-

The wealth management industry loves a good abbreviation. Here's a way to help master the jargon.

March 20 -

Scroll through to learn about five core changes impacting retirees.

March 19 -

Parents should ensure that their child has earned an income to be able to open the account.

March 14 -

In a bull market's later stages, some types of investments work better than others. Find out which ones they are.

March 13 -

The normal mantra these days for Social Security strategy is to delay as long as possible. But some clients would be better off filing early, including those who have high debt or those who do not expect to live on their retirement benefits.

March 12 -

Lottery winnings of retirees will not result in a lower retirement benefit, as the windfall will not be subject to the earnings test.

March 9 -

Clients can bring their effective tax rate below 3% in retirement by using a combination of three strategies.

March 8 -

Benefit are usually expected to replace about 40% of their pre-retirement income, but that's an average, so many people will get even less. The question is: how much less?

March 7 -

Traditional wisdom says that bonds and stocks complement each other, but this is not always the case, especially when a reduction in valuations occurs.

March 5 -

The research found that claimants were not told they could take widow or widower's benefits while delaying their own retirement benefits, which would allow those checks to increase.

March 2 -

The contributor was recently called to be an expert witness and realized that defending a retirement plan in court can provide a good opportunity to better understand a portfolio.

February 27 -

The products can offset potential losses from lowered state and local deduction limits.

February 27 -

Working seniors who intend to start collecting Social Security benefits in the middle of the year should know about the monthly earnings test.

February 26 -

82% of beneficiaries who qualified for survivor benefits and their own benefits were not informed that they could opt for a restricted application and boost their benefit.

February 23 -

New FINRA rules will help the wealth management industry do its part to identify and prevent elder abuse.

February 21

-

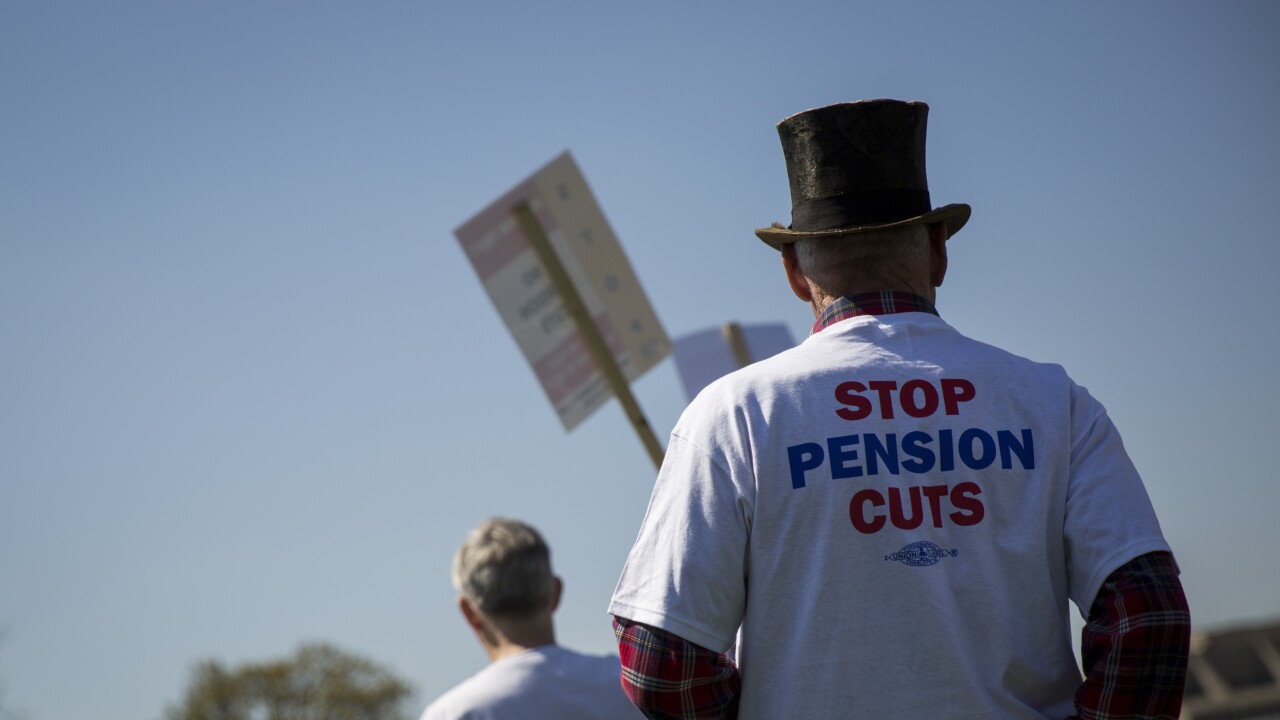

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

The right strategy can put them “in the 0% tax bracket,” an expert writes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9