-

The SEC says the 33% owner of the parent of the IBD network participated in unlawful microcap stock sales resulting in “virtually worthless” investments.

September 10 -

In response to a Supreme Court ruling, the regulator will revisit 126 legal proceedings, including nearly two dozen advisor cases.

September 7 -

The barred onetime Questar Capital and Woodbury Financial rep had pleaded guilty to the scam, which he says stemmed from a gambling addiction.

August 1 -

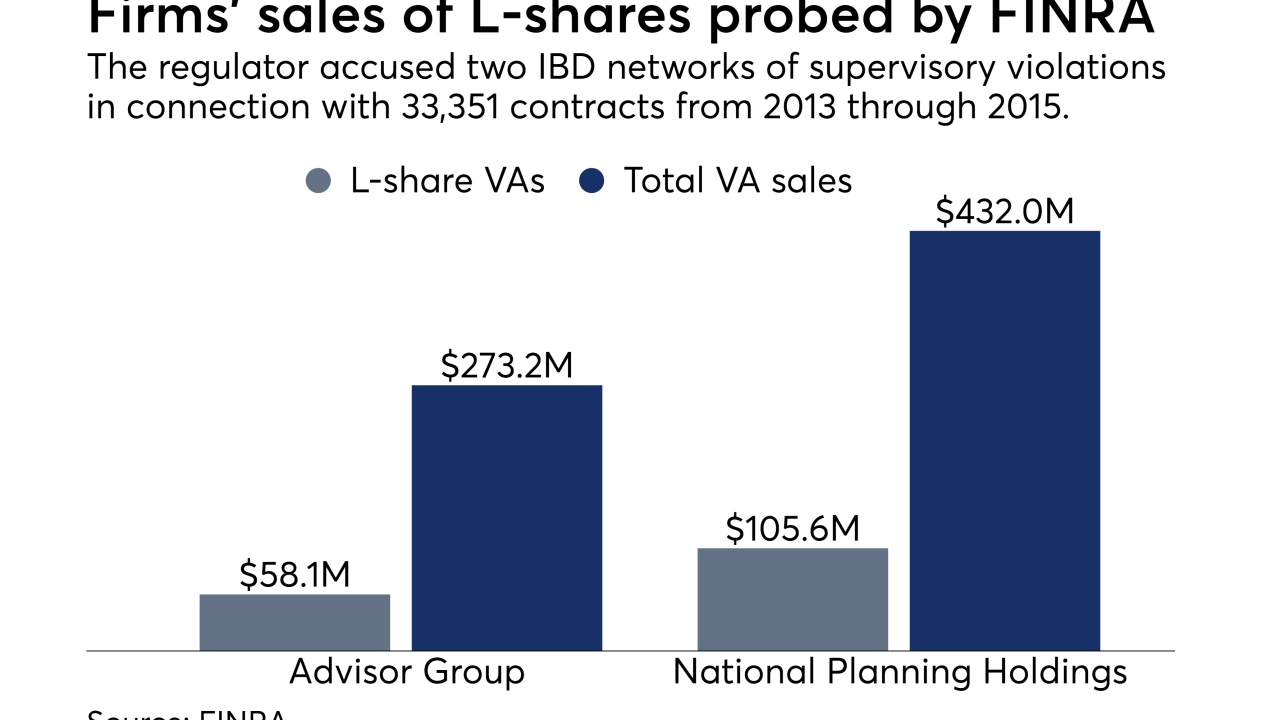

The regulator accused the four firms and the Advisor Group network of supervisory failures in sales of L-share VAs in separate but near-identical cases.

July 30 -

The rep helped the customer conceal the true source of funds into his accounts, FINRA claimed.

July 23 -

The broker-dealer failed to supervise Infinex registered reps selling annuities and other products to seniors and other investors at local banks.

July 19 -

The rep mismarked 105 trades in five PNC customer accounts as unsolicited when in fact they were solicited, FINRA claimed.

July 17 -

The rep cut and pasted or traced the signatures of 16 customers on more than 70 life insurance and annuity replacement forms and other documents.

July 11 -

The regulator barred an ex-Wells Fargo advisor for fooling the bank into reimbursing him for $3,400 after he falsely claimed that he was the victim of fraud.

July 10 -

The rep agreed to a six-month suspension and a $5,000 fine to settle claims that he wrote and deposited checks without sufficient funds to cover them.

July 6