-

A watchful planner might have saved a matriarch’s IRA from being allegedly pillaged by her son.

March 6 -

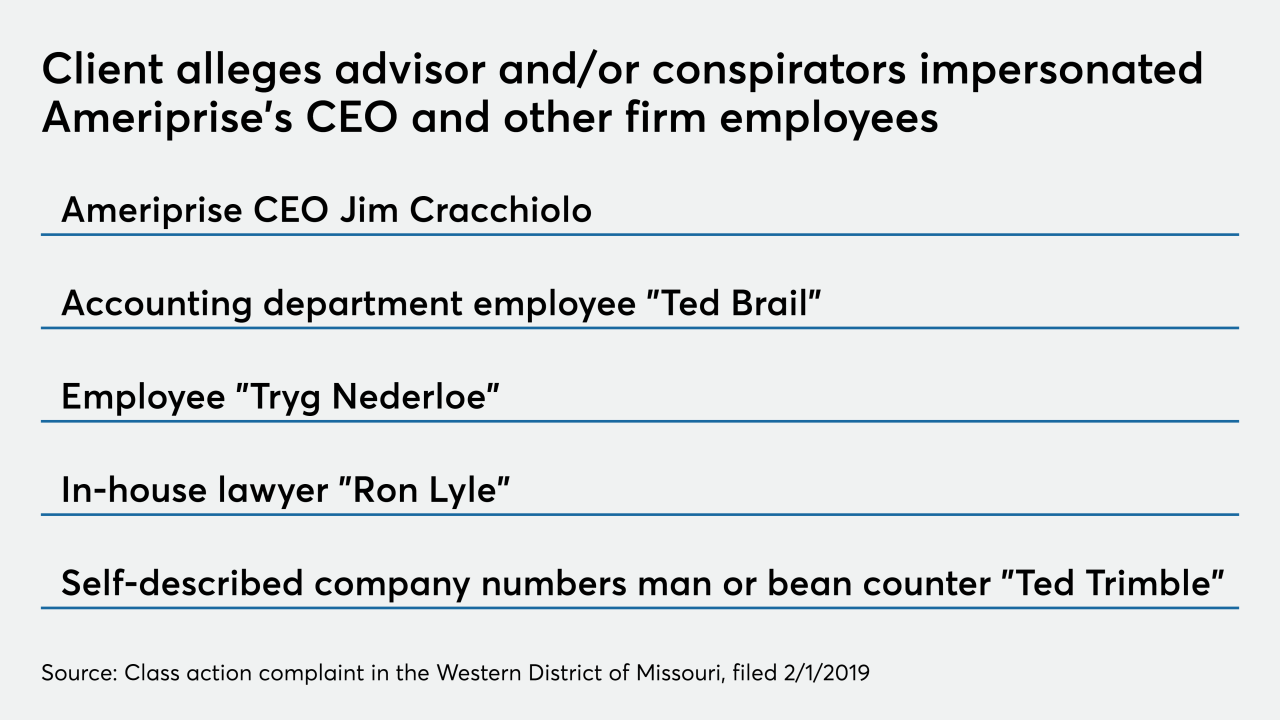

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2 -

The major custodian lost its second arbitration case — with even more filings likely — over the services it provided to a brokerage later proved to be engaged in massive fraud.

February 27 -

The settlement marks the bank’s largest yet from a series of scandals that claimed two chief executive officers.

February 21 -

The former investment advisor, convicted of running one of the biggest Ponzi schemes ever, says he suffers from terminal kidney failure and other ailments.

February 6 -

Edward E. Matthes allegedly renovated his home, paid child support and bought luxury items with client money.

February 4 -

He used client funds money to pay for massages, jewelry and to shore up his wife's failing pet store.

January 14 -

The advisor was charged with overbilling clients by hundreds of thousand of dollars and diverting millions from the company’s payroll to his own account.

January 7 -

“I want to give a huge thank you to my clients” for feeding local families, Keith Springer blogged the same day the SEC filed its complaint.

December 20 -

The SEC says broker-dealers may treat investment advisors as if they were subject to the AML Rule — under certain conditions.

December 16 -

A former rep has drawn at least 30 claims after pleading guilty to fraud, while clients of another ex-LPL advisor are seeking damages five years after his initial arrest.

December 10 -

Her hospitalized client's accounts had more than $14 million in transactions over a nine day period, according to FINRA.

October 23 -

He used investor money for his $6.7 million home and $3.1 million for chartering planes and personal travel, according to prosecutors.

October 16 -

The regulator’s move follows a Financial Planning investigation into whistleblowing by former JPMorgan financial advisor Johnny Burris.

September 16 -

NASAA’s annual survey of regulators sheds light on legal proceedings against BDs, RIAs and unregistered firms that often go unnoticed in the wider industry.

September 11 -

Elias Herbert Hafen, “every client’s worst nightmare,” could face years in jail. The wirehouse says it is repaying clients.

September 9 -

Following a plea agreement, Bradley Mascho is sentenced for his role in defrauding investors of more than $20 million.

September 6 -

The agency's goal of trying to recover client losses allows advisors accused of fraud to decide who'll manage their clients’ remaining assets.

September 5 -

Over a nine-year period, he allegedly defrauded clients of more than $2.1 million.

September 4 -

At this stage it's not an actual data breach, but it could become one.

August 13