fund, such that by the end of the five-year time horizon they will once again have a $15,000 investment back into the fund, but with a new current cost basis from their new purchases, making the old capital gain vanish forever.

The end result of this charitable clumping strategy is that by doing five years’ worth of contributions at once, the couple gets at least part of the value of the deduction for a charitable contribution, while also saving additional taxes by donating appreciated securities and replacing them at a new, higher cost basis with the money that would have been donated.

This means that the net cash flows into the household and out to the charity are the same — but by engaging in the charitable clumping strategy, the couple obtains both a partial charitable deduction and avoids capital gains. Alternatively, the strategy could be executed by simply contributing cash to the donor-advised fund, which doesn’t produce any capital gains tax savings but still results in additional charitable deductions through clumping.

And of course, the donor-advised fund also can remain invested — which, under the

The key tax planning benefit though, is simply that by clumping the charitable contributions together, donations that otherwise would have been itemized deductions falling below the threshold for the standard deduction are at least partially above the threshold, producing an immediate tax benefit that simply would not have been received at all if the contributions had been made annually over the years. There’s also the opportunity to use existing appreciated securities — and permanently avoid future capital gains taxes — as an added benefit.

Notably, the strategies of deduction lumping and charitable clumping don’t have to be mutually exclusive. In fact, some households may find it more beneficial to engage in both, and further stack their prospective itemized deductions on top of one another. For instance, some deductions might be lumped in alternating years, while charitable contributions might be clumped together four-plus years at a time.

Example 4. Jenny is a freelance consultant making $90,000/year, and lives in a $200,000 condo that she has fully paid off. She pays $6,000/year in income taxes, $2,500 in property taxes and donates about $2,000/year to various charities.

With total itemized deductions of $10,500, Jenny will simply take the $12,000 standard deduction. Consequently, she decides to start lumping and clumping in 2019. Accordingly, Jenny first and foremost delays paying her fourth-quarter estimated taxes of $1,500 until after January 1, 2019, as the $10,000 SALT cap limits the value of pushing any more of her state income taxes into 2019.

In addition, she establishes an $8,000 Donor-Advised Fund in early 2019, to front-lead her next four years’ worth of charitable contributions.

The combination of the two makes Jenny’s 2019 deductions $1,500 (2018 state income taxes paid in 2019) + $6,000 (state income taxes in 2019) + $2,500 (property taxes in 2019) + $8,000 (charitable contributions) = $18,000.

In 2020, Jenny won’t have any charitable deductions, and as a result won’t be able to itemize at all based on just her income and property taxes, but still will get the $12,000 standard deduction. In the meantime, the donor-advised fund makes a $2,000 distribution to Jenny’s various charities.

This process repeats itself in 2021 and 2022, but at the end of 2022 Jenny again waits on her fourth-quarter estimated taxes for 2022, pushing them into 2023, which produces a greater amount of total itemized deductions when she re-clumps contributions into her donor-advised fund in 2023 as well, for another $18,000 of deductions that year.

The end result is that instead of cumulatively getting $12,000/year in standard deductions — or $60,000 cumulatively over five years — Jenny gets a total of $72,000 in deductions instead, thanks to the two years where she had $18,000 of itemized deductions. By just engaging in charitable clumping, Jenny would have only received an extra $4,500/year (or $9,000 total) by claiming $6,000/year in income taxes, $2,500 in property taxes and $8,000 in donor-advised fund contributions; the remaining $1,500 of extra deductions came from adjusting the timing of her fourth-quarter estimated taxes to bring her total deductions up to the $10,000 SALT cap in the same years she also clumped together her charitable contributions.

When it comes to proactive planning for deductions and charitable clumping though, it’s crucial to recognize they are only relevant for those who don’t already have enough itemized deductions to exceed the threshold of the standard deduction. And it’s only relevant for those who can reach the threshold by actually pursuing lumping and clumping strategies.

In practice, this means that such strategies will primarily be relevant for high-income single individuals who do not own a property with a mortgage, and married couples who do own a property.

The reason is that high-income single individuals who do not own a property can get close to the $12,000 standard deduction by getting up to the maximum $10,000 SALT cap, and then engaging in charitable clumping on top; those who have a mortgage of any material size will likely already have enough deductions, in the form of mortgage interest, to clear the standard deduction.

On the other hand, for married couples, the $10,000 SALT cap — combined with a $24,000 standard deduction — would make it almost impossible for clumping alone to produce any tax benefit, and charitable clumping would require a substantial contribution to be relevant.

The only caveat is whether the couple has a primary residence with a mortgage, in which case the mortgage interest deductions can bring them close enough where lumping and clumping are relevant again. That said, a large mortgage can itself produce enough mortgage interest to nearly or fully exceed the standard deduction.

Nonetheless, for those who would otherwise not surpass the standard deduction ceiling, deduction and charitable clumping remain appealing ways to squeeze out a few additional dollars of tax savings. Repeated systematically over time, they can still deliver a material amount of cumulative tax deductions and savings.

So what do you think? Will you suggest deduction lumping as a strategy to clear the standard deduction hurdle? What do you think are the biggest opportunities for deduction lumping? How do you plan to communicate these strategies to clients? Please share your thoughts in the comments below.