-

The contributor was recently called to be an expert witness and realized that defending a retirement plan in court can provide a good opportunity to better understand a portfolio.

February 27 -

The products can offset potential losses from lowered state and local deduction limits.

February 27 -

Working seniors who intend to start collecting Social Security benefits in the middle of the year should know about the monthly earnings test.

February 26 -

82% of beneficiaries who qualified for survivor benefits and their own benefits were not informed that they could opt for a restricted application and boost their benefit.

February 23 -

New FINRA rules will help the wealth management industry do its part to identify and prevent elder abuse.

February 21

-

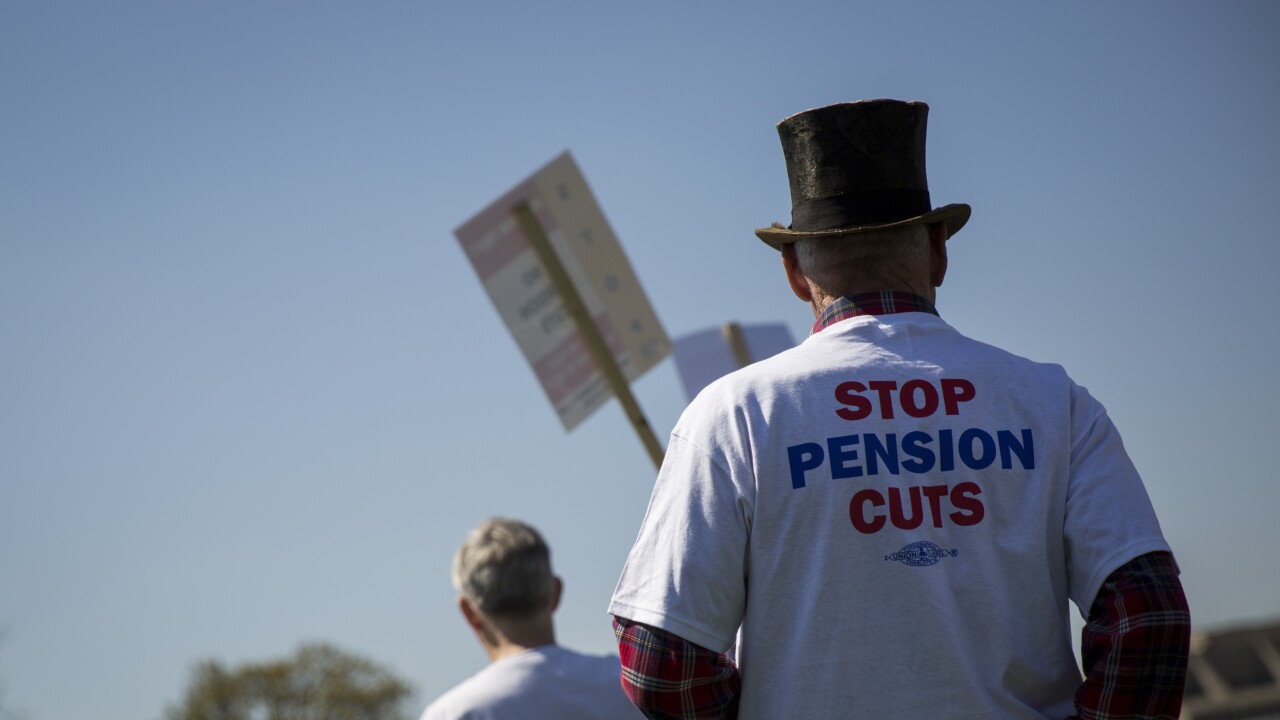

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

The right strategy can put them “in the 0% tax bracket,” an expert writes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9 -

Retirees are advised to step back to get a better perspective and then review their asset allocation in their portfolio.

February 8 -

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 6 -

Claiming above-the-line tax write-offs doubles the standard deduction.

February 6 -

Even if those assets are used to pay for nonmedical expenses, an HSA can still be ahead of a 401(k) plan or an IRA.

February 2 -

Solid financial planning is a key component in helping demystify these government programs.

February 2 -

Clients have a hundred—if not a thousand—possible options to consider when claiming Social Security benefits.

February 1 -

Personal income is not subject to state taxes in Alaska, Florida and five other states, while 31 states do not impose taxes on Social Security benefits.

January 30 -

Parker’s candid responses to Financial Planning’s rapid-fire queries on new digital tools, sexual harassment, Social Security planning, deal-making, how (not) to talk to clients about the stock market run-up and more.

January 29 -

Retirees living overseas can still claim Social Security benefits, but they must see if their country of residence requires them to have a local bank account.

January 26 -

Retirees should consider that state laws may differ on who may be legally recognized as a beneficiary's spouse and thus whether their partner would be entitled to spousal benefits.

January 25