-

Firms can save on taxes by borrowing now to top up pensions.

February 27 -

The products can offset potential losses from lowered state and local deduction limits.

February 27 -

82% of beneficiaries who qualified for survivor benefits and their own benefits were not informed that they could opt for a restricted application and boost their benefit.

February 23 -

Retirement investors may want to adopt the billionaire's investing strategy if their risk tolerance allows them.

February 22 -

Finance professor Tom Warschauer calls on the academic research community to improve communication and further understanding of clients' behavior.

February 21 -

Seniors who reach the age of 65 and are in good health have the option of opening a Medicare medical savings account.

February 21 -

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Advisors and their clients may not yet realize how much the new regulations dramatically change their strategies.

February 14 -

A partnership could extend a firm's reach, while ethical investing portfolios offer clients more options.

February 13 -

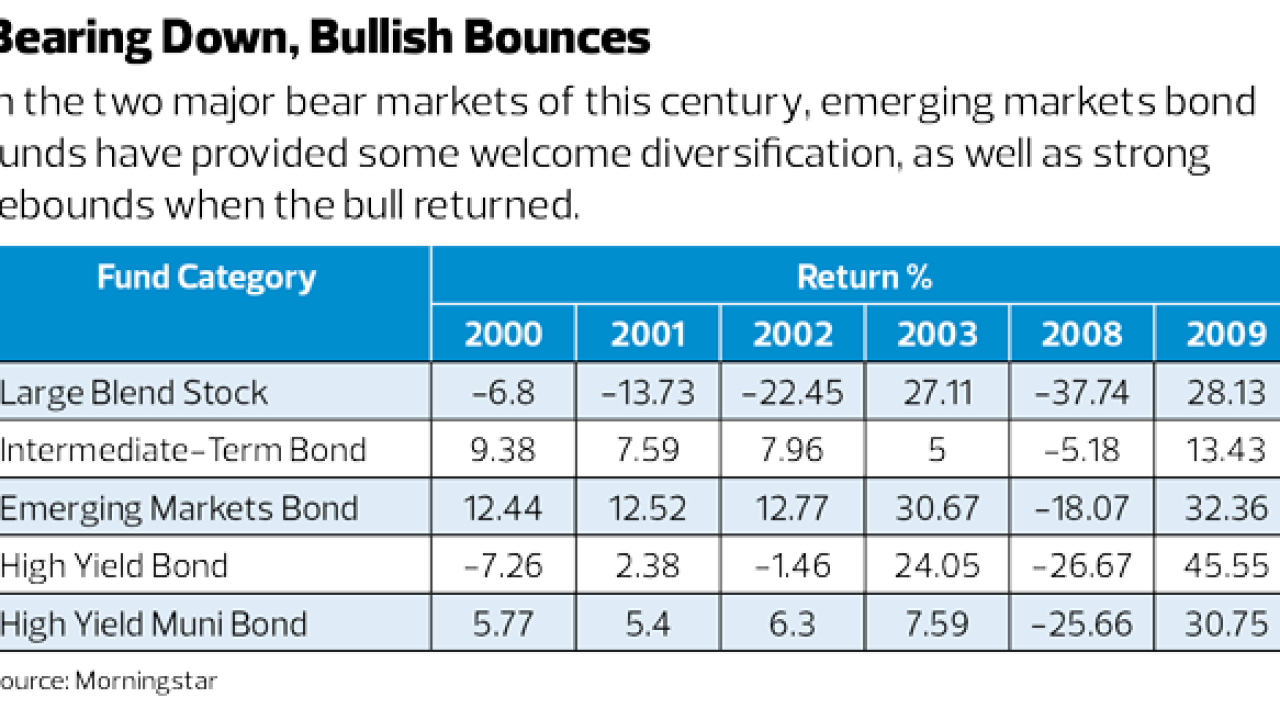

After stellar performance in a hectic decade, advisors home in on these funds.

February 13 -

A couple in their 60s had vastly different plans for retirement: One spouse envisioned Florida, the other Chicago.

February 12 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9 -

Retirees are advised to step back to get a better perspective and then review their asset allocation in their portfolio.

February 8 -

The revamped toolset includes financial planning software and fraud and identity theft protection.

February 8 -

-

Commission prioritizes retail investors as OCIE issues its must-read compliance letter.

February 8 -

Investors are advised to liquidate some assets or transfer them to certificates of deposit and money market funds.

February 7 -

I told clients they need a plan. Turns out, I needed one, too.

February 7 -

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 6 -

Moving to a retirement community is a great option for seniors if they don't have enough support from family and friends and they have a sizeable nest egg to finance such an arrangement.

February 5