-

The asset manager says its free tool for target date fund clients will "supplement the advisor conversation."

March 21 -

A report says that boomers and Gen X-ers should expect disruptions in the labor force in the next 12 years.

March 19 -

Fintechs are pitching new tools to plan providers claiming they can lower 401(k) costs.

March 14 -

In a bull market's later stages, some types of investments work better than others. Find out which ones they are.

March 13 -

One strategy for clients to continue their philanthropic work and reduce their bill is to bunch multiple years of donations into one with a donor-advised fund.

March 13 -

The normal mantra these days for Social Security strategy is to delay as long as possible. But some clients would be better off filing early, including those who have high debt or those who do not expect to live on their retirement benefits.

March 12 -

Many taxpayers can expect a lower tax bill under the new law and should consider adjusting their withholding to put the money to good use.

March 6 -

Understanding what is important to millennials can help retirement service providers not only capture more of the mass affluent retirement market, but also build relationships with the next generation of investors.

March 6 A.T. Kearney

A.T. Kearney -

Advisors should educate themselves about the treatment of Medicare premiums, tuition fees and 401(k) distributions.

March 5 -

Working seniors who intend to start collecting Social Security benefits in the middle of the year should know about the monthly earnings test.

February 26 -

Retirement investors may want to adopt the billionaire's investing strategy if their risk tolerance allows them.

February 22 -

Seniors who reach the age of 65 and are in good health have the option of opening a Medicare medical savings account.

February 21 -

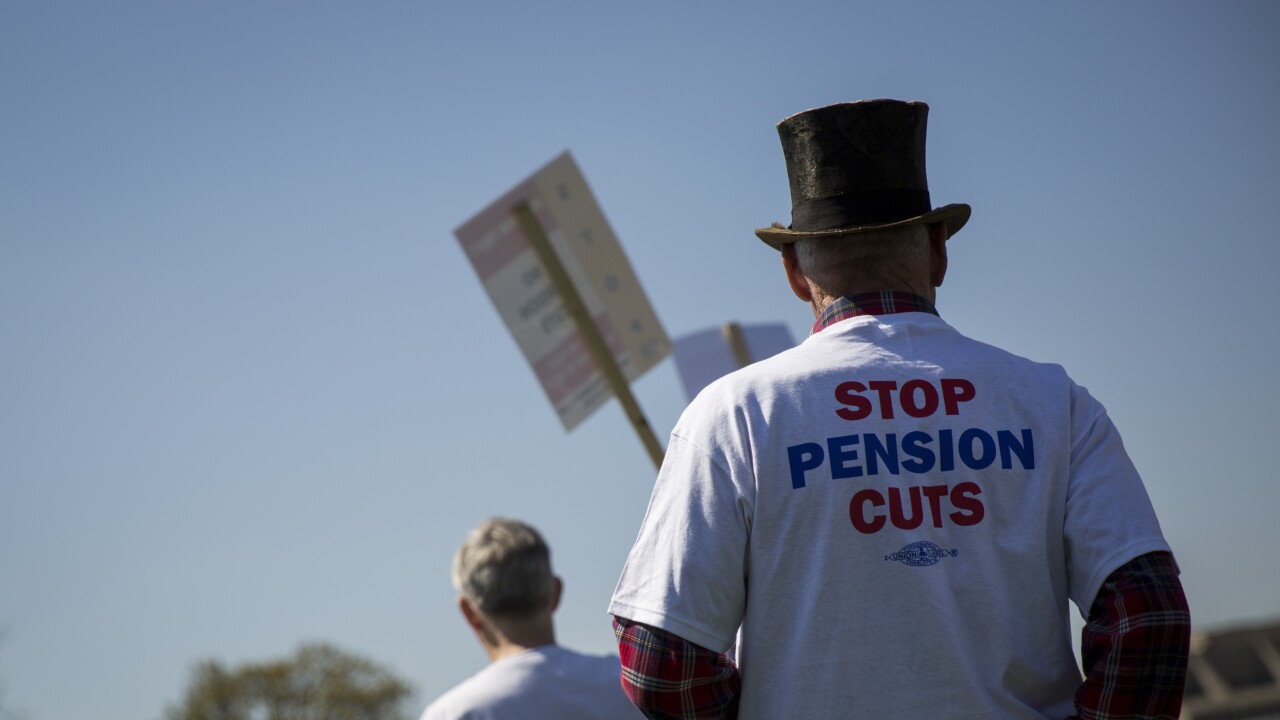

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

The proposed budget includes a provision that would give Medicare recipients the option to contribute to a health savings account, which would offer various tax benefits.

February 15 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

A partnership could extend a firm's reach, while ethical investing portfolios offer clients more options.

February 13 -

Younger investors may see the market's swing as just another fluctuation in the market, while assuming that time is on their side. Older investors, on the other hand, may be far more stressed.

February 12 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9 -

Moving to a retirement community is a great option for seniors if they don't have enough support from family and friends and they have a sizeable nest egg to finance such an arrangement.

February 5