-

The bank's wealth management businesses earned $205 million on $720 million in revenue in the second quarter.

July 18 -

The Minneapolis bank is pitching the automated investment advice platform, a joint venture with a BlackRock unit, to a wide range of age groups, not just younger consumers.

June 19 -

The broker used the funds to pay his mortgage, FINRA claimed.

June 6 -

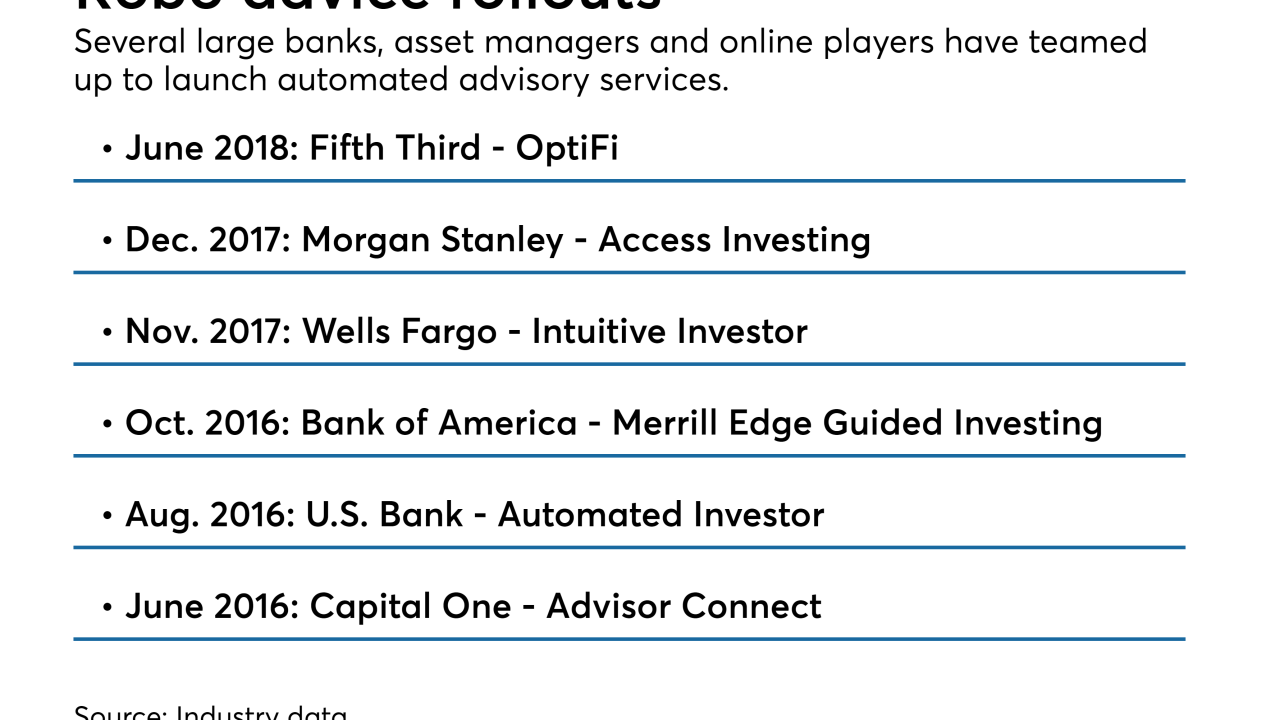

Most big banks are launching robo advisers to compete for a new breed of wealth management customer. The risk is that automated services will disappoint traditional customers.

June 5 -

The bank’s wealth management businesses posted $217 million in first-quarter profits, up from $156 million in the same quarter a year ago.

April 18 -

The bank is looking to attract more affluent customers with $250,000 to $3 million in investable assets, the bank's head of wealth management told analysts.

February 27 -

The unit recruited the co-founder of an investment advisory firm to launch a new office in La Jolla, California.

February 9 -

Thirteen executives were recently tapped to lead wealth management and related investment services groups at several financial institutions, including Fifth Third, SunTrust, Wells Fargo and U.S. Bank. Find out who they are and what their new roles entail.

January 11 -

Ben Ollendick will focus on new business development and lead a team of advisors serving clients with a net worth of more than $75 million.

November 2 -

When hit with an increase, clients are urged to pony up but reducing benefits and terminating policies are options too.

October 23