-

“It’s bad when this happens on a Friday, because then people get freaked out over the weekend.”

April 6 -

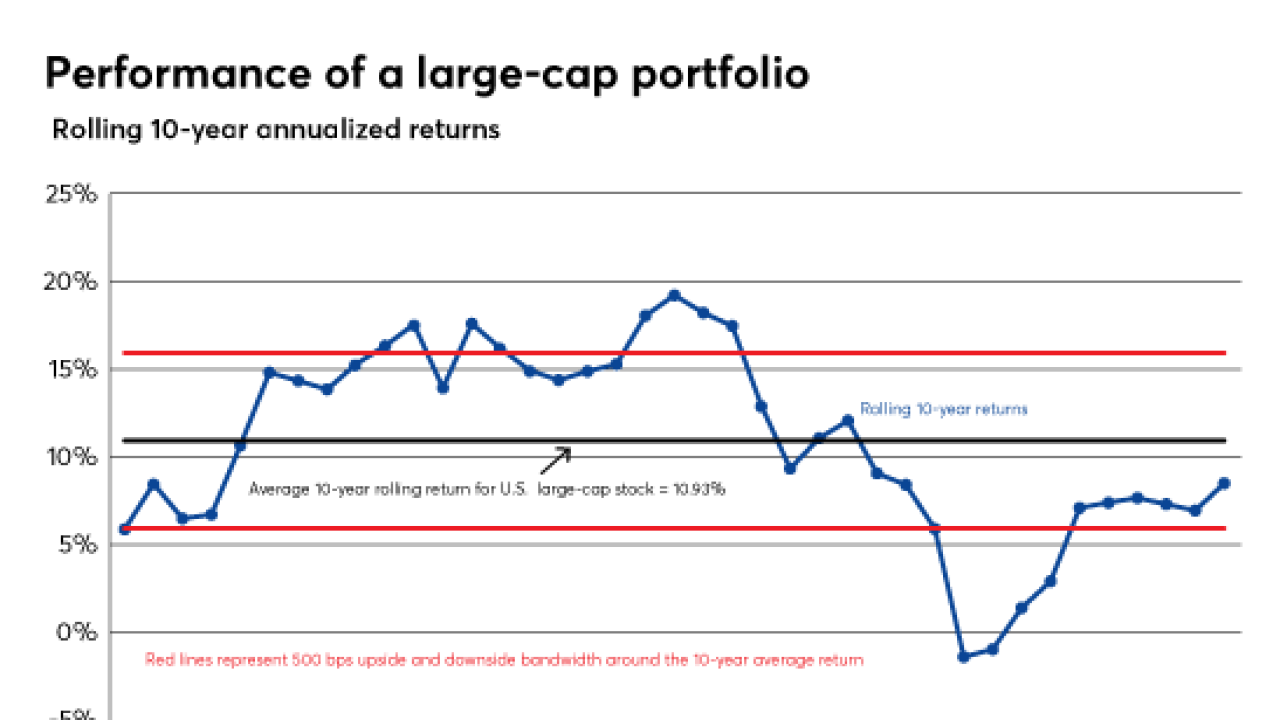

Booms and busts both have the potential to create unrealistic outlooks on both ends of the performance spectrum.

March 29 -

While the S&P 500 has risen or fallen by more than 2% six times this year, it swung by twice that amount nine times in October 2008.

March 28 -

S&P 500 enjoys its biggest one-day jump since August 2015.

March 26 -

Stocks plummet the most in six weeks as investors shift focus from Fed to China.

March 22 -

One fund’s strategy this week amounted to almost 48% of its average daily turnover during the past 90 days.

March 8 -

Both long and short investments focused on volatility were mostly crushed lately.

February 14 -

The firm says it has moved away from the products after an implosion of a vast array of arcane bets against stock market volatility.

February 12 -

The resurgent threat of inflation and higher bond yields helped trigger a burst of volatility.

February 8 -

The last time the industry’s largest ETF experienced redemptions close to this pace was before the financial crisis.

February 7