-

The "sticker shock" of tax rates and IRS reporting rules may place the recent record highs and falls in a different context for investors, one expert says.

February 11 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

Fixed-income ETFs are rapidly gaining popularity among advisors, driven by growing familiarity, diverse offerings and strong asset flows, new Cerulli research shows.

January 22 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

Even as markets sometimes touched all-time highs, there was a general feeling of uncertainty among advisors and clients. Experts say that's why several tried-and-true strategies became more attractive this year.

December 23 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

President Donald Trump is reportedly considering moving cannabis from a Schedule I to Schedule III substance. Experts say this could go a long way toward establishing the industry's legitimacy.

December 15 -

Current market conditions and declining interest rates make small-cap ETFs an attractive option for diversification, but choosing the right one requires a hard look at the details.

December 4 -

Funds that primarily hold select cryptocurrencies, including bitcoin, ether, XRP and solana will be allowed.

December 2 -

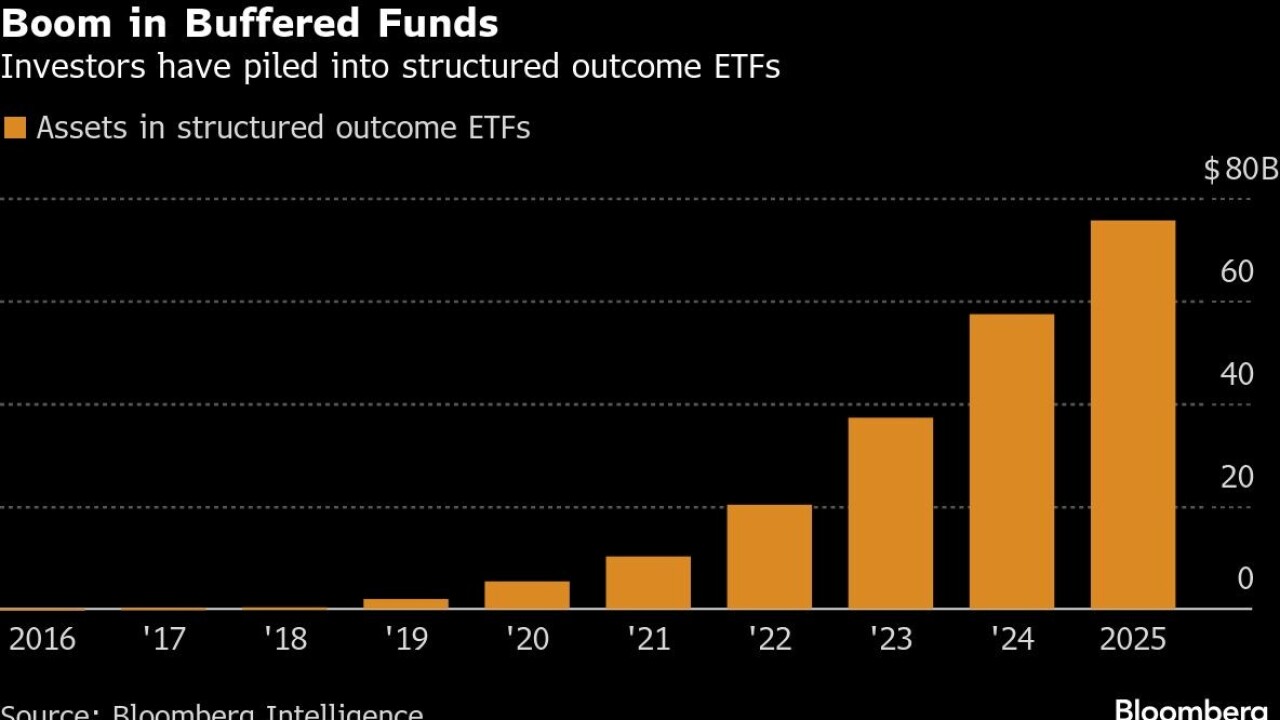

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

Falling client risk tolerance and domestic turmoil may mean that these international equity funds could be more attractive to investors looking for diversification.

November 20 -

Quant firm Dimensional Fund Advisors has received formal approval to adopt a fund structure that for two decades has been used exclusively by Vanguard.

November 18 -

Financial advisors know how to guide clients through volatility, but the math displaying the portfolio risks of AI may present an altogether different challenge.

October 29 -

Advisors cited better liquidity, lower expenses and higher tax efficiency as among the reasons they like ETFs, the market for which has topped $11 trillion.

October 16