-

As much as 46% believe Medicare will cover the costs of long-term care.

May 23 -

In one case, a 6-year-old owed $7,000 in federal taxes two years after his father, a U.S. Navy senior chief petty officer, died of a heart attack.

May 14 -

With longer life expectancies leading to increased health care spending later in life, experts are second-guessing the 10% savings rule.

May 9 -

A market correction only becomes a real risk if investors act and make buy or sell decisions to alleviate mental anguish today at the expense of tomorrow, says an expert.

May 3 -

“Health care prices are increasing at levels that significantly exceed overall inflation,” an expert warns.

April 23 -

Unfortunately, physical and cognitive decline are among potential side-effects.

April 22 -

Capital gains tax rates are not just taxed at a single, more favorable, rate anymore.

April 17 -

A proposal to increase payroll taxes is facing opposition from some lawmakers who believe millennial workers cannot afford to bear the brunt of higher payroll taxes.

April 17 -

Grandchildren won't be able to have their own accounts until they are earning their own income, but they can be named beneficiaries.

April 8 -

Picking up on a client's unspoken wishes led an advisor to an unexpected asset allocation — one that benefited the client's daughter.

April 4 Mercer Advisors

Mercer Advisors -

Errors are regrettably common. They are also easily avoidable.

April 1 -

Parents should have a smart plan on how to help their adult children returning to their home without putting their own retirement at risk.

March 26 -

A higher standard deduction makes itemizing deductions less valuable.

March 26 -

Not having a full understanding could hurt workers’ retirement prospects by causing them to possibly miss out on their employer’s match or not reducing their taxable income as much as possible.

March 8 -

The worst thing you can do during a stock market crash is panic and sell your stocks near the market bottom.

March 6 -

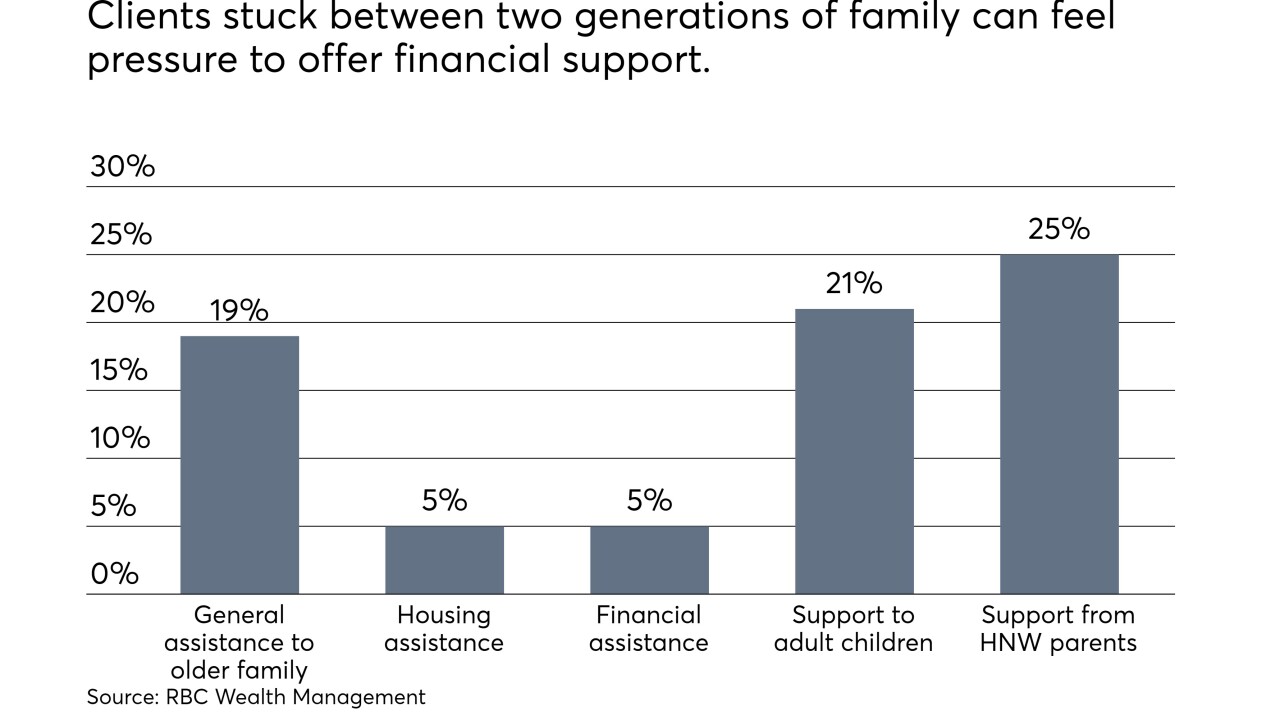

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 26 -

Some clients may experience a taxable event that pushes them into a higher tax bracket.

February 26 -

Cash is becoming an attractive security blanket again for investors amid rising interest rates and stock market volatility, says an expert.

January 22

-

Although income that is taxable is likely to increase for families with two children, their final bills will be smaller.

January 22 -

Clients can often retire smoothly even during a downturn if they diversify and rebalance their portfolios properly, as well as pay off debts and maximize their Social Security benefits.

December 27