-

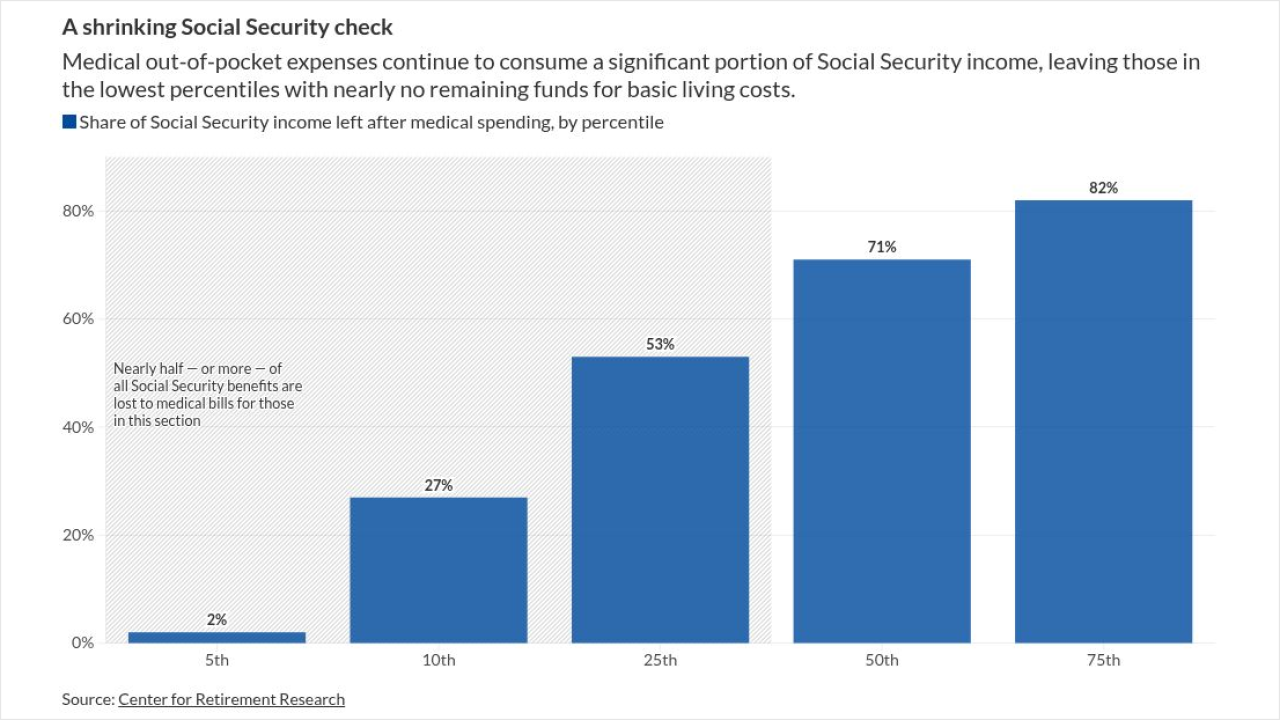

Medical inflation is projected to climb at double the rate of Social Security cost-of-living adjustments, leaving a growing number of retirees with a shrinking share of their benefits.

February 9 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

The increased sophistication that cyber attackers are getting from technology requires more frequent updates to cybersecurity defenses, according to cyber insurance experts.

October 28 -

More seniors than ever are choosing Medicare Advantage, but the growth isn't universal. In some states, most still prefer original Medicare, according to a recent SmartAsset study.

October 20 -

Rising health care and long-term care costs are reshaping retirement planning. Advisors need to know how the landscape is shifting for retirees.

September 4 -

Customer satisfaction with Medicare Advantage plans is down, according to a new survey from J.D. Power. But some financial advisors say zero-premium plans remain a lifeline for cash-strapped seniors.

August 20 -

As major insurers reduce Medicare Advantage benefits and exit markets, retirees face higher costs and limited options. Advisors need to understand the implications for retirement planning.

August 13 -

Many retirees mistakenly believe Medicare will cover all their medical costs, but new Fidelity research reveals that even without long-term care, routine health care expenses can add up to tens of thousands of dollars.

August 6 -

A vast majority of Americans yet to enroll in Medicare say they're worried about whether the program will be there for them, according to a new survey from Retirable and eHealth.

July 21 -

Side products no more, life insurance and annuities can make financial longevity possible for clients at all AUM levels.

July 8 Zinnia

Zinnia -

Without legislative action, Social Security and Medicare trust funds are heading toward depletion within the next decade, triggering automatic benefit cuts that could severely impact retirees and the disabled.

June 20 -

Despite health savings accounts being highly tax-advantaged, most savers do not fully utilize their unique benefits, new data from the Employee Benefit Research Institute shows.

June 18 -

A TIAA Institute survey found that the average U.S. adult cannot answer a majority of retirement-related questions. Financial advisors say that's a problem.

June 2 -

A new Morningstar study found that long-term care costs can dramatically impact retirement plans, with 41% of households projected to run out of money when such expenses are incurred.

May 16 -

Forming a trust now and funding it after Congress decides whether to keep the current gift tax exemption rate could make for an effective preemptive strike.

March 25 Casner & Edwards

Casner & Edwards -

For wealthy and ultrahigh net worth clients, the advantages often prove very attractive. But the policies carry some sophisticated planning challenges and a high cost.

March 3 -

The estimate for the amount required for 65-year-old spouses is one of many from a study full of figures that financial advisors can use to highlight the value of HSAs.

February 10 -

A client's immediate health needs make saving their accounts until they're 65 or over a difficult endeavor, and the accounts carry some highly specific rules.

January 22 -

From cryptocurrency to Medicare, 2025 is likely to be a year of change. Here's what nine experts are forecasting.

December 17