-

The decision marks a shift for firm, which has largely ridden its equity-fund offerings.

July 17 -

The math wizards of the investment world are hoping to disrupt the established giants of the trillion-dollar credit market.

July 9 -

Defined-maturity funds offer traditional fixed-income interest payments.

July 1 -

The yield on Mozambique’s sole dollar bond, due 2023, has fallen almost 5 percentage points this month to 11%.

June 20 -

Worries over weak U.S. data, the impact of President Trump’s multi-front trade war and the interest rate outlook has whipsawed investors in recent weeks.

June 11 -

An AQR executive just sketched a blueprint for traders seeking to hitch a high-octane ride on the global credit cycle.

May 14 -

The firm unveiled a discount in a footnote on page 94 of a revised regulatory filing.

April 9 -

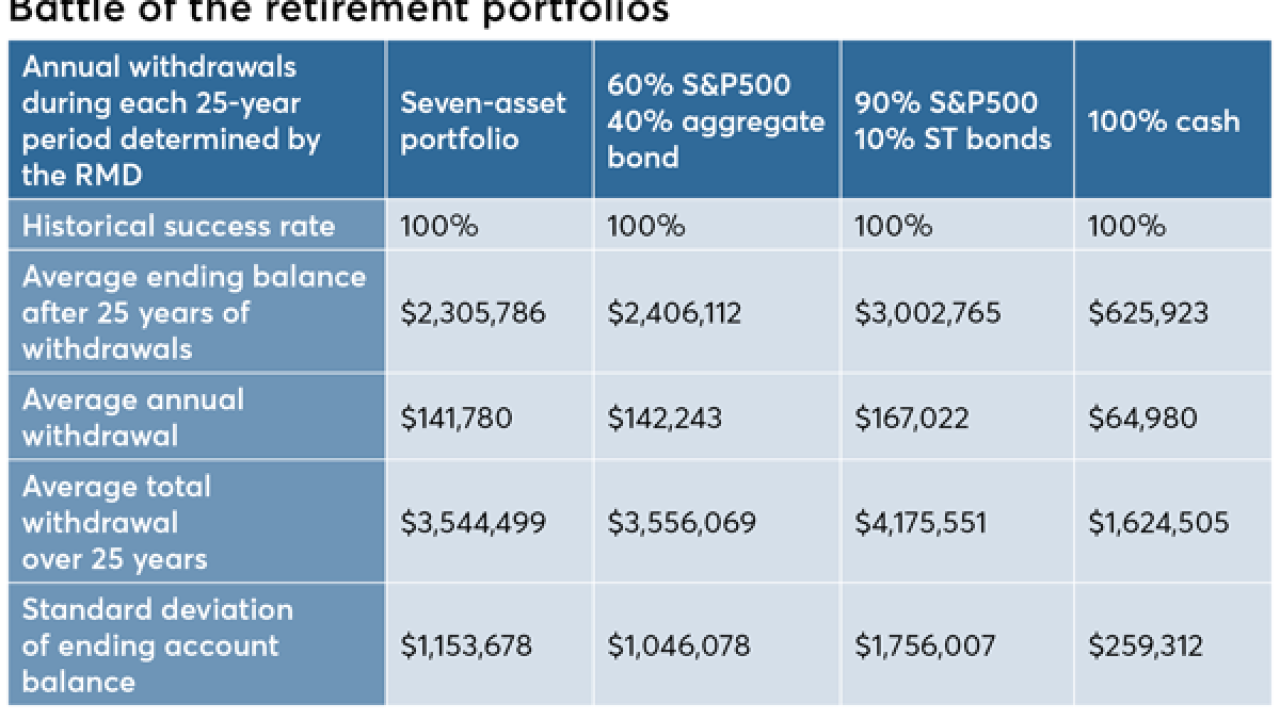

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

The firm plans a 0.2% to 0.5% allocation to the products in its global and international fixed-income index portfolios.

March 29 -

It’s not just clients in high-tax states buying up muni bonds.

March 14