Gift Tax Exceptions Every Advisor Should Know

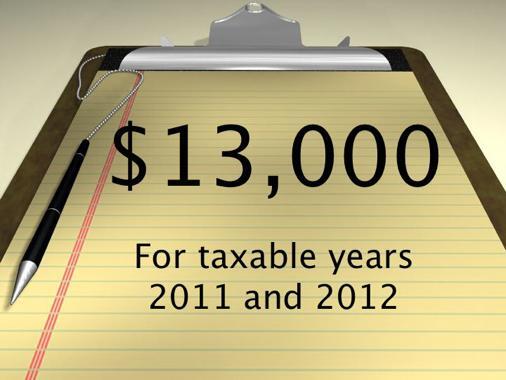

The Exclusion<br><br>

The Gift of Learning<br><br>

The Gift of Health<br><br>

The Gift of Love<br><br>

The Gift of Your Point of View<br><br>

The Gift of Helping Others<br><br>

Splitting That Gift?<br><br>

But, if you split a gift, you must file a gift tax return (Form 709) to show that you and your spouse agree to use gift splitting. And, that's even if the split gift is less than the annual exclusion.