-

Clients adding investments other than target-date funds to their 401(k) or 403(b) could potentially hurt their bottom line.

September 3 -

To make the most of their savings, workers should start funding their accounts as early as possible.

August 30 -

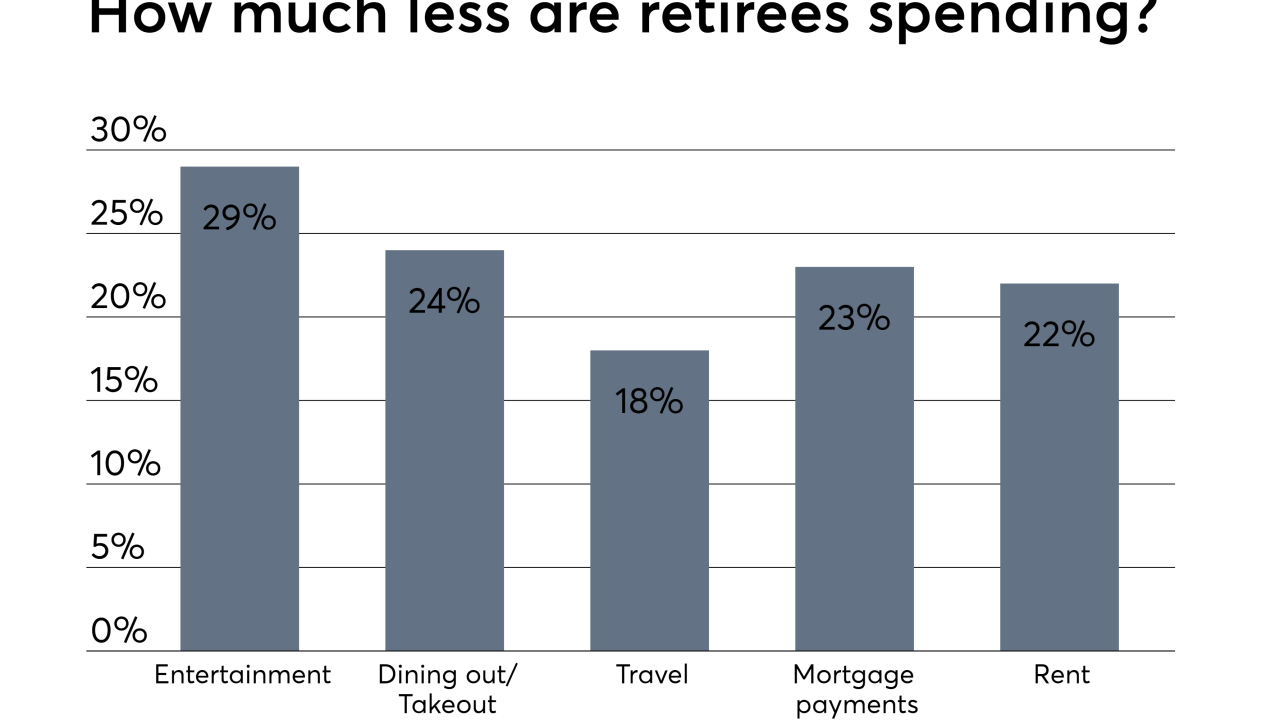

Many clients are “denying themselves today for fear of what could happen tomorrow,” an expert says.

August 23 -

Many pin the blame on stagnant or dwindling income, according to a new survey.

August 22 -

Aside from cutting spending and contributing to a Roth account, investors are also advised to sock away at least 10% of their annual earnings.

August 21 -

Plus, the average employee contribution rate reached 8.8% in the second quarter, up a full percentage point from a decade ago.

August 21 -

These clients will need bigger savings than other age groups to fund a longer retirement horizon, according to a study.

August 20 -

Depending on where they live, retirees can expect their six-figure savings to last more than two decades, data shows.

August 14 -

Clients who retire early are more likely to experience bouts of anxiety and self-doubt.

August 12 -

Some managers have taken on more risk amid a decades-long decline in interest rates and slow global economic growth to meet long term targets.

August 12